Financial Literacy

for High School Students

Over 20,000 high school teachers use our personal budget game, stock market game, and curriculum every year.

Experiential Learning

Whether you are teaching Personal Finance, Economics, Business or Social Studies, our products provide real world experience.

Games are Fully Customizable by Class

Teachers configure the simulations to match their objectives and time frame.

Curriculum Aligns to Standards

Our games include embedded lessons and assessments to make sure students are always learning.

Real-Life Financial Literacy Games for Students

Financial Literacy Skills for the Real World

Make sure your students become financially literate before they graduate. Engage them with our real-world financial literacy game at PersonalFinanceLab where your high school students play our personal budgeting game or stock market game, or both! As students progress through these games, your students compete for class rankings, earn badges, and ultimately receive certifications. To learn more about PersonalFinanceLab:

Request Demo Contact Us

Education Through Gamification

Whether you are using our virtual stock market simulation or our personal budgeting game, each includes embedded curriculum to make sure students are learning each step of the way. Site licenses are available for larger programs, trading rooms, and campus wide financial literacy initiatives.

Stock Market Simulatios Budgeting Game

Teachers Easily Track Student Progress & Performance

- Full admin section allows teachers to manage and review multiple class activity with one login

- Assessments of performance by student in managing portfolios

- Class rankings and statements can easily be downloaded into Excel for further analysis

- Built-in assignments and pop quizzes to track and verify student completion

Standards Aligned

Our curriculum of over 300+ lessons aligns to a variety of National and State Standards. This includes JumpStart, Council for Economic Education, and CTE Standards.

View Curriculum Contact Us

Experiential Learning

Whether you’re preparing your students for real-life budgeting situations or to introduce them

to the stock market, our K-12 products help prepare your students for their future.

What Students Say About Us

Recommended Use Cases

PersonalFinanceLab.com

The PersonalFinanceLab.com platform is a unique teaching and learning tool for Financial Literacy and Business classes. Our combination of personal budgeting games, real-time stock games, and standards-based curriculum with built-in assessments is designed to perfectly integrate with your classes.

Teachers can mix and match games and curriculum, all with built-in assessments and dozens of customizable reports. Every aspect of PFinLab is designed to be customized to work with your existing classes, or use our pre-built course outlines with customizable lesson plans to launch a new class from scratch!

Our resources start by using our budgeting and stock games as long-term foundational activities – teachers usually dedicate at least 20 minutes per week for each game they choose to include in their class. Students manage their long-term budget and/or stock game portfolio over the entire duration of their class, reinforcing long-term consequences for every action in an environment controlled by the teacher. The games are enhanced with our 300+ lesson curriculum library, so teachers mix and match lessons with the games for a new experience every class period, uniquely tailored for your class!

Request Demo Visit websiteCreate a Finance Lab!

We also work with schools to set up physical lab spaces – turning any classroom into the coolest room at the school!

You can start by taking any existing TV and upgrading it to a MarketInsight Display – schools that already have a site license to PersonalFinanceLab can get a MarketInsight Display feed for just $360/year (and can be used on up to 3 different screens).

We also work with schools who install colorful wall-to-wall tickers – the crown jewel of any lab space! Schools typically start using PersonalFinanceLab in their classes while their labs are still in the planning phase, and add on the tickers and LCD screens via grants or as funds become available.

Learn more about building a labHowTheMarketWorks.com

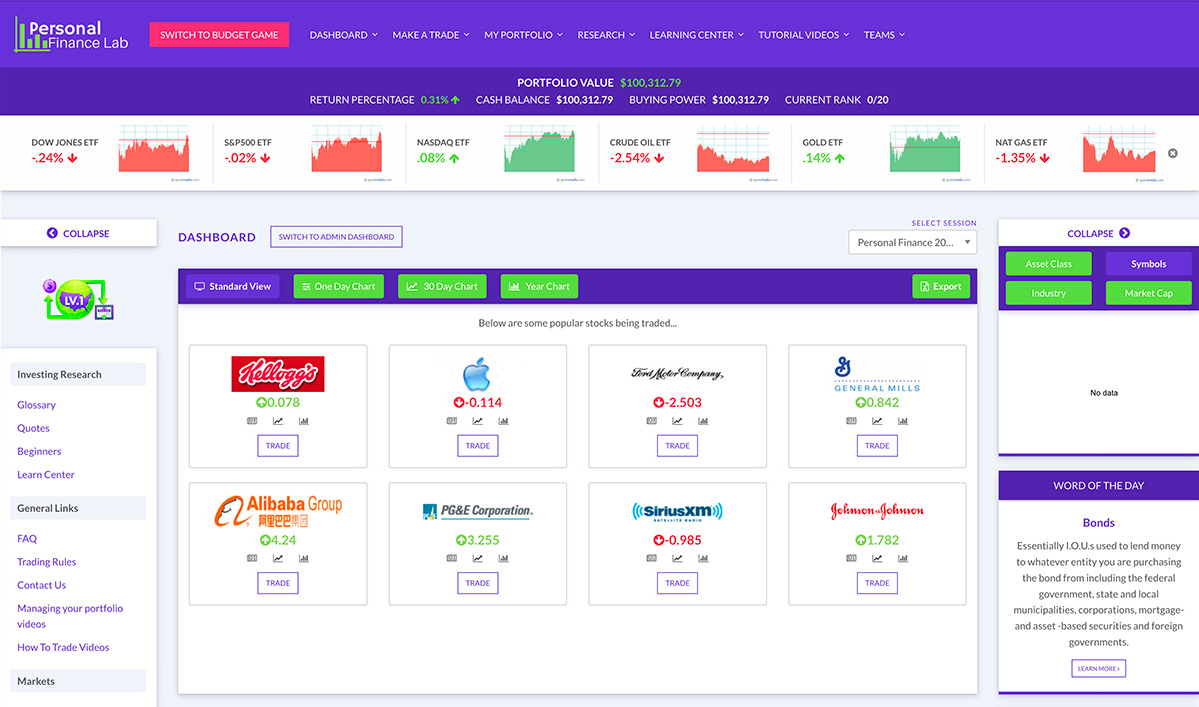

At HowTheMarketWorks.com, you can practice trading online stocks and mutual funds. You can create your own contests and trading rules, practice trading on several portfolios, and best of all – registration is absolutely free!

The stock market game at HowTheMarketWorks is designed for the absolute novice so the screens are simple and easy to understand. You can create your own contest with custom trading dates and cash balance. Trading and portfolio updates are in real-time.

Just because the site is designed for beginners, don’t let that fool you. Our online stock market game is still packed with extensive quotes, charts, news and stock screeners to help you make better investing decisions and learn faster.

Visit website

This is a wonderful way to align my lessons with something that is interactive and of high quality.

FAQ

Who are we?

- The leading provider of financial literacy games and simulations for universities, high schools, corporates and the general public.

- Our various stock market and financial literacy simulations are used by over 20,000 professors/teachers worldwide and by over 100 corporations.

- We are used in 80% of the top U.S. business schools.

- For our Financial Literacy simulations, students learn to trade U.S. stocks, ETFs, bonds and mutual funds.

- Founded in 1990 with over 10,000,000 students served.

How it works?

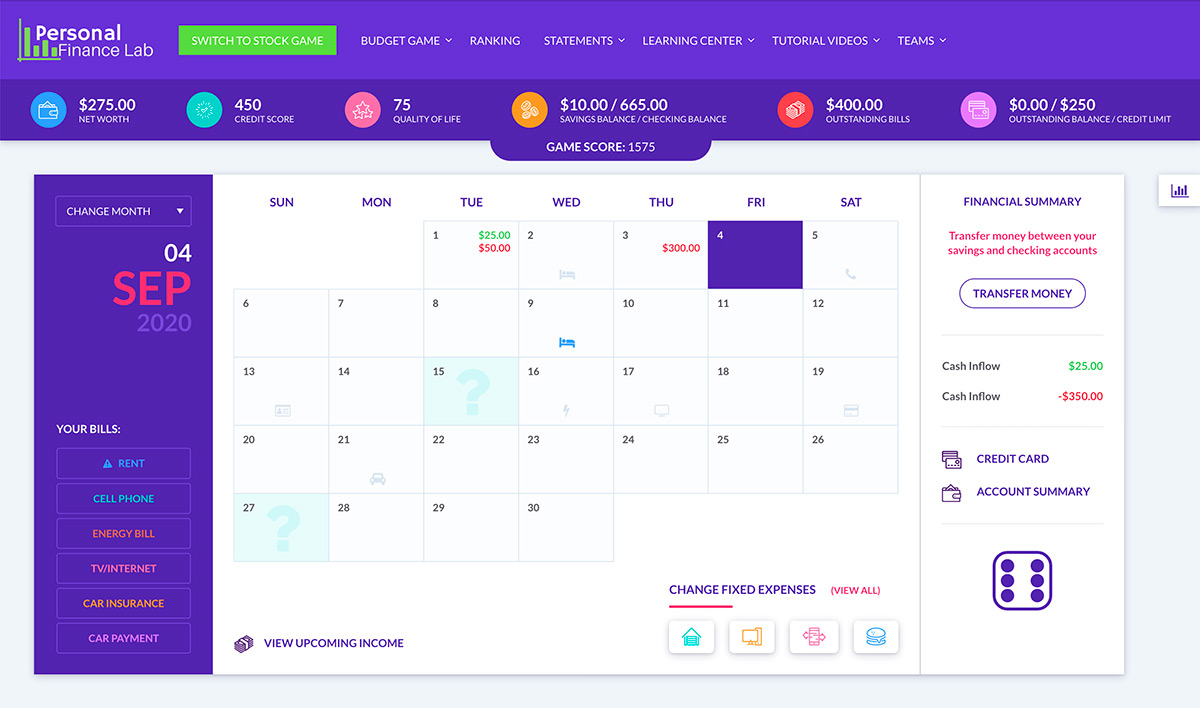

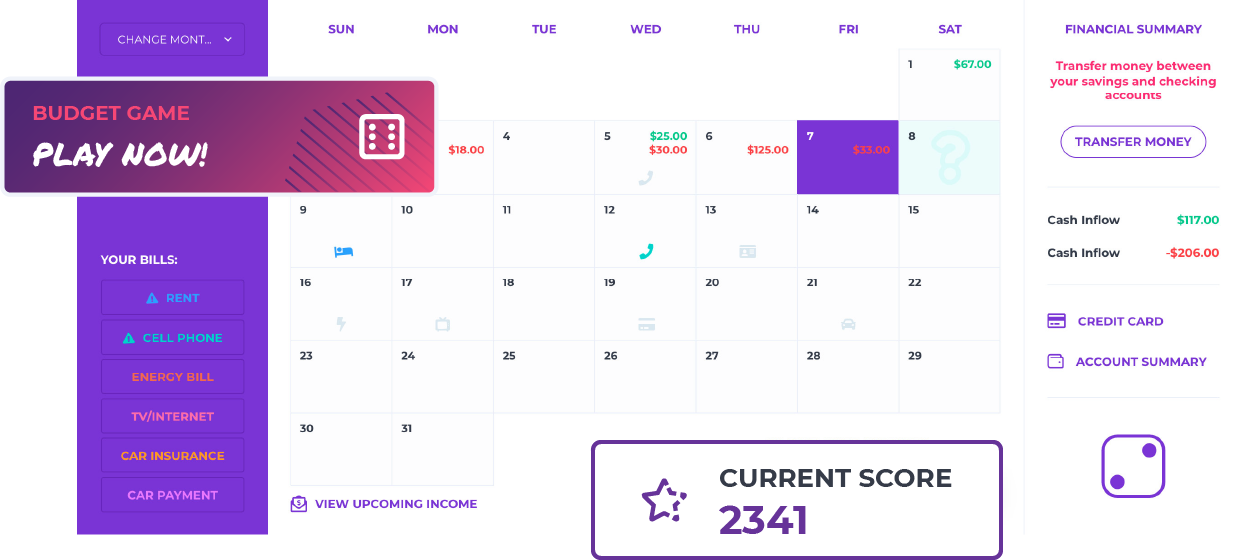

Students are given a scenario where they are working full-time and living on their own. They start with a virtual checking account with $1,000, as well as a savings account, credit card account and investment account with $10,000.

Students roll virtual dice to proceed through the weeks and learn to deposit their paychecks, pay all of their bills, start an emergency fund, learn to improve their credit score, and practice investing in the stock market. Meanwhile, life’s unexpected events keep happening that challenge their budgeting and cash management skills.

Find answers to other common questions and learn everything

you need to know so you can use our products in your classroom.

Student Accounts and Site License Pricing

Find out more about pricing information on our K-12 products,

including site license and district licenses.