What is a Balance Sheet?

The Balance Sheet (or Statement of Financial Position) is one of the four financial statements required by the SEC based on the U.S. GAAP (Generally Accepted Accounting Principles). According to the SEC, the Statement of Financial Position presents “detailed information about a company’s assets, liabilities and shareholders’ equity.” In other words, this statement is a financial snapshot of the firm on a specific date.

Why is the Balance Sheet important?

Understanding the Balance Sheet is very useful in understanding a firm’s financials. The Balance Sheet is important because it resumes what the firm owns and what is owes. More specifically, it presents the firm’s assets, liabilities and the shareholders’ equity. Many types of ratios can also be measured from the balance sheet. Let’s take the debt-to-equity(D/E) ratio as an example. The breakdown of the Debt-to-Equity is the Total Liabilities divided by the Shareholders’ Equity, where both values can be found in the balance sheet. This ratio is very important because it measures how much debt the firm has with respect to the amount provided by the shareholders. Thus, for management, investors and creditors, it will be essential to review the CF statement to ensure that the business is financially stable.

Who is interested in the Balance Sheet?

There are many players who are interested in the Balance sheet:

- Investors

- Current and future investors will review the Balance Sheet to view the company’s financial position and use it to evaluate its solvency, liquidity and capital structure using financial ratios.

- Lenders/Creditors

- Lenders and creditors will investigate the Balance Sheet to define the firm’s liquidity to conclude if it is able to meet their payment requirements and obligations, should the firm seek more funding.

- Management

- Managers can keep track of the company’s financial standpoint over time and be able to make strategic decisions for growth and prevent bankruptcy.

What does a Balance Sheet look like? What are the components?

In a balance sheet, there are three main components with sub-components. Whether you are building a balance sheet or working on an accounting exercise, the golden rule of a balance sheet is that at the end, the following equation must equate: Assets = Liabilities + Shareholders’ Equity. It is also important to note that the balance sheet is listed by liquidity per category. We will briefly review all three main components of this statement:

- Assets are what the company owns and uses for its operations. It includes tangible and intangible assets. The assets of a company can be divided in two sub-categories:

- Current Assets are assets that can be converted into cash within a period of one year or less. These assets are very liquid and can help investors define how much of liquid assets the company owns.

- Non-Current Assets are assets that cannot be converted within a period of one year. This category includes fixed assets such as properties, plants and equipment used for production.

- Liabilities are what the company owes and need to pay to complete their obligations. The liabilities of a company can be divided in two sub-categories:

- Current Liabilities are obligations that needs to be fulfilled within a year. As an example, the salaries payable account contains all the salaries that needs to be paid to employees of the firm.

- Non-Current Liabilities are obligations that needs to be fulfilled after one year. For example, a long-term Bank loan is a financial obligation where the issuer will be paid back at a time that is higher than one year.

- Shareholders’ Equity is what the company’s investors contributed to the company. It also includes earnings and dividends issued to shareholders.

Where can I find the Balance Sheet for a specific company?

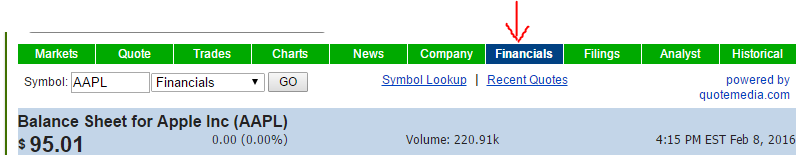

You can find the balance sheets of every publicly traded company in the United States using the Quotes tool.

Just open the quotes page, and search for the symbol you want to find (for example, AAPL). Next, click “Financials” on the menu just above the search bar:

The balance sheet will load below (you can also use this page to find the income statements). You can compare the most recent balance sheet with several of the previous years to get a sense of what direction the company has been heading.

A company’s balance sheet provides investors the ability to compare the current balance sheet to previous editions. They can see when a company is improving current assets relative to those reported a year ago.

Often companies display this period’s balance sheet line items along site prior year’s balance sheets. The income statement is the first piece of information many investors look at when they are thinking about investing in a company.

Pop Quiz!

It appears that this quiz is not set up correctly.