ETFs are a fairly new way that you can buy a large group of stocks, assets, or other securities all at once. ETFs trade just like stock; you can buy and sell shares of an ETF throughout the day on an exchange.

Definition

ETF funds are not usually actively managed, instead they work like an index; the fund is established to track a basket of stocks or other assets in a certain pre-existing class. An example is the Spider SPY ETF: this fund is based on the S&P 500. This means that all shares of the SPY ETF represents a small piece of shares in the 500 companies in the S&P 500.

ETF funds are not usually actively managed, instead they work like an index; the fund is established to track a basket of stocks or other assets in a certain pre-existing class. An example is the Spider SPY ETF: this fund is based on the S&P 500. This means that all shares of the SPY ETF represents a small piece of shares in the 500 companies in the S&P 500.

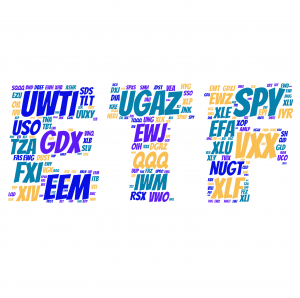

Almost all popular stock indecies have an ETF that tracks them these days, but that isn’t the only kind of index an ETF will follow. There are also ETFs that are designed to follow commodities; for example USO and OIL are based on the price of oil, and companies that mine/refine oil, while GLD and SLV follow the price of gold and silver, respectively.

ETFs are very useful because it is an easy way to buy a diverse range of assets all at once; you don’t need to worry as much about trying to ‘beat the market’ if you can buy the SPY ETF and be very close to matching the market’s performance automatically.

Types of ETFs

There are many different types of ETFs, but they all have one thing in common; they are designed to track a pre-existing index of some sort. Here are some of the most popular ones:

Stock Index ETFs

These ETFs track an existing stock index and attempt to replicate its performance. For example, SPY tracks the S&P 500, DIA tracks the Dow-Jones Industrial Average, the QQQ tracks the Nasdaq and IWM tracks the Russell 2000. There can be several ETFs that track the same index, since ETFs are issued by individual companies, some companies may want to track the same index as another.

Commodity ETFs

There are also ETFs designed to follow a basket of commodities. These ETFs are very popular with investors that would like to buy oil, for example, but do not want to start trading commodity spot contracts or futures. Some ETFs in this category are OIL for Oil, GLD for Gold, and SLV for Silver.

Volatility ETFs

Volatility ETFs are much more complicated; they are based on the “fear” of the market at any given time. Volatility ETFs are generally based off the VIX volatility index, which measures how much investors expect the market to move over the next 30 days. These are more complex financial instruments, and while anyone with a brokerage account can buy them, they are more difficult to manage and use.

Inverse ETFs

These ETFs work by doing the exact opposite as the ETFs above; their goal is to do the exact opposite of the index they are tracking. For example, the Inverse S&P 500 ETF SH tries to go down by 1% every time the S&P500 goes up by 1%. They do this by short selling and other financial derivatives. You may be interested in an ETF if you think the index you are tracking will be going down in the short term; for example you could want to buy an inverse Oil ETF if you think the price of oil is about to fall. It is a very popular way of short selling for investors who do not have a margin trading account.

Leveraged ETFs

Leveraged ETFs use a complex set of financial tools to double or triple the index it tracks; for example JDST tries to triple the returns of the Gold index it tracks, on a daily term. This means that if gold goes up by 1% today, the JDST ETF will be somewhere close to 3%. The opposite is also true, so if the index goes down by 1%, the leveraged ETF will fall by 3 times that.

Inverse leveraged ETFs also exist, which double or triple the inverse of the index they track. For example DWTI is an inverse leveraged Oil ETF; when oil goes down by 1%, it tries to go up by 3%.

Difference between an ETF and Mutual Fund

There are a few main differences between the two, but the biggest one to keep in mind is that mutual funds are actively managed (meaning there is a portfolio manager and a team of analysts actively buying and selling securities in the fund to try to get the best return given the mutual fund’s purpose), while an ETF is not actively managed; it follows a pre-existing index. This means that the underlying assets of most ETFs do not change much; the makeup of an S&P 500 ETF is not going to change much over time. Some other important differences are:

- ETFs trade on an exchange, just like a stock

- ETFs may have a slightly different value than the Net Asset Value (NAV) of its holdings; this means that it may be possible to buy an ETF for slightly less than the value of the securities it represents, making an opportunity for profit through arbitrage

- ETFs typically have lower fees than mutual funds

- It is often easier to keep track of the underlying assets in an ETF, since they do not change as much as mutual funds

Other Details

Just like a mutual fund, if an underlying asset of an ETF that you own pays a dividend, it is transferred to the ETF holding members (so you may receive an ETF dividend payment). ETFs can also split; usually this will happen once per year, with all ETFs created by a company having their split at the same time.

Savings Growth and Compound Interest Calculator

Savings Growth and Compound Interest Calculator Car Insurance

Car Insurance 5-08 Resources

5-08 Resources

[…] What Is An ETF? […]

[…] videos showing students how to use the StockTrak simulation, reading articles (such as “What is an ETF“, and “How to choose and compare stocks“), and placing […]

[…] What is an ETF? […]