Spring 2024 is already upon us – here at StockTrak we’ve been hard at work bringing the latest and greatest improvements for classes in the new year! Cryptocurrency Updates Our first major change is coming to our cryptocurrency trading pit. For the last several years, we have supported open trading of every “coin” under the Read More…

StockTrak has been allowing students to virtually trade options for years, but we have recently updated our option spread trading pit to now make it easier for students to place these trades with the correct legs. For Fall 2023, StockTrak has completely revamped our Option Spreads trading engine. The Option Spreads trading pit now includes Read More…

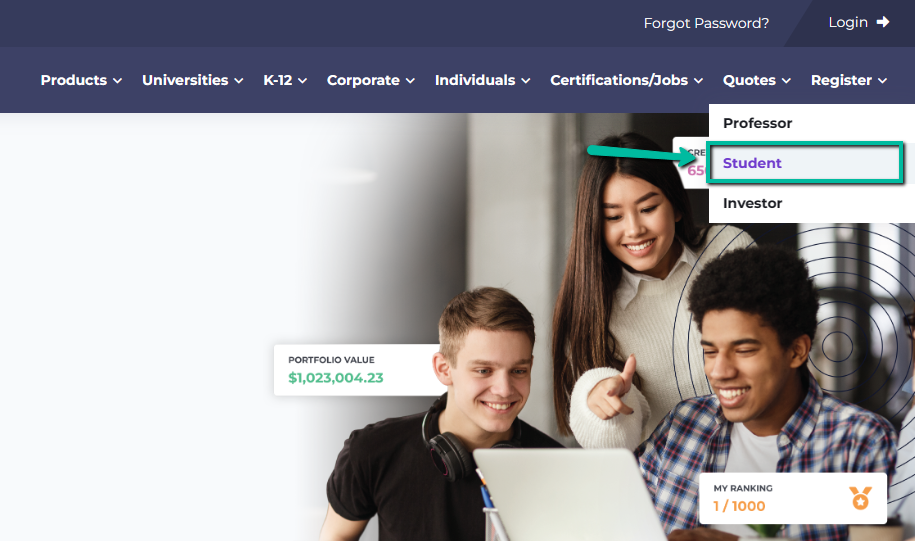

The Fall semester is almost here, and we couldn’t be more excited! We have a ton of new features ready for the Fall 2023 – Spring 2024 school year: here is a quick run-down of what you can expect for your classes. StockTrak Version 6.0 Our latest major revision to our core trading platform is Read More…

StockTrak is looking to ring in the new school year with one of our biggest updates yet! From mobile to budgeting to forex and everything in between, this is all you need to know about our huge pack of new features! StockTrak 6 – Trading Redesign Our first (and biggest) update is a complete redesign Read More…

StockTrak’s new version is available for students now! The StockTrak virtual trading platform has been the gold standard for academic portfolio simulations for over 3 decades – and it just got better. The newest version of StockTrak will be released over the summer of 2022, but students can have early access now to preview the Read More…

StockTrak’s Budget Game has already become a cornerstone in financial literacy classes across the United States, and our Summer 2021 update brings the most-requested new features directly to your classroom. Over the Summer, key improvements include: Improved Bank and Credit Card Statements Student’s checking account, savings account, and credit card statements have had a major Read More…

StockTrak’s Assignments engine have become a key tool utilized by professors around the world to assign reading, video, and interactive lessons while students are engaged with our portfolio simulation and budgeting game. This Fall, we are releasing a major update to how student activities are logged to give more insight than ever to your class Read More…

StockTrak has been a leader in online portfolio simulations for over 30 years, and we are excited to announce a whole new revision to our platform coming this Fall! The StockTrak 6 project is a complete re-imagining of our user interface with key goals in mind based on the feedback we have received from tens Read More…

This Summer, the StockTrak team has put a premium on ease-of-use and clarity for students with our major updates to the user interface. The star of our new look is the new Student Dashboard, which brings everything your students need to see in one place. We brought the student’s progress on your class Assignments front Read More…

Beyond StockTrak’s world-class portfolio simulation, our Assignments engine is what really sets our platform apart as an indispensable tool for university finance, personal finance, and accounting classes. This summer, our curriculum specialists have launched our biggest update in years, focusing on our most in-demand topics. Our major update includes: Investing101 Update Our Investing 101 curriculum Read More…

The Sharpe Ratio has been a staple of StockTrak for years, where professors could include Sharpe Ratio calculations and rankings on all of their classes. Over the summer of 2021, our accounting system has updated the Sharpe Ratio calculation to improve its accuracy for all classes. What Has Changed The previous Sharpe Ratio on StockTrak Read More…

We are getting into grading season for the Spring 2021 semester, when your TA can be a real life saver. With that in mind, we are excited to announce the latest improvement to StockTrak’s reporting tools – our TA accounts! How It Works StockTrak traditionally has had a variety of detailed reporting tools for every Read More…

Robinhood and Your Investments Robinhood was just fined 65 million dollars for misleading customers. Ouch. Robinhood (or RH, as they are known to exactly no one) caused a massive shake-up of the brokerage industry when they launched in 2015. They promised $0 commissions. Their waitlist was months long – but I was ready. I signed Read More…

What is a Student Loan? A student loan is exactly what it sounds like – a loan given to students to finance their studies. This is most common for college or university students, but also works for trade schools and other vocational studies. Most of the time when a person takes out a loan, they Read More…

Thanks to a new partnership with Wiley Efficient Learning™, the top-performing student in all US and Canadian classes using StockTrak.com this Spring with 20 or more students will receive a free CFA, CFP, SIE, Series 7, or CPA Wiley Review Course of their choosing – a value of $130 to $1,600, depending on the course Read More…

StockTrak’s reporting features may be the most useful corner of the site for professors and tournament administrators, which is why we are excited to announce our new set of “Fun Fact” reports for every class! Our Fun Facts reports will have useful summaries of the trading data for your class, both as a quick look Read More…

At StockTrak, we have supported currency and commodity trading for years for a complete derivatives simulation. This Fall, we are excited to announce the addition of Cash Spots as a new security type, available for all classes! What Are Cash Spots? StockTrak previously supported both Futures and Forex trading, giving leveraged options for trading currencies Read More…

We have been the leader in realistic investing simulations for colleges and universities for over 30 years. Beyond the typical Investments, Portfolio Management, Derivatives, and Economics classes, our platform has seen growing numbers of Personal Finance and Financial Literacy classes adopting it as well. After almost 2 years of collaboration with several faculty and many Read More…

As thousands of finance, accounting, and portfolio management classes are planning a full or partial switch to distance learning for the Fall, it can be a struggle to reach the same level of engagement with your class (particularly for classes usually held in a trading room). This is where StockTrak’s wholly-online portfolio simulation can really Read More…

Our first major update for Fall 2020 is almost here – and we’re calling StockTrak’s Engagement Update! As the name implies, our Engagement Update is all about getting (and keeping) your classes fully engaged with their StockTrak portfolio throughout the semester. The update is centered on three key components: Assignment Prerequisites, Assignment Rewards, and Badges. Read More…

Teachers Have Already Claimed Over $250,000 of Student Accounts of PersonalFinanceLab.com’s Personal Budget Game and Stock Market Game. For Immediate Release (Montreal, Quebec) April 24, 2020 – In response to teacher and parent demand for its online educational services, Stock-Trak Inc., the leading provider of educational personal finance games, is now offering access to its Read More…

During these unusual times, we want to let you know that StockTrak.com is fully operational to support our professors and students. With the wild swings in the stock market over the last few weeks, having your students use StockTrak may be a once-in-a-lifetime opportunity for them to experience these extreme moves as we navigate through Read More…

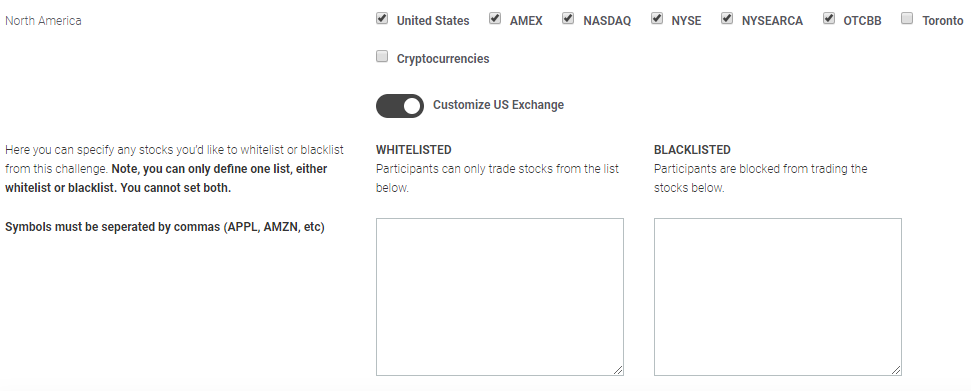

Almost every class on StockTrak restricts the universe of securities that are available for each student’s portfolio – whether by restricting entire security types or just limiting trades to certain exchanges. However, we have received many requests to take this a step further, to allow professors to either restrict certain specific stocks, or to only Read More…

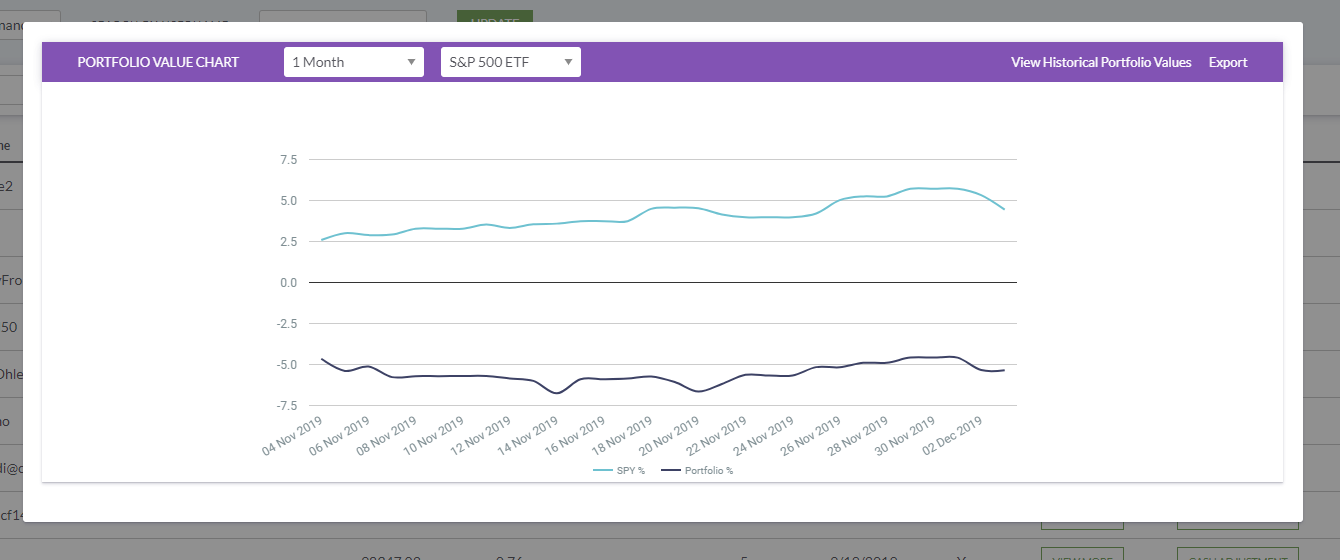

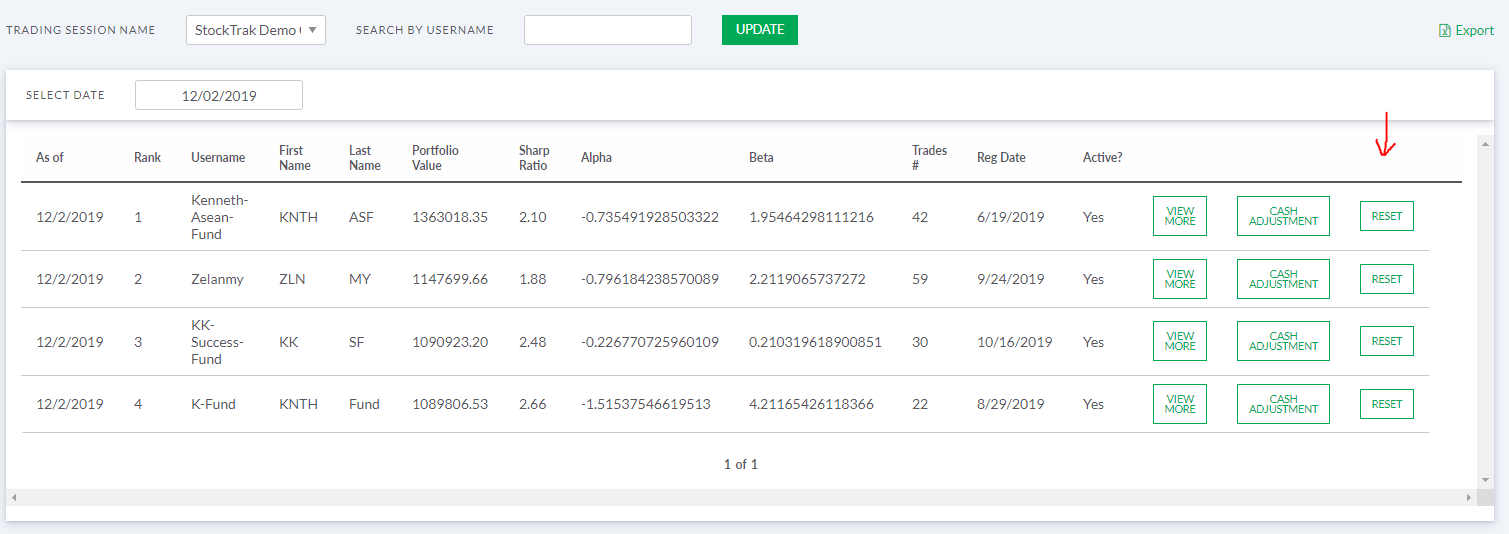

Professors may have already realized there are two separate Rankings pages on StockTrak – the “Live Rankings” (which is visible for students), and the Rank Report (available in your Class Summary Reports). The rank report uses end of day values from the previous trading day, and includes useful tools for managing your class – including Read More…

Professors often ask for our team to reset individual accounts, or even entire classes after a “practice period” at the beginning of the semester. These requests have been getting so popular that we built it right into your admin pages! Starting in Spring 2020, the “Ranking” report in your professor administration tools will have a Read More…

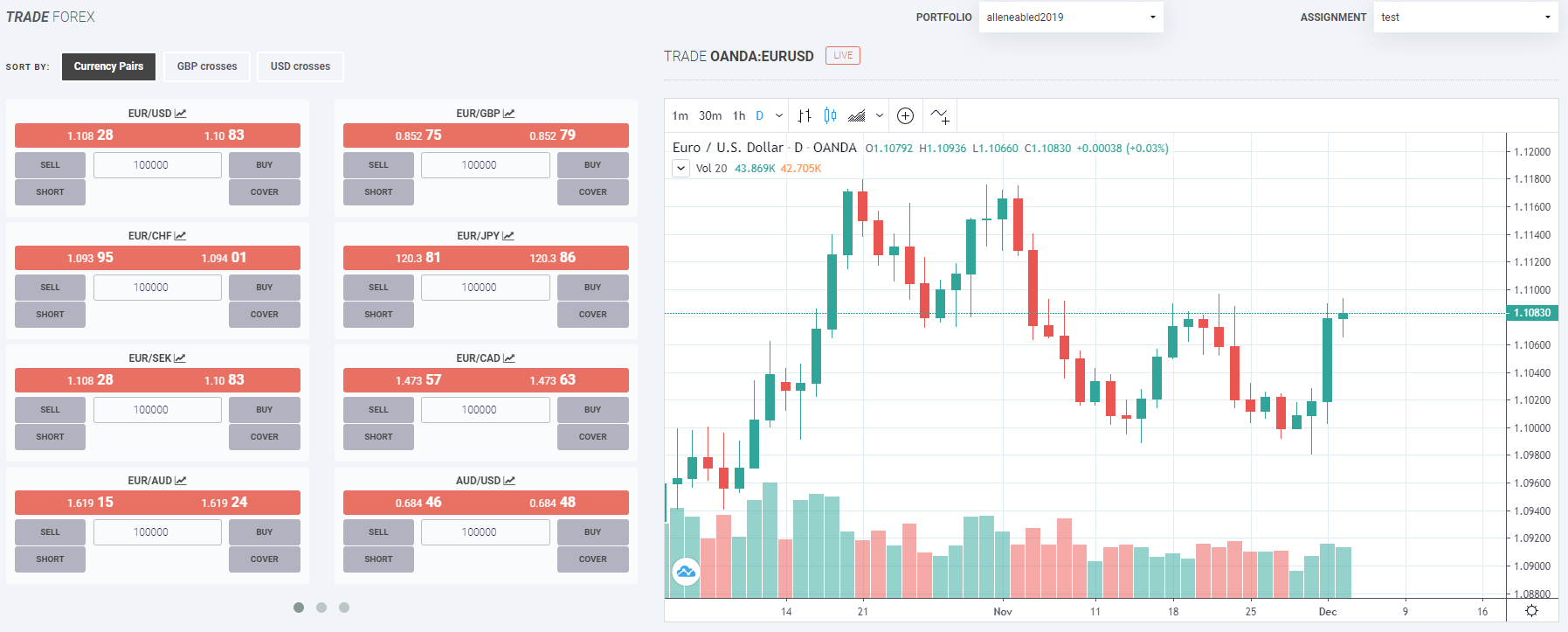

The latest enhancement to StockTrak finally brings to bear our real-time, true-to-life Forex simulation! Our previous currency trading simulation allowed trading on a pure cash basis – students could buy and sell currencies at the real-time FX rates. While this is still very instructive, it missed out on the full nuance of Forex trading with Read More…

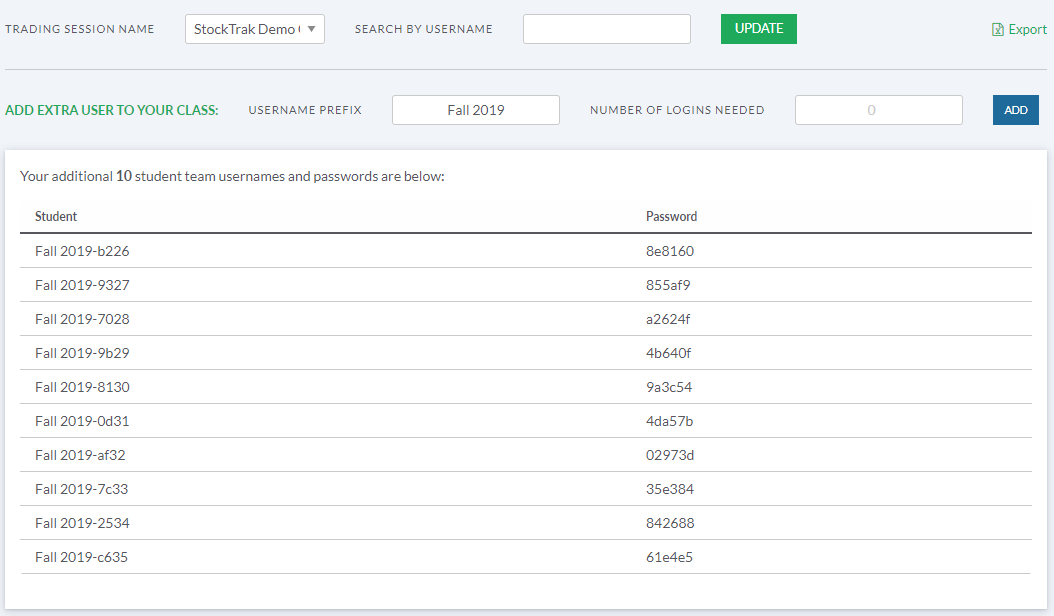

We take student data privacy seriously at StockTrak – with constant innovations to keep student data secure. However, we work with more and more schools that have their own restrictions on what kinds of personal information can be gathered, even for administrative purposes. To help make sure that all schools have access to StockTrak, we Read More…

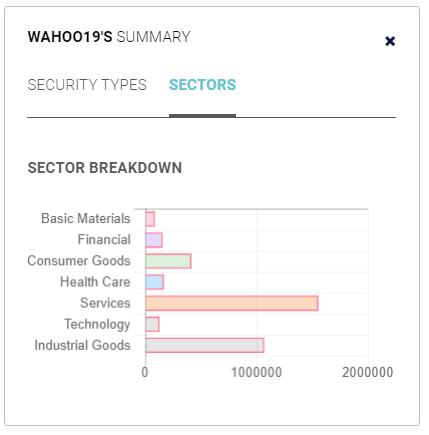

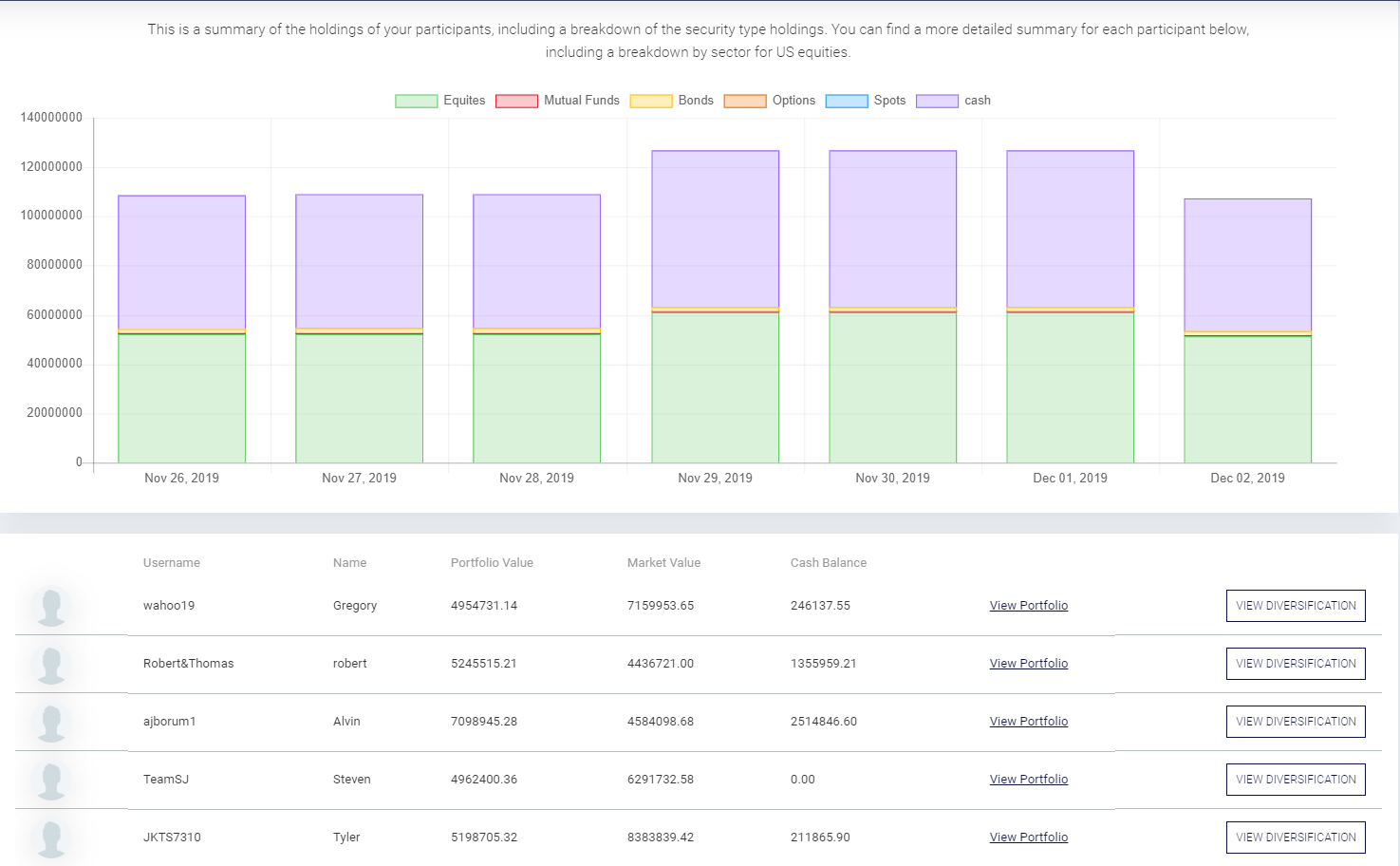

Evaluating how students diversify their portfolios is one of the key concerns of most professors using StockTrak. Our new Diversification Report just made this a whole lot easier! The new Diversification Report on StockTrak.com gives you a complete look at how students allocate their portfolios – both by security type and by industry. The top Read More…

StockTrak is often used as a group project in investments and finance classes, where two or more students jointly manage a portfolio. Until now, all students in a group would need to share a login – making it impossible to track individual activity and performance. Enter StockTrak Teams! How Does It Work? With a regular Read More…

We just held our “New Features” webinar for the Fall of 2019. If you missed it, you can view our recording here:

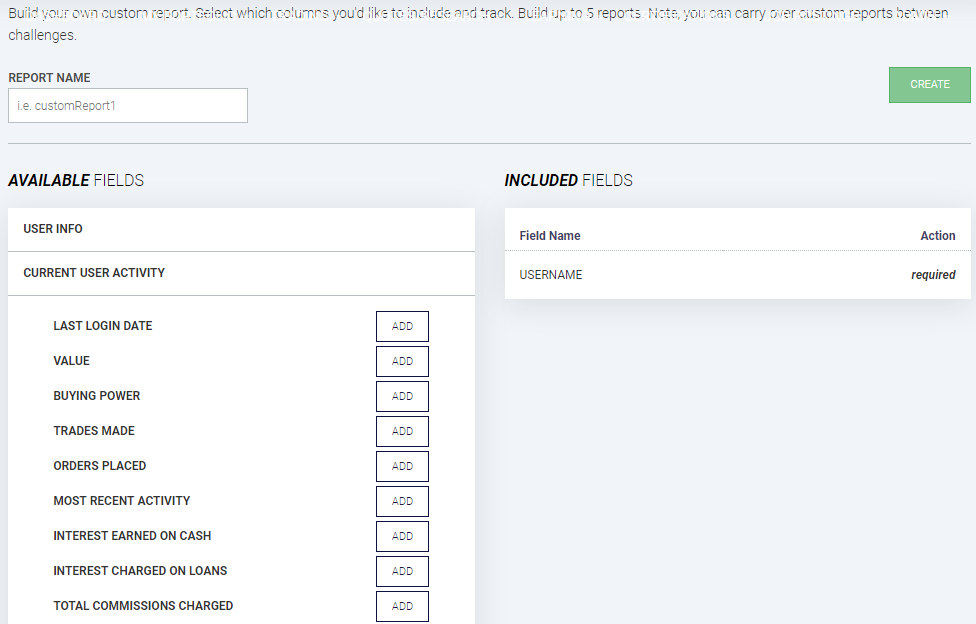

Reporting might be THE MOST important feature on StockTrak for professors. Our newest update gives every instructor the ability to build their own Custom Reports – so you can see the fields YOU need, exactly as YOU need to see them! How It Works To use the new Custom Reports, go to your “Summary Read More…

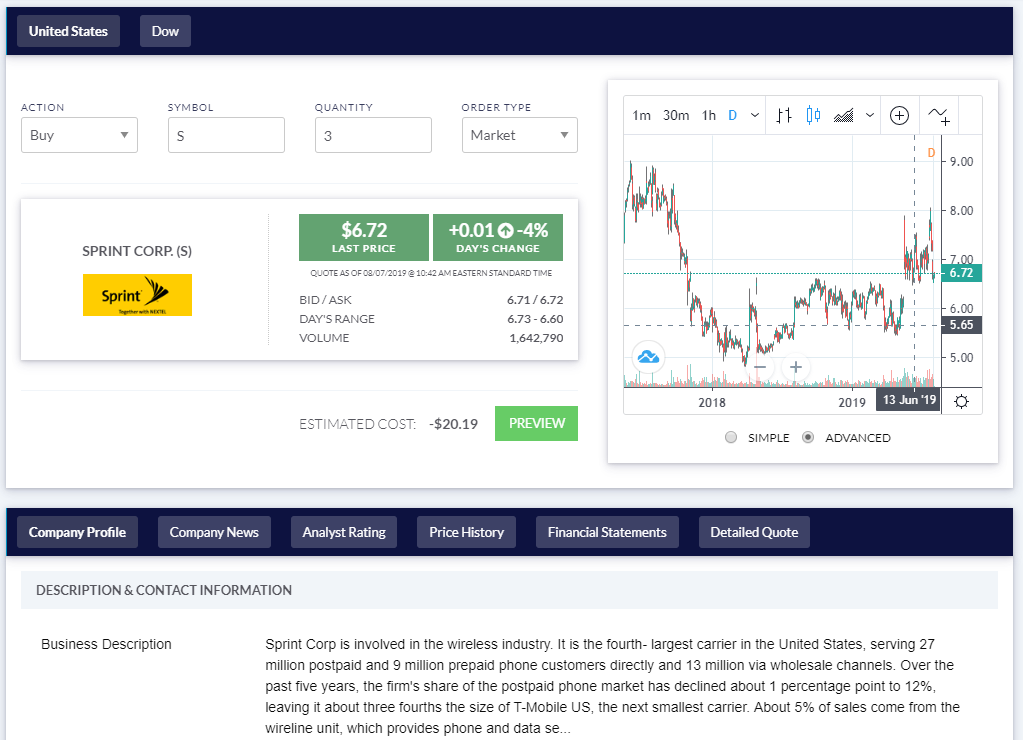

We just rolled out enhancements to our equities trading page, integrating more research, better charts, and an easier-to-read quote box for the Fall semester! Check out the image map below to see the new page – hover over any info element for more information.

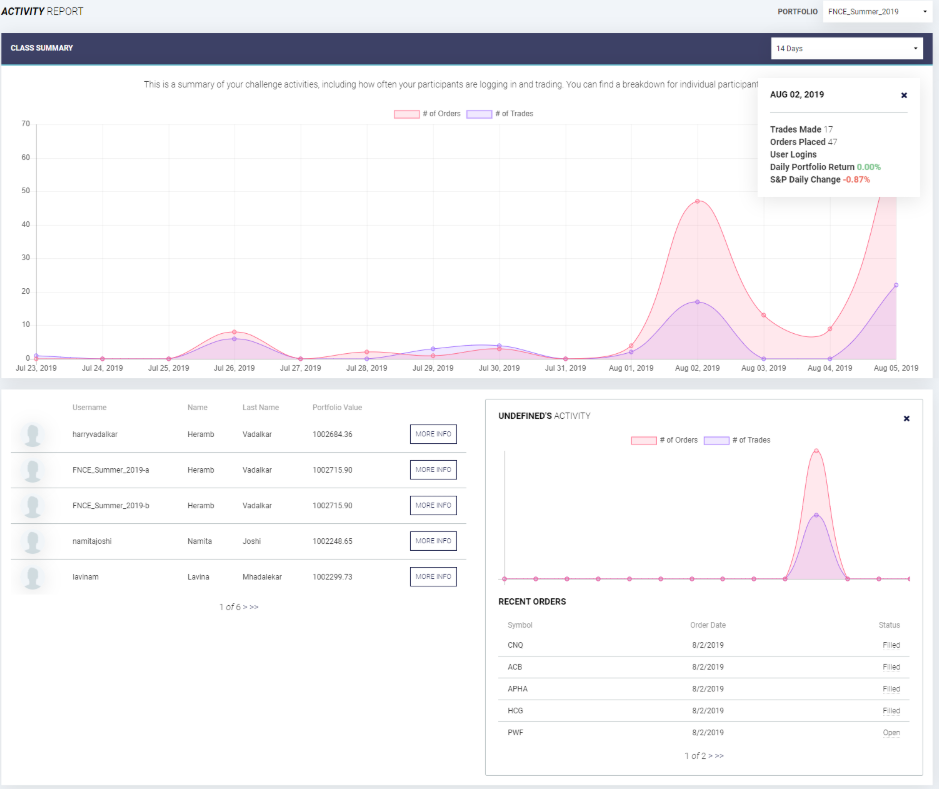

It takes time to dive into reports on StockTrak, and ensure students are following up with their portfolios as they should. That is why we created our new Activity Report, available for Fall 2019 classes! The new Activity Report shows an interactive graph of your class trading activity over the last 14 or 30 days, Read More…

Stock-Trak was founded in August of 1990 – which means we just celebrated our 30th birthday! We would like to thank the tens of thousands of professors and millions of students we have served over the last three decades for helping us reach this milestone, and ensure that there are many more years to come! Read More…

CashCrunch 101 Expands Company’s Educational Personal Finance Simulations For Immediate Release (Montreal, Quebec) May 8, 2019 – Stock-Trak Inc., the leading provider of virtual stock market trading applications for the education and consumer markets, has recently acquired a personal budgeting simulation (CashCrunch 101) from Fortune and Venture, LLC. “The addition of a customizable personal budgeting Read More…

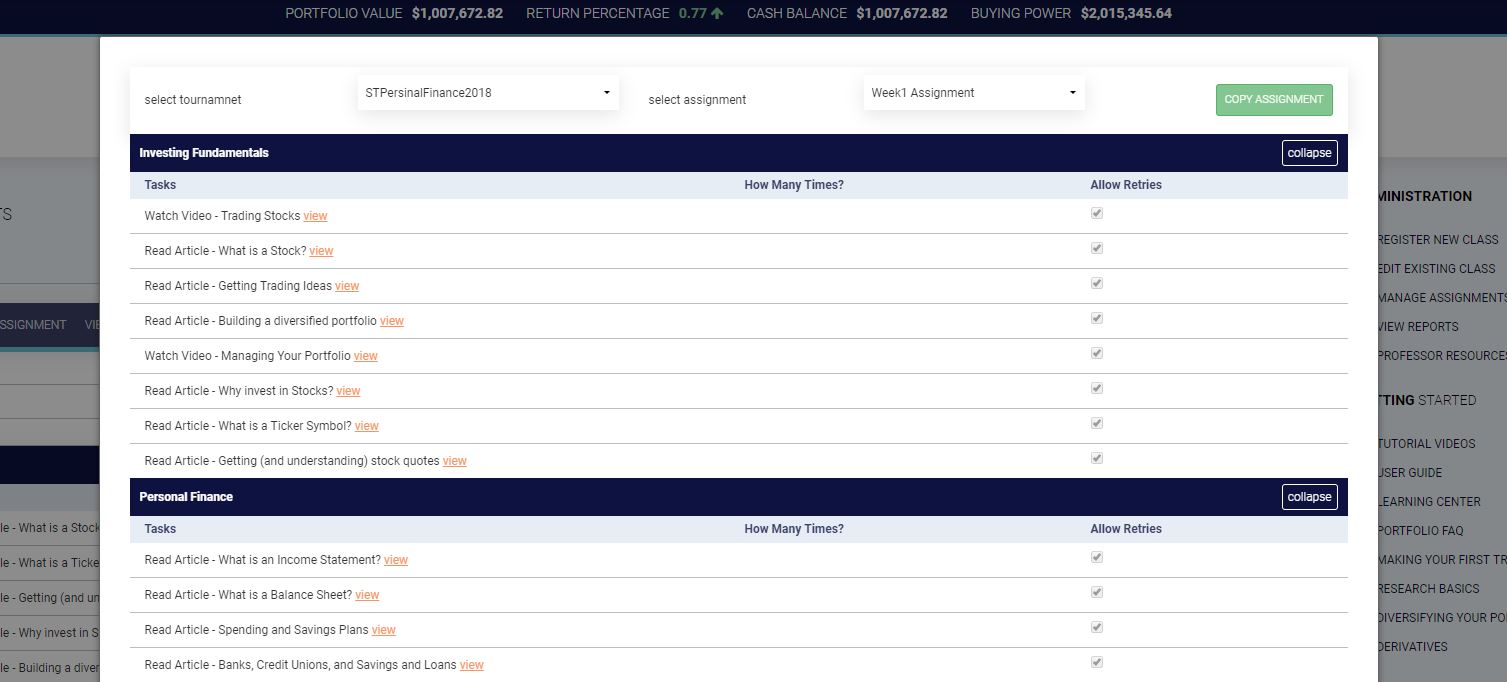

StockTrak’s assignments feature is a fantastic way to help get your students introduced to the trading platform and follow up with trading. However, remembering your exact settings for each assignment every semester has always been a bit of a burden. Thankfully, our latest update makes this a thing of the past! The new “Duplicate Assignments” Read More…

StockTrak is based on the East Coast, which means our servers operate in New York Time. This conveniently syncs up with trading on American equities exchanges, but not very well for European and Asian exchanges. We also have received some feedback from the (vast majority) of students who do not happen to be in Eastern Read More…

Every class that uses StockTrak is different – some focus on equities, others derivatives, still others on Forex or Bonds. However, all classes have one thing in common: an emphasis on portfolio diversification. StockTrak has supported basic diversification rules for many years. Our “Position Limit” rule puts a cap on how much your students can Read More…

One of the most common requests we get from instructors is if students can see each other’s trades. Well, now they can! One of the most common requests we get from teachers is if students can see each other’s trades. Well, now they can! We added a new contest rule, called “Public Portfolios”. If you Read More…

More international exchanges are now available for your class! We just upgraded our data feeds to accommodate more exchanges than ever – classes now have access to over 40 equities markets in the StockTrak platform. The new exchange include, but are not limited to: Tokyo Mumbai Kuala Lumpur Bangkok Istanbul Milan Auckland Madrid Tel Aviv Read More…

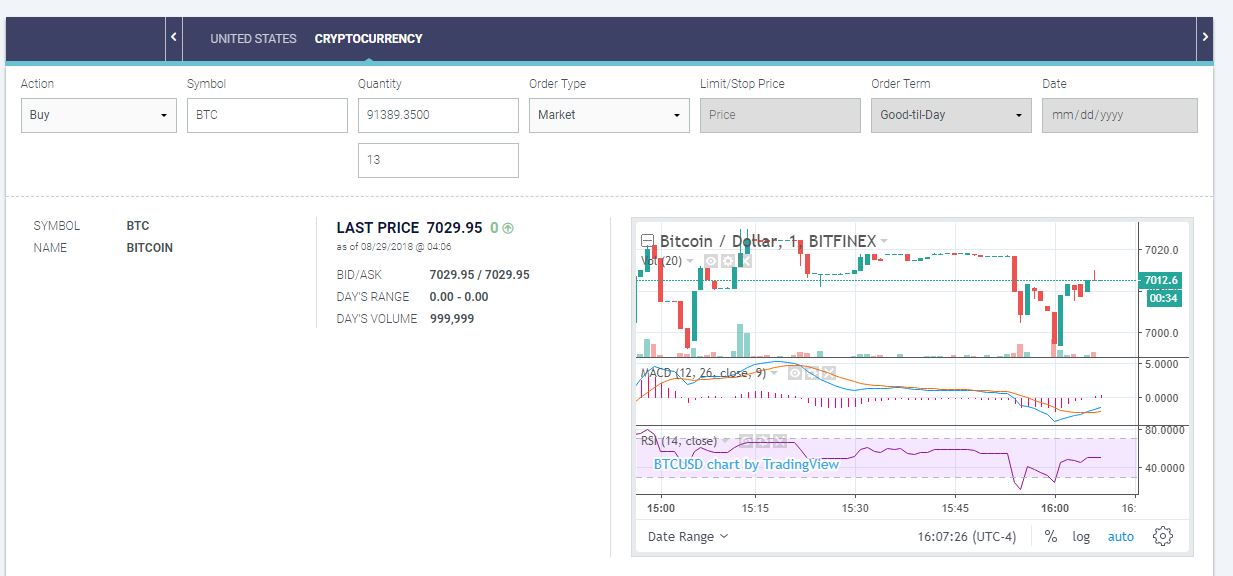

Cryptocurrency trading has arrived on StockTrak! Based on our survey of students and professors in Spring 2018, over 90% of students and over 60% of professors requested we add cryptocurrencies as a new security type, available for trading. You asked and we listened – cryptos are now available for trading! Students can enter values in Read More…

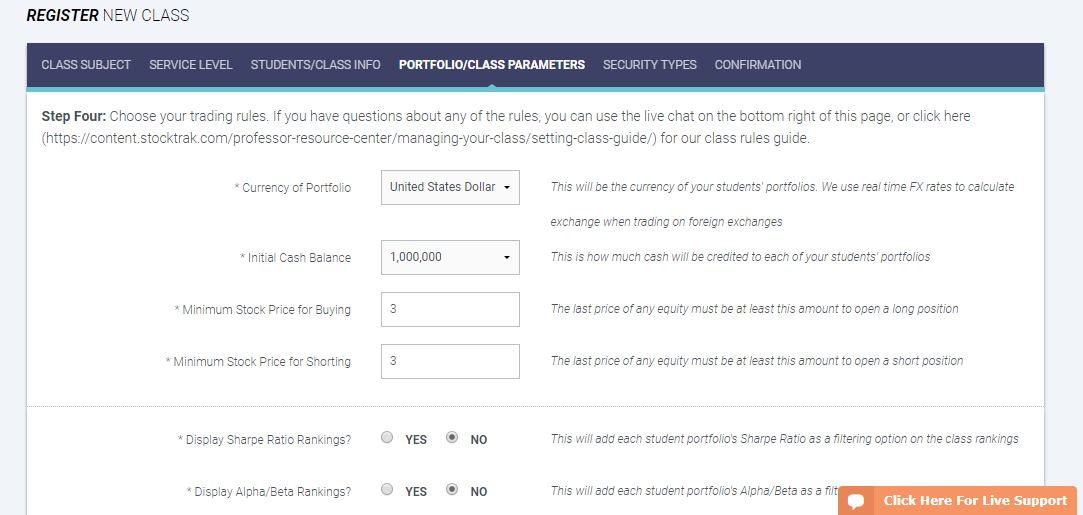

When you set up your class on StockTrak, there are over 50 different settings you can tweak to make the best possible simulation for your class. Unfortunately, 50 settings can be also a bit overwhelming for new professors. To help simplify the process, and make sure every class gets the best settings for the subject Read More…

More and more schools are offering shorter 8-week classes in the late Spring. Students love the condensed schedule, but it can be hard to include useful experiential lessons in such a short time frame. While the first 8-week Spring session comes to its close and the second kicks off, we wanted to highlight be best Read More…

StockTrak has been the leader for investments simulations over 27 years, but we are also one of the most powerful supplements included with college and university Personal Finance classes. To make our platform the absolute best it can be for Personal Finance classes, we just launched a completely new service level – including a suite Read More…

Full Forex trading has come to StockTrak! Long-time professors may already be familiar with our Spots trading pit – we have allowed students to trade currency and commodity spot contracts using a simplified trading interface, similar to a stock trade. However, with our most recent update, we have introduced our brand-new Spots trading pit, giving Read More…

Definition When we think of money, stored value means anything that isn’t cash, but you can still use to transfer value – checks, debit cards, gift cards, and forms like that. These are used to transport some dollar amount which we can later exchange for goods and services. Each of these forms of stored value have their Read More…

Use this calculator to find Net Present Value, based off expected annual growth, cash flow over a variable number of years, and separations of cash flow between investments and operations. This calculator will help you determine the attractiveness of a company by seeing how much it would be worth if you wanted to buy it Read More…

Knowing your net worth is the first step towards growing it! This tool will help you organize your assets in one place, and even help project how they will grow in the future. If you have used our Home Budget Calculator to help see where you can improve your savings, the next step is measuring Read More…

The first BIG purchase many people make is when they buy their first car. This calculator will help show the impact of many of the biggest factors people need to consider when taking out their first loan for a big purchase. If you have used our Credit Card Payment Calculator to see how minimum payments Read More…

The biggest expense most people have is the place they live, one of the biggest decisions young people face is whether to buy their home, or continue to rent. Conventional wisdom says that buying will pay off in the long term, but believe it or not this is not always the case! Make sure you Read More…

Credit Cards! These are usually the first “loans” a person takes out, and the first monthly payments! Tens of thousands of young people dig themselves deep into credit card debt before they even realize it, so have fun with this payments calculator to see how much these bits of plastic REALLY cost! If you have Read More…

The most difficult thing people think of with personal finance is building your monthly budget, and sticking to it. There are tons of different expenses and payments to consider, so we put all the big ones in one place! This tool will also help you see exactly how much you can set aside for savings Read More…

Want to be a millionaire? Everyone does, but do you know how much you need to save and what rate of return you need to get on your investments to reach that million level? This financial calculator helps you learn how your savings grows over time and how sensitive your final savings balance is to Read More…

Find out the difference between Simple and Compound Interest! See how big an impact your tax rates and inflation have on your savings over time! If you have already used our Becoming A Millionaire Calculator, you can use your targeted Expected Investment Return numbers in this calculator to see how to make that return happen! Read More…

The first thing to consider with all personal finance is the idea of compound interest! This is what separates the “Piggy Bank” savers from the Warren Buffets; making use of interest compounding is how you can really make your savings grow! If you have already used our Investment Return Calculator, you can use this calculator Read More…

There are hundreds of small tips and rules you will hear about managing your personal finances, but putting everything together into one coherent plan can be a daunting task. You have probably already heard about budgeting, spending plans, savings strategies, credit cards, and all points in between – now we will put everything together to Read More…

Raising a family is expensive. According to CNN, it costs over $230,000 to raise a child from birth to age 17 in the United States! Starting a family is the biggest change you can make to your life as a whole, but for your personal finances in particular. Some say that no one is ever Read More…

Your home will probably be the biggest purchase you make in your lifetime. Buying a home not only saves money on rent, but is a serious asset that can appreciate over time. Since homes are so expensive, (almost) no-one buys them in cash. Instead, homes are typically purchased with a special type of loan, called Read More…

Buying a car is usually the first big purchase a person will make. There is also no shortage of horror stories of people immediately regretting the decision, either by buying a new car and later struggling to meet payments, or a used car with hidden mechanical problems demanding costly repairs. When you need to buy Read More…

Automatic Payments – Blessing Or Curse? That title may be a bit hyperbolic – Automatic Bill Payments can be a huge time saver, and do help make sure your bills get paid on time (avoiding late fees and general headaches). This does come at a price, though – when your bills are automatically paid, you Read More…

“Spending Shocks” are large, irregular expenses. According to CBS, more than 60% of Americans cannot absorb a $500 spending shock: spending shocks are the #1 reasons why budgets end up abandoned, and being prepared for large spending shocks is the best thing you can do to keep your personal finances healthy. Types of Spending Shocks Read More…

Everyone needs to start from somewhere. While you build your personal finances from the ground up, you may already have faced times when you had low (or no) income, trying to get any advantage to pull yourself up. There are several public programs specifically designed to help people get out of these situations. In the Read More…

Building a budget or spending plan is tough. Sticking to the plan is even tougher. Thankfully, there are a few ways you can game the system to make sure you stay under budget, and your savings continues to grow. Budgeting Strategies A “Budgeting Strategy” means different ways to approach your budgeting to build something that Read More…

If you know something about personal finance, you understand how complicated it can be to make sure all bills are paid on time, you are fully insured, and your credit is healthy. Juggling all the different aspects of finances usually means savings and investing takes a back seat to everything else on your plate. This Read More…

If you are severely behind on your bills and all other debt management plans have failed, the last option available is declaring Bankruptcy. What is Bankruptcy? Bankruptcy is a type of forced debt settlement, and is a legal procedure. When you declare bankruptcy, the courts will gather all your unsecured creditors together, and hear the Read More…

If you find yourself over your head in debt, there is always a light at the end of the tunnel. Credit counselling agencies, both for-profit and non-profit, exist in every state to help people build a clear, workable path back to healthy personal finances. If you do need the help of a credit councillor, this Read More…

If you start falling seriously behind on your bills with simple prioritization and negotiation not enough to catch up, you still have some options available to keep your finances under control. One of the most straight-forward options is Debt Consolidation. When to Consider Debt Consolidation Most adults have at least half a dozen creditors, such Read More…

Everyone has had financial emergencies, when a huge spending shock breaks your budget or spending plan into pieces. If you have more than one emergency in a short time, such as if you lost your job, your outstanding debt balances might start to spiral out of control. Even in extreme circumstances, it is still possible Read More…

It happens to everyone: a monetary emergency happens, such as a car breakdown, draining your bank account. Bills are still coming in, and you already know that you will not even be close to paying off everything this month. One of the goals of strong personal finance is trying to avoid these scenarios by having Read More…

Every person makes hundreds of purchases every week. Think about how many individual items you have when buying groceries, how often you eat out or use a vending machine, or how often you buy new clothes. Each purchase has a reason, but each purchase costs money. One of the cornerstones of strong personal finances is Read More…

Every high school student makes a choice when they are about to graduate – enter the job market right away, enter a trade school, or enrol in a university? Everyone will make the same kind of choice many times throughout their lives. If you first choose to work, the option is usually still available later Read More…

When you are evaluating how to spend your money, most people make a fairly simple comparison – if the benefit you think you will get from the purchase is bigger than the cost, then most people go ahead with the purchase. When you are working to master your personal finances, you might notice a problem. Read More…

Health Insurance is usually the most complicated and expensive insurance you need. Unfortunately, it is also usually the most important, making it very difficult to avoid the cost. With very few exceptions, health insurance is mandatory for all citizens in the United States, but the way you become insured will change drastically based on your Read More…

Life Insurance is an insurance policy designed to pay out if the insured person dies. They were created to make sure that if the main income holder of a household dies, the payout from the policy can be used to help continue to support his or her family. Over the last 50 years, Life Insurance Read More…

Homeowner’s Insurance is a broad type of insurance coverage designed to cover a home and the property it sits on. This insurance is very broad, wrapping many different types of coverage into one package. If you want to take out a mortgage on a home, the institution you borrow from will probably require you to Read More…

“Rental Insurance” is taken out on property you rent to insure against damage. Rental insurance works like a lighter version of Homeowner’s Insurance. Why Would I Need Rental Insurance? As a renter, this insurance does not do you much good. For example, if there is a fire at your apartment caused by one of your Read More…

If you drive a car, you need to be covered by some sort of car insurance. You have probably seen dozens of advertisements from insurance companies claiming to help lower your rates, improve your coverage, or just help you compare, but before you buy your first insurance (or change providers), the first step is knowing Read More…

Once you file your income taxes, the IRS will review all the forms you submit, and either issue your return or refund, usually with very little turnaround time. However, occasionally the IRS will ask you to provide some supporting documentation before your return is accepted. The Basics of an Audit An “Audit” is what happens Read More…

Most young people are perfectly capable filing the Form 1040 EZ, or even using the longer Form 1040 or 1040 A. As personal finances grow more complex, becoming eligible for more and more tax credits, or needing to report common tax additions, filing your own taxes can be a greater burden, with more tax credits Read More…

Everyone loves getting tax breaks, but what can really ruin your finances in the long-run is forgetting about tax additions – extra taxes and fees that you need to add on to your tax bill. Missing these extra taxes will hurt – taxpayers are currently charged 6% APR on all outstanding tax balances. This means Read More…

When you file your income taxes, you can “write off” certain expenses, and get extra tax credits based on your living situation. This means that if you had a qualifying expense over the course of the year, you basically get to subtract that expense from the income you report to the IRS, which will increase Read More…

What is income tax? Income tax is the tax you pay on your income, usually directly taken out of your paycheck. Everyone who works in the United States should be paying income tax on their earnings. Income is more than just wages and salaries too. If you earn rents from rental properties, investment income, interest Read More…

What Is Sales Tax? “Sales Tax” is a tax that is charged on goods sold to end customers. The Sales Tax is a set percentage of the price of the goods sold. In the United States, all states except Alaska, Delaware, Montana, New Hampshire, and Oregon charge a sales tax, but the sales tax will Read More…

Short Term Financing “Short Term” financing means taking out a loan to make a purchase, usually with the loan term at less than a year. There are many different types of short-term financing, the most common of which are “Buy Now, Pay Later”, “Unsecured Personal Loans”, and “Payday Loans”. Short Term Financing VS Credit Cards Read More…

What are Credit Cards? Credit cards is a form of unsecured credit (meaning a loan without collateral) that you can use to make everyday purchases. All credit card purchases are made using a loan – you borrow money from your credit card issuer, and later pay it back with interest. Credit Cards Vs Debit Cards Read More…

Before Debit Cards Before the 21st century, if you wanted to buy groceries or visit the mall, you had 4 options that you could use to pay, all of which had their own drawbacks: Cash, checks, credit cards, and short-term financing. Cash is always reliable to make a purchase, but is prone to being lost Read More…

Beginners trying to tackle their personal finances for the first time see debt as sort of a “boogeyman”, a specter that looms overhead, trying to trap people into inescapable cycles of minimum payments and late fees. Or at the very least, something to be avoided whenever possible. Deep down, we all know this is not Read More…

If you want to start building your first workable budget, it is important to know exactly what should be in it, how to keep it updated, and the specific reason you want to have this budget. What does a budget look like? A budget is usually a spreadsheet or table. On one side or column, Read More…

You might have experience reconciling your checkbook by comparing your own written records with your bank statements. Fortunately, in the 21st century, this exercise is a bit dated, for two reasons: Paper checks probably only account for a small amount of your total expenses per month You probably have an automatic record with your bank’s online Read More…

When you are getting your financial records organized, it is important to keep track of your spending, so it is important to keep track of receipts. This can add up to a lot of paper very quickly, so one of the most common questions beginners are faced with is “how much do I save, and for Read More…

Credit Reports are basically a report that contains your credit history – both the good and bad. If you watch late-night TV, you have probably seen a few commercials offering free credit reports, so you might know that these are important. Most people, however, don’t know just how big a role a credit report can Read More…

The idea behind insurance is that there are random bad – and expensive – things that happen to just about anyone. Car crashes, medical emergencies, and other problems that can destroy your personal saving and investing plans if they happen. How Does Insurance Work? To protect against this, insurance companies work to pool the resources Read More…

To be “In Debt” means to owe money to someone else, usually making fixed payments to pay back the amount over time, plus interest. Debt means different things to different people – having some debt is perfectly healthy for your personal finances, but too much can leave you buried. There is also a major difference Read More…

Everyone needs some income – money to pay the bills and live off of, but income comes in many shapes and forms. It might seem obvious, but your total compensation for work is more than just the paycheck you get – depending on your age and where you work, there can be many different forms Read More…

An “Investing Strategy” is a plan for how to save money to help it grow. Sometimes an “investing strategy” can just mean “plan for trading stocks”, but it really means a lot more. Liquidity, Risk, and Potential Returns All investments balance liquidity (how easily it can be converted into cash for other use), risk (the Read More…

Today, all of our financial lives are online. Apart from a few paper records, everything you need to know can be accessed from nearly anywhere in the world, instantly. The only problem is making sure that you are the only one who has access to it. Fraud and Identity Theft are growing problems, impacting just Read More…

“Consumerism” can have many meanings, but each person in an economy is a “Consumer” – someone who buys and uses goods and services. As the world’s economy grows, each person is involved in more, and bigger, transactions, and so the rights and responsibilities of being a well-education consumer are more important now than ever before. Read More…

Building the next “Big Thing”. Being your own boss. Getting the full rewards for your work. There are a lot of reasons to start a business (along with lots of risks), but taking the plunge is a step every entrepreneur has to face if they plan on striking out on their own. Why Do People Read More…

What Is Credit? “Credit” is when you have the ability to use borrowed money. This can come in many different forms, from credit cards to mortgages. There is a wide range of ways to use credit, which means that it is often a challenge for beginners to learn all the different ins and outs of Read More…

When should someone start planning for retirement? Fidelity Investments recommends most young people try to save up 2x their annual salary by the time they turn 35, which is a pretty good benchmark to shoot for. Unfortunately, retirement is so far off the mind of most young people that they find their retirement account is Read More…

Definition A “Contract” is a legally binding agreement between two parties (people, companies, or both). Having a contract means that if one party does not keep their word, the other can sue them in court to either force them to fulfill their side of the agreement, or pay back compensation. What Makes A Contract Binding? Read More…

Financial Records are what you use to have an easy way to tell where all your money and assets are, and exactly how much you have, at any given time. They are not one document, or even one type of document. In fact, most people’s financial records will not look the same as anyone else’s, Read More…

How Is Money Created? In the United States (and many other countries), the question “How is money created?” comes up a lot. The treasury isn’t just printing cash all day, if they were the government debt would be zero! In the US, money is created as a form of debt. Banks create loans for people Read More…

Definition of Wealth “Wealth” means having an abundance of something desirable. This can be tangible, like money and property, or intangible. Intangible Wealth Just because something does not have a monetary value does not mean it is worthless. Having strong connections with friends and family is often considered a major component of wealth – since Read More…

When talking about Banking, people generally group Banks, Credit Unions, and Savings & Loan companies all in one group. They do provide similar services, but they each have specific differences that might make them a better or worse fit for your financial needs. What They Have In Common All three of these institutions can do Read More…

Definition of Spending Plan A “Spending Plan” is exactly as it says – a plan of what you will be spending each month. There are usually two parts – your “fixed” spending and your “variable” spending. The fixed part is usually the same every month, with things like rent/mortgage payments, grocery bills, insurance, and car Read More…

What is a Balance Sheet? The Balance Sheet (or Statement of Financial Position) is one of the four financial statements required by the SEC based on the U.S. GAAP (Generally Accepted Accounting Principles). According to the SEC, the Statement of Financial Position presents “detailed information about a company’s assets, liabilities and shareholders’ equity.” In other Read More…

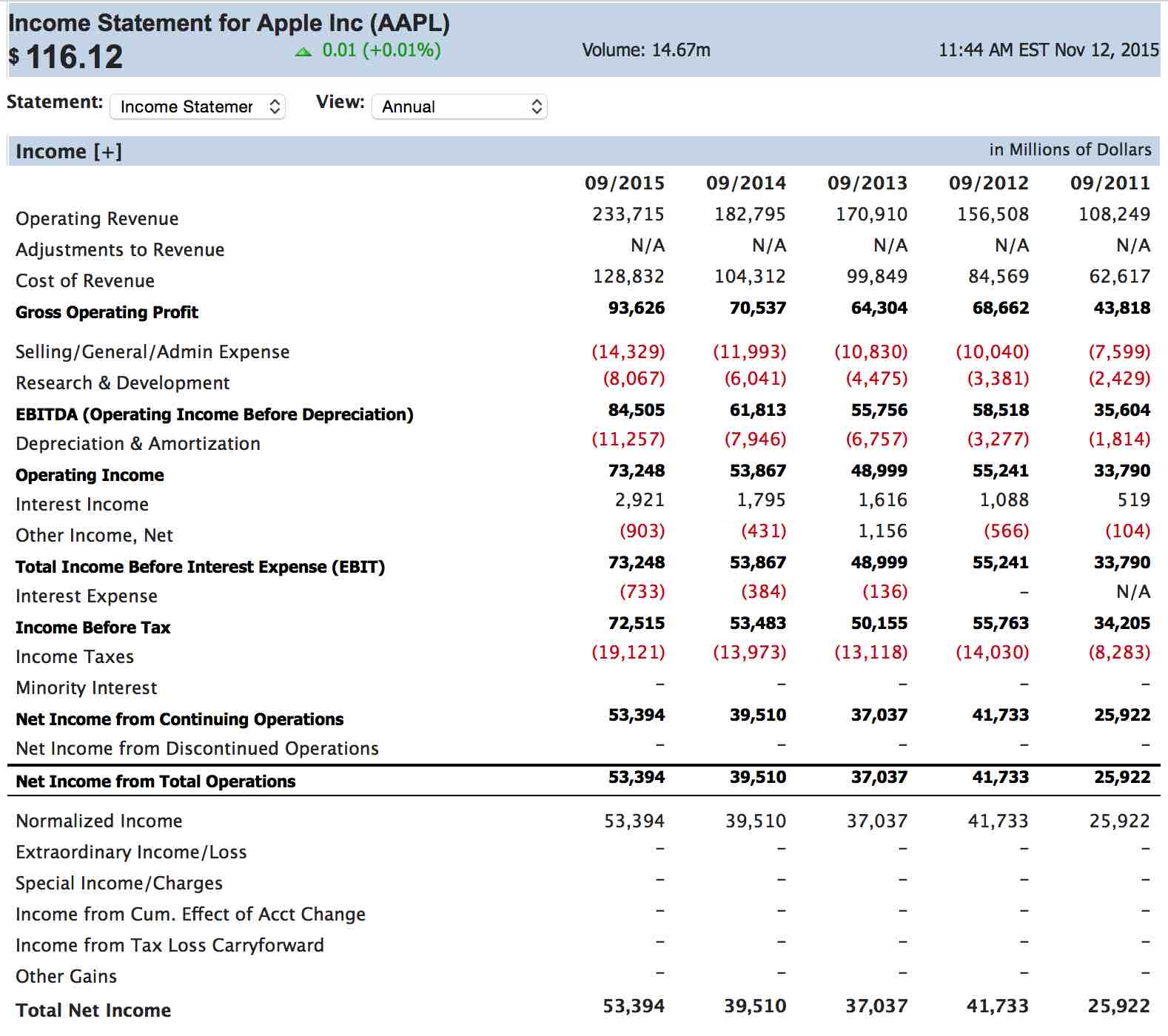

Definition: The Income Statement is one of the financial statements that all publicly traded companies share with their investors. The income statement shows the company’s sales, expenses, and net profit (or loss) over a period of time–usually 3 months, year-to-date, and twelve months. The income statement also comes with a lot of notes and discussions from the Read More…

It is essential that students are able to justify every trade placed while using StockTrak – most professors already require students to write summaries of their trading activities, usually as a final report or presentation of their portfolio. The only downside is that these summaries are always written with 20/20 hindsight – it is hard Read More…

The GBP/USD pair is currently trading at 1.2736 (up 0.43% or $0.0054) as at Friday, 23 June 2017. The cable has had a rather torrid time over the past 1 year, dropping from 1.4877 on June 23, 2016 to its current level. Over the past 1 month, there have been significant movements in the value Read More…

The most challenging aspect of starting to invest is picking the first few stocks to add to a portfolio. Every investor has their own techniques and strategies, but we want to give you the tools you need to place your first trades, and get your portfolio off to a running start. Establish Goals Before choosing Read More…

A common request we receive is professors looking for ways to make StockTrak more accessible for students in entry-level classes – students who are first starting to understand the fundamentals of investments and finance, or participating in remote classes with less face time with professors for explanation on how to get their portfolio started. Well, Read More…

The definitive StockTrak user guide. Details on creating your account, making your first trade, managing your portfolio, and everything you need to get started.

These tutorial videos walk through how to make trades, use different order types, conduct research, and manage your portfolio.

Definition Spot and Futures contracts are a standardized, transferable legal agreement to make or take delivery of a specified amount of a certain commodity, currency, or an asset at the current date. The price is determined when the agreement is made. The only difference between spots and futures is the delivery date. The current date Read More…

Definition: A “Ticker Symbol” is a unique one to five letter code used by the stock exchanges to identify a company. It is called a ticker symbol because the stock quotes used to be printed on a ticker tape machine that looked like the images below. WARNING: The ticker symbol is NOT just an abbreviation of Read More…

Mutual Funds are a way you can buy into a wide range of stocks, bonds, money markets, or other securities all at once. They are professionally managed, so you’re basically buying a piece of a larger portfolio. Definition Mutual Funds come in several different “flavors,” but the core concept is always the same. Read More…

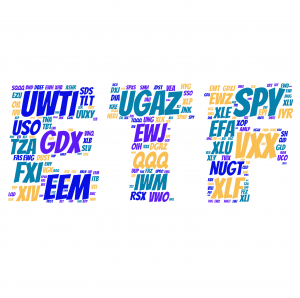

ETFs are a fairly new way that you can buy a large group of stocks, assets, or other securities all at once. ETFs trade just like stock; you can buy and sell shares of an ETF throughout the day on an exchange. Definition ETF funds are not usually actively managed, instead they work like an Read More…

Simply put, when you have money to invest for an extended period of time (like 20 years or more), the stock market historically has provided the greatest return. When most people are able to save money, they usually put it in the bank. Banks usually pay interest on the cash in your account, so if Read More…

Definition A stock quote represents the last price at which a seller and a buyer of a stock agreed on a price to make the trade. Because stock prices are determined by a continuous auction process between buyers and sellers, stock prices change frequently as the buyers and sellers change. Prices also change as new Read More…

Following is a list of the most popular (largest) mutual funds. Rank Symbol Fund Name 1 PIMCO:Tot Rtn;Inst 2 Fidelity Cash Reserves 3 Vanguard Prime MM;Inv 4 Vanguard T StMk Idx;Inv 5 Vanguard Instl Indx;Inst 6 JPMorgan:Prime MM;Cap 7 Fidelity Contrafund 8 Vanguard 500 Index;Adm 9 Vanguard T StMk Idx;Adm 10 American Funds CIB;A 11 Read More…

One of the most common requests we’ve received from professors is to remove themselves from the class ranking, leaving only student accounts. We have just as many professors who like to leave “benchmark” portfolios for students to compete against, keeping the competitions lively. To accommodate both types of teaching, we are happy to announce a Read More…

The Open Positions on StockTrak have just gotten an upgrade. Now from the “list” view, students can sort their holdings alphabetically, quantity held, price paid, last price, market value, or profit/loss. Simply click the column heading of the value you would like to sort by to instantly re-order your holdings by what matters most.

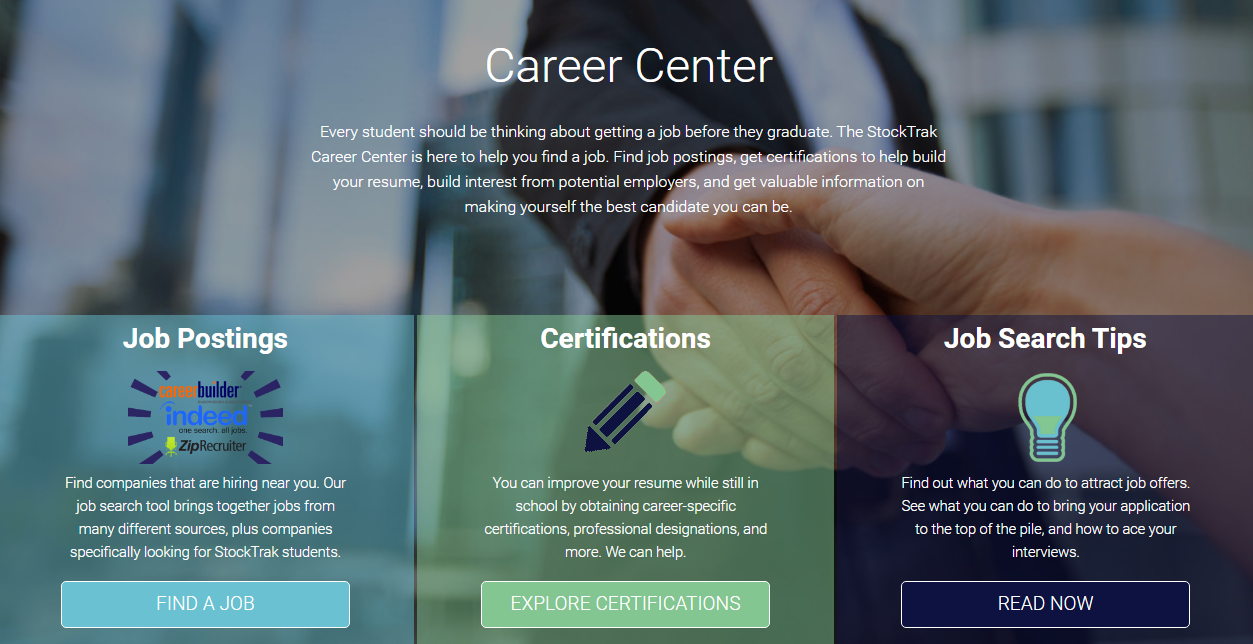

This might be the most valuable update to StockTrak yet! Last year, over 80% of students who used StockTrak believed it made them a stronger candidate in the job market, and we take that information seriously. We want to help your students find jobs, and to help, we have launched our new Career Center. The Read More…

Just because you aren’t graduating this semester does not mean you can ignore the job market! There are some very important steps you can take towards starting a great career that you are still in school that over 90% of students overlook, find out what you should be doing now!

Graduating students who hit the job market can go for months without a single call back or interview if they make just one of these mistakes. Even if you have a perfect academic record, internship experience, and a head start, make sure you do not fall into one of these common traps that will get your application immediately rejected.

Most students search hard for a great internship to help launch their career. Unfortunately, not all internships are created equal. Learn how to spot internships that provide great work experience, valuable networking opportunities, and very few coffee runs.

If you want to land a great job, you will have to go through several rounds of interviews for each company who is interested in you. Find out what you can do to stand out from the competition, and what mistakes to avoid to move on to the next round.

If you are applying to a big company after graduation, there is a big chance your resume will get rejected before even seeing human eyes. To succeed in the highly competitive world for jobs after graduation, learn how to optimize your resume for keywords, and get your resume to the desk of the people you want to see it.

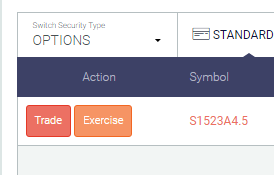

If your class includes options trading or derivatives, you have probably covered options, and how to exercise them, in great detail. In the past, StockTrak generally discouraged students from exercising options, since it is generally more profitable to sell the option contract itself and keep the time premium. If students wanted to exercise their options, Read More…

Everything you ever wanted to teach your next investments or finance classes StockTrak Set To Launch A Completely Redesigned Trading Platform The StockTrak Team has been working very hard to offer you the best stock market simulation and virtual trading application. We are proud to officially announce the release of our newly redesigned trading platform Read More…

STOCK-TRAK’S Get Rich Slowly Tip: Refinance Your Student Loan and Start Saving Your Cash! If you want to get become wealthy, most successful people will agree it is easier to get rich slowly than to get rich quickly. When most recent college graduates think about improving their personal wealth they tend to focus on making Read More…

The Achilles Heel of big class competitions on StockTrak used to be the lag between when your students’ portfolio values updated, and when they moved in the rankings. For big classes, this delay could be over 2 hours long. With this most recent update, your class rankings are now streaming in real time – as Read More…

Using StockTrak could be an exercise of patience for students who day trade – constantly refreshing the Open Positions to see price movements can be draining. Not anymore! With our most recent upgrade, the Open Positions now flashes price updates as they happen – every few seconds, the values will update. It is also color Read More…

This semester we have been working hard at some back-end upgrades to help StockTrak grow into the future. This week we completed a serious upgrade to our webserver space – in short terms, StockTrak is now much faster and more reliable than ever before! Our initial benchmark tests show open positions and class reports load Read More…

Do you have students looking forward to a career as a Stock Broker? They will need the Series 7 certification! StockTrak has partnered with Securities Training Corporation, who has trained over 75% of professionals working on Wall Street today in at least one of their training programs, to offer the new Series 7 prep course Read More…

Options trading on StockTrak just got better with our new Option Payout Diagrams! Now, as soon as a student pulls up a quote for an option, we will also draw the payout diagram showing the break-even points and estimated profit for the option contracts based on the underlying stock price. Just one more way StockTrak Read More…

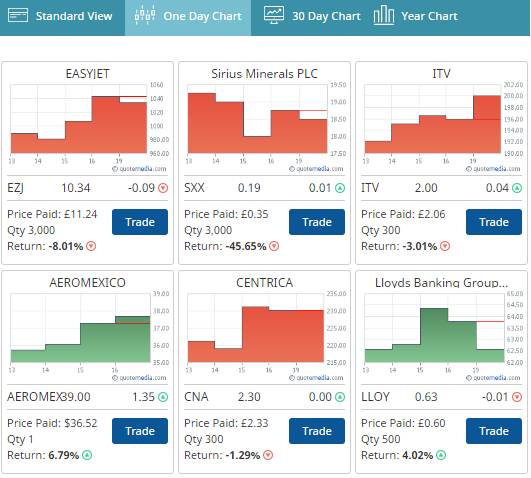

The new wave of portfolio management is here! With our most recent update, all StockTrak users can view their Open Positions either with the classic list view, or switch to brand-new Charts. The charts can toggle between the performance of each user’s holdings over the last day, month, or year. They are also color-coded: green Read More…

StockTrak is the world’s leading portfolio simulation, but what if you could also include a trading simulation with your class? With TraderEx, you can! What is TraderEx? TraderEx is a way to simulate working as a Wall Street trader throughout a single trading day. The portfolio manager (professor) gives instructions to the traders (students) which they Read More…

New System Messaging has been added to StockTrak! These new system messages appear as a colored bar at the top of the screen – these are used by our team to relay important information to all users, such as market closures or any system announcements all users need to be aware of. This is also Read More…

Using StockTrak in your finance and investing classes just got a lot easier! Starting today, the “Quotes” page on StockTrak has a new suite of professional-grade research tools at your students’ disposal. This powerful new addition brings the StockTrak simulation to a whole new level. These professional investment research tools include detailed information at every Read More…