Every class that uses StockTrak is different – some focus on equities, others derivatives, still others on Forex or Bonds. However, all classes have one thing in common: an emphasis on portfolio diversification.

StockTrak has supported basic diversification rules for many years. Our “Position Limit” rule puts a cap on how much your students can invest in any single security. But when it comes to many investments classes, this may not be enough – professors were looking for a way for diversification to be enforced across entire security types (requiring, for example, students to invest equally between “Equities” and “Options”).

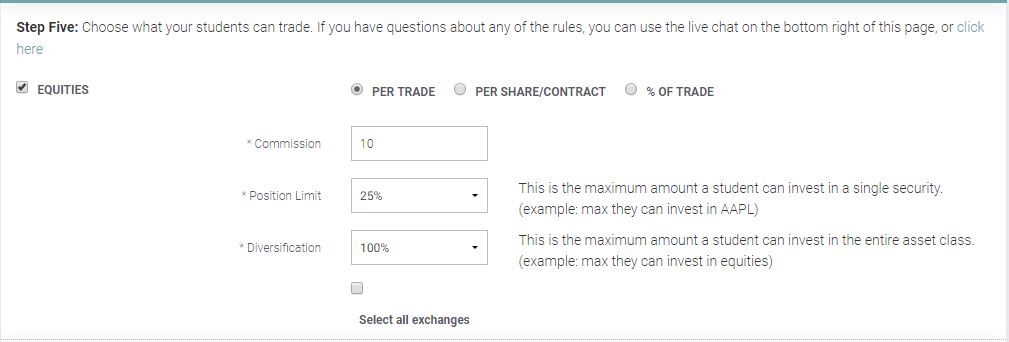

To fill this gap, we just introduced new class rules for Diversification by Security Type. The next time you set up your class on StockTrak, you will see a new setting on the Security Type Selection:

The new “Diversification” rule puts a cap on how much of each student’s portfolio can be invested in that security type. For example, putting a 50% cap on Equities means students can only allocate 50% of their portfolio to equities as a whole – the remainder must be divided between Mutual Funds, Bonds, Options, Futures, or Forex.

The diversification caps are set independently for each security type (so you can enforce no more than 50% invested in Equities, but up to 75% in Mutual Funds), and can be modified as your class goes on.

To take advantage of the new Diversification Rules, click here to set up your new class.