You can change your password by clicking “Edit Profile” under the “Dashboard” tab, or click here to change your password.

If you have forgotten your password, please use the forgot password link.

Student StockTrak Technical Support and FAQ

Student’s Frequently Asked Questions

Need help with your portfolio? This is the place to start!

If you can’t find the answer to your question here, use the support form at the bottom of the page and we will get back to you within 1 business day.

General Questions

About Stock-Trak

In order to cancel your account, please use the contact us form and our help desk will assist you in canceling your account. For individual investors, we offer a 30-day money back guarantee, no questions asked.

Yes, each day we receive an updated list of stocks that have split or have paid a dividend. The dividends and splits are then accounted for on the website. If we happen to have missed one, please fill the form below so that we can apply it.

This message usually pops-up when the class name is not entered correctly. To receive the exact class code, please fill the form at the bottom of this page with the following information:

- Name of your professor

- Name of your institution

- Class name and class code

Stock-Trak allows trading of Equities(stocks), Mutual Funds, Bonds, Options, Spots, Futures and Future Options. It is up to the class creator to decide what securities are allowed to be traded in his/her game.

My Account

To change your username, fill out the form at the bottom of this page and provide the new username you would like to have. Please provide two or three alternate names in case your first choice is taken.

Please write your current username as well to help us find your account.

My Portfolio

Yes! You can make a trade after the market has closed. Your trade will be filled at the open price of the stock at the next market open.

You can only cancel open orders. To see your open orders and to cancel any of them, go to the “My portfolio” tab and select the Order History in the sub-menu.

To report a possible error, please fill out the request form below and tell us the symbol and date/time of the trade(s) in question. (Example: AAPL on 2013-12-17 at 11:20 am). Providing as many details as possible and any screenshots to support your request will greatly help speed up the review process.

To make a trade, start by hovering your pointer over the “Trading” tab and then select the type of security you’d like to trade from the drop-down menu. From here you select what action (buy, sell, cover, short) you wish to take, the order type (market, limit, stop, trailing % or $) and fill in the rest of the required information. Then click “Preview Order” and if you are satisfied with it, click “Place Order” to confirm your trade.

Trading Tutorial Video:

If margin trading is allowed in your class tournament, then you will automatically begin trading on margin (or take a loan) once you have exhausted all of your available cash. You will also automatically start paying interest on your loan. Additionally, the loan will automatically be paid off once you liquidate your positions.

Do not get confused with margin requirements with futures and options. This is more like a line of credit or loan.

This means that your order is violating the position limit rule set by the professor. Position limit is the maximum % of your portfolio value that can be comprised of 1 single security. So for example if your position limit is 25%, then no single security can make up more than 25% of your portfolio value. Professors can also choose to set different position limits for different types of securities when creating their class.

If you do not have adequate cash and/or buying power, then the number of shares will be adjusted to allow the trade to be filled as best it can.

We can only make corrections to user errors with the direct permission of the Professor/Class Administrator. Please have them contact us on your behalf if you need a mistake corrected.

To see the status of any order, check your “Order History” page. There are several reasons why you can’t see your order in “Open Positions“:

- 1. If your order requested volume greater than 50% of available volume, then your order will remain pending until sufficient volume is available.

- 2. If you placed the order outside market hours, you order will stay open until next market open.

- 3. Limit and Stop orders remain open until your requested price has been hit.

There is a wide range of historical data that can be seen and exported.

For historical values:

- Go to Graph my portfolio and click on historical portfolio values.

- Go to Portfolio Summary and either export the entirety of your data from the drop down menu (Account Balances, Transactions, Open positions) or simply change the day you wish to verify.

For transactions:

- Go to Transaction History in the “My Portfolio” menu bar. From there you can either change the date range or hit the excel export icon in the top right corner.

For recent orders:

- Go to Order History under the “My Portfolio” tab. From there you can either change the date range or hit the excel export icon in the top right corner.

For historical rankings:

- Go to Rankings under the “My Portfolio” tab. You can export to Excel the portfolio and the Alpha/Beta rankings as of the selected date.

Exchange rate calculations are done automatically when making trades on foreign markets. There is no extra work on your part, though it is good to be aware of potential gains/losses you may experience due to exchange rates.

You do not need to exchange money in a different currency, it is done automatically when buying, selling, shorting and covering.

Yes, this could mean the symbol has stopped trading for a number of reasons or that there is an error with the security in our system. Please inform us of any problems you may encounter as we always work to correct the issue as quickly as possible.

Sometimes, due to a quick gap up or down, the stock may only trade at your limit price for a few seconds and then quickly bounce off of your ‘limit price’. As a result, your order will not get filled. This is normal and occurs on any trading platform, including real stock brokerages.

Also note that the bid or ask (whichever is applicable) must also hit that limit.

The system automatically makes symbol changes each morning, so this should happen right away. If your portfolio doesn’t reflect this change within 24 hours, please contact us using the form at the bottom of this page, and include a link to a news story or press release mentioning the symbol change for verification.

The system automatically implements stock splits before the market opens, so this should happen right away. If your portfolio doesn’t reflect this change within 24 hours, please contact us using the form at the bottom of this page, and include a link to a news story or press release mentioning the symbol change for verification.

Please contact us using the form at the bottom of this page if there is an error, we will gladly fix it!

Getting a different price from the preview can be due to many factors.

- The prices shown on the order preview have a 15 minute delay, but we execute all orders in US markets using the real-time bid/ask prices

- You were looking at the “last price” instead of either the bid or the ask price. This can be a large gap for some stocks, most commonly for stocks with low volume.

- There is a slight lag between confirming and the preview, the price can change in that time.

- The order did not execute immediately. This is most common with stocks with low volume.

“System Cancelled” means that either an admin or the systems’ automatic trade rules cancelled an order. This is generally due to insufficient buying power or you tried to purchase too much of one asset and we’re blocked by the position limit.

Under the “My Portfolio” tab select the “Open Positions” sub-menu – click on it to see all your open positions.

For an order to go through, a number of factors have to be satisfied:

- 1.You must have enough buying power.

- 2.There must be adequate volume on the market, since we only allow users to trade up to half of the volume of any security on the market.

- 3. You must not exceed your position limit. The default position limit is 25% which means you cannot put more than 25% of your portfolio value in a single security. Please note that only professors have the ability to change the position limit for their classes.

Once all three factors are satisfied, and given the market is open of course, the trades should execute right away.

There are several rules which may prevent you from placing an order:

- 1. Your challenge hasn’t started yet: Please check with your teacher for the beginning and end dates of your challenge.

- 2. Minimum Stock Price: The minimum stock price must be $3.00 or higher

- 3. Position Limit: You may not buy/sell an amount of securities that would be greater than 25% of your portfolio value.

- 4. Insufficient Volume: If the desired security does not have sufficient volume to execute, then the order will stay pending until filled or canceled. By default the volume in the real markets must be double the amount you are attempting to trade.

- 5. No Shorting Penny Stocks: You may not short sell any stock whose value is less than $3.00.

- 6. No Penny Stocks on Margin: Buying stocks on margin (loan) priced less than $3.00 is not permitted.

- 7. Insufficient Buying Power: You are out of money. Close some of your open positions to regain buying power.

- 8. Your Challenge has ended: Please check with your teacher if the challenge has ended.

Basics Of The Stock Market

A wise investor will always conduct some type of analysis before making an investment — acting on hot tips or blindly following the crowd rarely pays off. A great to start is to look around and observe the spending habits of their families, friends and even themselves—what are they buying? Are they buying more than they use to buy? What products do you always use and trust, and which ones you do not use anymore?

Students should start watching business channels on TV, and start reading a few of the popular stock market websites. Here is a list of popular sources for financial news:

Restricted Funds are set aside when you place any limit orders that are not immediately filled. The funds are needed in the event that your limit price is met and triggers the action you requested. When your limit order is filled, the restricted funds are used to complete the transaction.

Restricted funds are also created when you place a market order when the market is closed. As with limit orders, the restricted funds will be used once the order executes.

Everyone has heard the old adage “Buy low and sell high.” When a trader buys a stock, he is said to have a “long” position. He is “long” because he believes the stock price is going higher. This is also known as being “Bullish” or a ‘Bull” on the market.

Conversely, a trader can also make money when he thinks a stock is going to decrease in price. Instead of buying low and selling high, a trader can “Sell high and buy low.” In this instance, a broker will actually loan the trader shares of stock that the trader then sells. At this point, the trader has “sold short” the stock and believes the price is going to be lower. This is also known as being “Bearish” or a ‘Bear” on the market. When the price has fallen, the trader buys the stock at a lower price and “covers” his “short” position. The trader then takes the shares that he just bought and returns them to the broker from whom he borrowed the shares.

The stock exchanges provide the valuable service of bringing together all of the buyers and the sellers of stocks each day and matching the buyers and sellers that agree on a price. The exchanges keep track of all of the open orders and show the highest buy order price as the “bid price” and show the lowest sell order price as the “ask price.” The “ask” is the price the person who owns the stock is asking to sell his shares.

A limit order is an order in which a specific price is set to buy or sell a security. If the price point is hit and there is sufficient volume at that price point or better, your order will be filled. Limit orders may be placed as “Day” orders which are good for the day only, or as “GTC” orders, which are good until canceled.

A market order is an order to buy or sell a specified number of shares (or bonds, etc. ) at the best available price when the order is submitted. All orders that don’t bear a specific price are considered market orders.

Market orders placed while the markets are closed or before the market opens will be executed at an appropriate bid/ask price shortly after the market opens and contingent to trading volume on that particular stock. If the stock requested does not have sufficient volume to execute, then that order will stay pending until filled or canceled.

Mutual funds are a professionally managed type of collective investment portfolio that pools money from many investors and invests it in stocks, bonds or other securities. The mutual fund is operated by a fund manager that trades the pooled money on a regular basis.

Companies initially raise money by selling their stock. A share of stock represents fractional ownership of a business. When you buy shares of stock in a company, you are buying a small fraction of the business and all the profits that go along with it. For example, if ABC Company needed to raise $1,000,000 they could sell 100,000 shares at $10. Each share that you owned would represent 1/100,000th ownership of the company.

Keep in mind that some companies are “public” and some companies are “private”. Private companies are smaller companies that have raised money through a small number of investors and their stock does not have an active market where it can be bought and sold. Public companies have sold their stock to many investors (shareholders) and have registered their shares with the Securities and Exchange Commission and with an exchange (NYSE, AMEX, or NASDAQ) and hence their shares can be bought and sold with ease on an exchange.

The two main types of shares are common and preferred stocks. Common stock gives the owner the right to vote at shareholder meetings and receive dividends if any are declared. While preferred shares typically don’t confer voting rights, they have priority over common shares for earnings and assets. This means when a company declares dividends, preferred shareholders are paid before common ones and have a higher claim to assets if the company goes bankrupt and is liquidated.

A stop order is an order to buy or sell a stock when the stock price reaches a specified price, which is known as a stop price. When the specified price is reached, the stop order becomes a market order.

- (a) A Sell Stop Order is used by investors and traders long a stock to protect an existing profit or avoid further losses if the stock price drops. A stop order to sell must be placed below the current market price.

- (b) A Buy Stop Order is used by investors and traders short a stock to protect a profit or limit a loss if the stock price increases. A stop order to buy must be entered at a price above the current market price.

Stop orders may be placed as “Day” orders which are good for the day only, or as “GTC” orders, which are good until canceled.

For example, if you own 100 shares of IBM at $100/share and you want to sell it if the stocks goes up to $110, that would be a limit sell order; but, if you wanted to sell if the stock price drops to $95 so as to limit your losses, that would be a stop sell order.

A market order that was placed when the market was closed and has not filled yet, or a limit/stop order that has been placed but the price has not been met yet and therefore has not executed yet is called an open order.

Day trading is when you are able to buy and sell the same stock on the same day. Keep in mind that such frequent trading will generate lots of commission charges and that you are limited to a certain number of trades for the Challenge.

Whether day trading is allowed is dependent on the tournament you are in.

The North-American stock market opens at 9:30AM EST and closes at 4:00PM EST. Any trade made when markets are closed will be processed the next business day. This is only true for stocks, bonds and mutual funds. Futures trade at different times.

Markets are CLOSED for these Federal Holidays in the U.S.: New Year’s Day, Martin Luther King, Jr. Day, Presidents’ Day, Memorial Day, Independence Day, Labor Day, Thanksgiving Day, and Christmas Day (observed). On the day following Thanksgiving and frequently the day before Christmas, the market will close at 1:00 pm EST.

Trading Rules

Commissions are decided upon by the professor and can be set as fixed $ amounts per trade, per share or a % total of each trade.

Stock-Trak executes all North American stocks, options, and future orders at real time prices. Mutual funds and bonds are executed at end of day prices while trades from international stocks are delayed 15-30 minutes. Since the markets close at 4 pm ET., trades made after that time will be executed at the opening price of the next trading day. Please note that although trades are executed at real time prices, and that the bid and ask prices are real time; the prices you see in your open positions are delayed by 10–15 minutes.

Every successful transaction you make (buy, sell, short or cover) is counted as a trade. Open and cancelled orders do not count against your trade limit. Dividends and stock splits do not count as trades.

Your initial cash balance is decided by the professor/class administrator when creating the game and can vary from thousands of dollars to hundreds of millions in the currency of their choice. You can view the initial cash balance by clicking “Portfolio Summary” under the “My Portfolio” tab.

If you are an individual investor you can contact us to change your initial portfolio value.

Security Type Questions

Not all challenges allow all security types. Check your Portfolio Summary page to review what is allowed in your current challenge.

Stocks

Yes, short selling is permitted and short orders do not need an uptick to be filled. You can short sell stocks that are priced greater than $3.00. Proceeds from a short sell are restricted and cannot be used to buy additional stocks. You can view the proceeds from shorts as ‘Short Balance’ on your account balance page or make a trade page.

No, you cannot trade halted, restricted and blocked stocks. Any trade that is confirmed after trading has been halted will be reversed.

Yes, we allow stock trades on many different exchanges across Latin America, Europe and Asia as well as North America as long as the tournament you are in has allowed it.

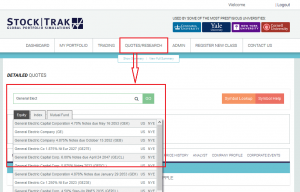

When making trades, you must know the ticker symbol of the securities to be traded. Go to the ‘Symbol Lookup’ page under the “Quotes/Research” tab and enter the full or partial company name and click “Search”.

Mutual Funds

No, you can only buy mutual funds in long positions.

No, all US mutual funds are 5 letter symbols ending in X (VALBX, GARFX, ICTWX, etc.). Symbols that end in XX would mean it is a Money Market fund.

Yes, you can as long as you cancel the order prior to 4:00 PM EST. Go to the “My portfolio” tab and select “Order History” from the sub-menu. From this page select all or open orders and you can cancel the order.

Mutual fund orders do not work like other types of securities. Orders can be placed throughout the day, but they are only processed/filled at approximately 6:00 pm EST. Any orders placed after 4:00 pm EST will not be filled until 6:00 pm EST the following day. Do no worry if your order has not executed before 7:00 pm EST.

Options

Options do not have to be exercised in order to realize any potential gains. In fact you actually lose money by exercising them, since you paid a time premium to buy them which is lost if you exercise the options. They can also be traded like any other security or they can be held until expiration. If they are held until expiration, the system will settle the contracts in cash.

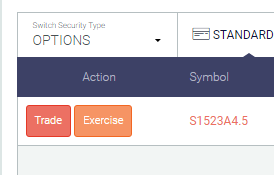

If you do wish to exercise your options, you can click the “Exercise” button on your Open Positions page next to the option you wish to exercise.

Each particular option contract has its own trading volume and it is very likely that your option orders aren’t filling because those contracts have little to no volume in the real world. Even options for huge stocks like GOOG and AAPL still have much, much lower volume than the stock itself. Options on smaller company’s stocks often have no volume except for the strike prices that are very close to the stock’s current trading price.

To check the volume of an option you are trying to buy or sell, go to the options trading page and enter in all the details as you normally would when making an order. When you have finished, you will see a quote for the option itself appear right under the company’s stock quote. If the option’s volume is smaller than your order quantity then the order likely will not fill.

Futures

Futures have very high multipliers. Each future has different multipliers and so a small change in the underlying asset price can, in some cases, create very large losses (or gains).

Futures do not trade at the same time as the stock market. Please see CMEGroup for the futures you are interested in. For example, currency futures trade nearly 24 hours whereas others have a trading halt throughout most of the day.

You can click here to find more information on the contract specifications per future contract. For the futures expiration calendar, click here for more information.

Future options are already infrequently traded. Shorting future options is very infrequent in the real world, so to reflect this we have disabled it on our platform.

Submit A Support Request

If you need more help, or contact our technical support team, you can use the “live chat” at the bottom-right corner of every page, or click here to create a support ticket.