sponsored by This Challenge is for FMA STUDENTS (and FMA Advisors) ONLY! For more information about becoming an Student FMA member, please visit the FMA Student Page here. FMA Student Investing Challenge Rules: CLICK HERE TO REGISTER FOR THE SPRING 2025 FMA STUDENT CHALLENGE REMEMBER: You must register with your email address that you used Read More…

As of January 2023… StockTrak is happy to announce the NEW Options Spread Trading page that allows students to easily construct twenty-one different 2, 3, and 4 legged option spread trades. You can access the Options Spread Trading by selecting “Options” under the “Portfolio Simulation” menu. Once you are on the Options Trading Page, click Read More…

Congratulations! You made it through the basic investing course unscathed, armed, and ready to begin a long, successful investment career. You have enough information to begin with some confidence. Remember, you can test your personal investment strategy using the real world simulation. You’ll get all the excitement and results you’d achieve in the market – Read More…

Developing a workable investing strategy – and sticking to it through its high and low points – is the major component of your overall action plan. You need to create an investing strategy that is “comfortable” for you. If it doesn’t fit you, you won’t stick to it. Here are some proven ways to select Read More…

Like all good athletes, musicians, actors, and astronauts, the word “practice” is central to performance success. The newer investor should adopt this action plan. Just as few people are born knowing how to hit a baseball or play the piano, successful investors are made, not born. Your investment education should not stop with this course. Read More…

Even if you start out as a “buy and hold” investor, staying informed at all times is a critical component to your investment career. Should you be tempted to walk the ever-exciting and dangerous tightrope of day trading, your stream of current information is even more important. Here are some suggestions that will keep you Read More…

Over-diversification. Sure, every expert with a pencil, computer, or microphone keeps telling you to diversify your portfolio. They are right, but they often neglect to tell you the rest. For example, assume you only have $200 to invest. You buy 40 different stocks at $5 each. Guess what? Now you’re too “thin” and you have Read More…

Here are ten important things to remember as you take the next step in your investing journey. These are real world keys that you should embed into your conscious brain to help you become a consistently smart or profitable investor. Understand and control the fees and costs of your investing activities. Ask your broker how Read More…

Summary Options are exciting investment “vehicles,” but to be used profitably, you need to understand what they mean and what they can or cannot do for you. You have now scratched the surface of the option world. Before you make a real-world decision, for better or worse, use the wonderful benefit offered by Howthemarketworks.com, and Read More…

Put and call interest does not involve the banking definition of interest, but the market excitement – or lack thereof – regarding puts or calls for a security. Before you start thinking we’ve all lost our analytical minds, try to understand that market prices for stocks and put/ [ts]call options[tm] The right, but not the Read More…

Any discussion of options and option prices would be incomplete without a mention of the Black-Scholes option pricing model. Academics Fischer Black and Myron Scholes, in a paper they authored in 1973, stated their theory that an option was implicit to the pricing of any traded security. Referencing the work of some of the most Read More…

Often used in relation to options, implied volatility is a calculation that compares the current market price of a stock with the theoretical value of the market price in the future, all to predict the true value of an option. This may sound like a risky probability equation – and it is – yet it’s Read More…

Volatility is a concept that involves all stocks and other securities. For good reasons, high volatility is most often viewed as a negative in the investment world since rapid movements in market prices inherently involve both wins and losses. In investment language, volatility implies two scary conditions for you: uncertainty and risk. For example, if Read More…

We noted earlier that 35% of option buyers lose money and that 65% of option sellers make money. Option trading comes down to the turtle and the hare story. Option buyers are the rabbits that are generally looking for a quick move in stock prices, and the option sellers/writers are the turtles that are looking Read More…

Now that you have a high level understanding of what options are, let’s look at option trading in a little more detail. When you get a quote on a stock you can also call up its option chain: First of all, you must realize that not all stocks have options. Only the most popular stocks Read More…

Whereas a call option gives the holder the right to buy the stock at a certain price, a put option gives the holder the right to sell the stock at a certain price. A trader that buys a put option believes that the price of a security will fall in the near future. You are Read More…

A call option is the option (remember, not an obligation) to buy 100 shares of a stock for an agreed price (the strike price) by an agreed date in the future (expiration date). Here’s how it works: you buy one call option contract which expires in October for 100 shares in Yahoo! () stock. For Read More…

Generally speaking, options are used in many areas of business and investment. Employees of larger companies frequently get stock options as an incentive to stay with the company for a long time and help the company increase in value. A lot of real estate transactions involve the option to purchase additional neighboring acreage at a Read More…

Summary This lesson focused on hot topics in the investment world. Obviously, by the nature of discussing “hot” topics, conditions can change quickly, sometimes making hot topics cold and others newly hot. However, the issues in this lesson have been “hot” for some time and should continue to be important for the foreseeable future. Further, Read More…

The subject of arbitrage is a bit confusing for the new investor, but you will undoubtedly hear the term as you start reading more and more about investing. In its simplest form, arbitrage is taking advantage of price differences in at least two different markets. By making simultaneous deals to maximize this difference, you can Read More…

Investor sentiment, sometimes also called market sentiment, typically relates to the stock market’s “attitude” towards specific securities, industries, or overall market conditions (bullish, bearish, or neutral. While of limited importance to a buy-and-hold investor, investor sentiment can be an effective tool if you decide to live in the fast lane by adopting a day or Read More…

Insider transactions and trading has become a sensitive topic in recent years. Most thoughts tend to be negative (images of Martha Stewart in prison may spring to mind), giving the impression that all insider transactions are illegal or unethical. Not true. Technically, insider transactions involve an employee of a company trading his own company’s stock Read More…

During the height of the dot.com explosion, a popular strategy – growth at any price – became the rallying cry for many investors. After the bubble burst, a more conservative strategy known as growth at a reasonable price, or GARP, became and remains a popular investing action plan. Paying a high price for a rapidly Read More…

The most popular investment strategy preached by brokers, fund managers and even famous investors like Warren Buffet is “buy and hold.” In its most basic form, this strategy believes that you should only buy stocks of solid, well managed companies that will deliver profits for decades to come; furthermore, that you should hold onto these Read More…

Penny stocks are often popular with the newer and smaller investor. These investments are classically defined as any stock that sells for less than $5.00, traded outside the major exchanges, and often traded on the OTCBB (Over-the-Counter Bulletin Board) market or on the “Pink Sheets.” In recent years, the names “nano caps,” “micro caps,” and Read More…

Swing trading is identifying “channels” or “tunnels” of price movements on a stock’s chart and then buying when the price gets to the bottom of the channel and selling when it gets to the top. Swing trading can be done with any time period: Intra-Day, Daily, Weekly or Monthly -depending on the trader’s temperament and Read More…

The buying and selling of investments (stocks, futures, stock options, commodities, currencies, etc.) within the same trading day, so that all positions are closed before the end of each day, is called day trading. Beginning investors should understand that day trading is very difficult to do successfully because you are trading against professional traders that Read More…

Your first order of business in looking at current investing trends is to see if the hot trend is worthy and justifiable, or whether it is just a mania leading to a bubble. While it can be profitable to ride the bubble as it is getting started, it is extremely important to make the leap Read More…

Alright, everyone, take a deep breath and relax. You’ve just been assaulted with a lot of information. Don’t panic. As you view real-world examples of these charts, you’ll become more familiar and comfortable with their interpretations. This and other sites will give you all the additional information you need to continue your current journey and Read More…

In the 1980s, John Bollinger developed a new technical analysis tool to measure the highs and lows of a security price relative to previous trade data. These “trading bands” help investors track and analyze the “bandwidth” of stock prices over a period. The object of Bollinger Bands is to identify a “relative” definition of high Read More…

Support and resistance are words used in the technical analysis universe. For reasons that are often difficult to quantify, market prices tend to “bounce” off the support and resistance levels that are established. Support in a stock chart forms at an area where the stock’s price seems to not want to move lower. This is Read More…

RSI is the acronym for “Relative Strength Index.” The RSI was created in 1978 by J. Welles Wilder to compare the strength and magnitude of a stock’s gains and losses in recent time periods. The simple formula converts this winning and losing data into a number ranging from 0 to 100. To keep the analysis Read More…

Moving averages are among the most popular and – important for the newer investor – easy to use and understand trading “tools” available to you. Also, moving averages are used as components in many other charts and analyses. By smoothing out data points and number series, moving averages make it easier to identify trends and Read More…

Often called the most accomplished mathematician of the Middle Ages, Leonardo Fibonacci is best known for his “numbers”. It is a sequence starting with 0 and 1, after which every third number is the sum of the previous two numbers. A Fibonacci “sequence” is 0,1,1,2,3,5,8, etc. The Fibonacci “ratios” are 23.6%, 38.2%, 50%, 61.8%, and Read More…

This is the acronym for “moving average convergence/divergence.” Got it? OK, here’s the simple explanation. This graph shows the difference between a fast- or slow-moving average of a stock’s prices. It is designed to identify significant trend changes. This can be a very important tool for you to anticipate trend movements that may occur in Read More…

Candlesticks are a type of stock chart developed in Japan. Instead of lines, a vertical block, which looks like a candlestick, is used to symbolize a day or week’s worth of price action. Candlestick charts track price movements of a security over some time period. An interesting combination of a line and a bar chart, Read More…

A wedge in the financial universe describes a triangular shape formed by the intersection of two trendlines, which form the apex. The wedge need not be upward facing and can easily be an inverted triangle. The “falling wedge” is often called a “flag” since it more resembles a pointed flag more than a typical triangle. Read More…

You’re probably aware that trendlines are important to all of your research on potential purchases or sales of securities. Base numbers are equally important to understand the true meaning of any trends you identify. Depending on the type of chart you are viewing, you’ll also want to establish a solid, unbroken trendline of your own Read More…

A double bottom chart will look like a “W.” It indicates that the stock hit bottom market price, had a quick – albeit brief – uptick, and decreased again to turn a “V” shape into a “W.” The two reverse peaks should be around the same floor price and the time period should be similar Read More…

A breakout occurs when market prices move through and continue through former highs/lows that had formed ceilings or floors in the past. Commonly called levels of support. Support in a stock chart forms at an area where the stock’s price seems to not want to move lower. This is due to the presence of buyers Read More…

Don’t you love the terminology that pictorially associates these charts with their graphic representations? The Head and Shoulders is an extremely popular pattern among investors because it’s one of the most reliable of all chart formations. It also appears to be an easy one to spot. Novice investors often make the mistake of seeing Head Read More…

The Cup with a Handle pattern is one of the best-known stock chart patterns. The Cup patterns follow outlines that simulate an inverted semi-circle (U-shape), indicating a price fall, a bottoming out, and a price rise. Afterwards, there tends to be a rather unstable period marked by a sell-off generated by investors who acquired the Read More…

This chapter will expose you to the most common charts available. Their names and meanings are important to your continuing education and the number of tools you carry in your toolbox in order to evaluate stocks. Understand that it will take some time before you are comfortable reading and interpreting many of these charts. Don’t Read More…

Everyone knows that for a company to become and remain successful, it must pay attention to its competition. When analyzing a stock, investors must also do some competitive analysis. Companies do not operate in a vacuum. They are in constant competition for consumer and investment dollars. To make the best investment decisions, you need to Read More…

A company with well-respected and reliable products that have been accepted by the consumer market is often a valuable investment. How many rolls of Charmin toilet paper have you purchased in your lifetime? How many tubes of Colgate toothpaste? How many boxes of Tide laundry detergent? How many gallons of BP gas have you pumped Read More…

As a potential investor, you need to know about the quality of the management team, the continuity of the management team, and projected future stability of the management team. After all, the performance of any organization is ultimately related to the leadership and direction provided by its leaders. History is full of examples of CEOs Read More…

In financial accounting, a balance sheet or statement of financial position is a summary of a person’s or organization’s balances. Assets, liabilities and ownership equity are listed as of a specific date, such as the end of its financial year. A balance sheet is often described as a snapshot of a company’s financial condition. Of Read More…

When you’re considering buying or selling a stock, it is just as important to look at future expectations as historical performance. We can read all of the [ts]10-Ks[tm]The annual SEC filing by public companies that includes their audited Income Statement, Balance Sheet, Cash Flow Statement and other detailed notes about the companies financial and operating Read More…

OK, so we have discussed sales, operating income, EBITDA, and net income. Which is the best measure of a company? The answer, unfortunately, is NONE OF THE ABOVE! If Stock A and Stock B are in the exact same industry, have the exact same revenues, costs, EBITDA and net income, which one is the better Read More…

Once you have understood a company’s profitability, take a look at the Statement of Cash Flows because this is the second most important element of Fundamental Analysis and it frequently needs more than a cursory examination. Many experts strongly contend that good cash flow is more important than earnings to ensure company viability for the Read More…

A company’s net income is one of the most critical pieces of data you can pull out of the financial statements because it is this profit that generates cash and cash drives value. A company can produce the most innovative products, be in an industry with minimal competition, and have superior management, but the company Read More…

You have to know how to read an Income Statement if you want to understand Fundamental analysis. An Income Statement follows this format: Revenue/Sales – The “top line” number on an Income Statement is usually the revenue/sales number that indicates the total sales of the company. This is the total cash register receipts of all Read More…

The first place to start analyzing a company is to go straight to the source and review the financial information that the company is publishing about itself. In previous chapters we talked about IPOs and what it takes to be a public company in the U.S. To remain a public company in good standing with Read More…

Summary You’ve made your first purchases and now you have some idea what to do with them. While you’re not yet an expert, you should now have enough information to create a basic holding strategy and an exit plan. You understand that you should ride your winners and dump your losers. Having a sensible exit Read More…

Exit Strategies Are Designed to Protect Your Value Rule #7 – Have an Exit Plan and Target for Every Stock Few experienced traders ever invest in any stock without having an exit strategy. In its simplest form, an exit strategy is a plan to get you out of something you’re in. In the investment universe, Read More…

Identify Market Tops to Maximize Profits Market tops are subjective opinions that often quickly become fact, for better or worse. How can you possibly identify a market top? Here are some suggestions that many experts believe will help you identify market tops. Closely watch the Dow Jones Industrial Average, NASDAQ Composite, and S&P 500. Pay Read More…

Rule #5 – Know When to Hold’em, Know When to Fold’em Avoid falling in love with any one particular stock as the market can turn on it very quickly. While you may love a particular stock, millions of others may develop a dislike on a moment’s notice. You must be prepared to cut ties with Read More…

Rule #4 – Diversify, diversify, and diversify Reminder: Always diversify your portfolio into at least 10 different stocks. It doesn’t matter if you are starting with $10,000 or $100,000–you’ll have more success if you think big and proceed as though you were a major-league investor. Diversification is important because while one sector of the economy Read More…

Rule #3 – Never, ever, ever lose more than 10% on any single trade. Traders, finance professors, and common sense all say that you should never let one sour apple ruin all of the other apples in your basket! Picking 9 stocks that gain 10% will be a waste of time if your 10th stock Read More…

Rule #2 – Don’t fall in love with your stock purchases – winners OR losers (particularly losers). Remember, you are not a welfare agency, rehab specialist, or air/sea rescue professional. If an investment is going south, sell it – without remorse and move on. Don’t forget, investing is a business, not a hobby or a Read More…

Selling a stock is just as important of an investment decision as buying and you must have a strategy to maximize your profits and minimize your losses. Developing a trading strategy is important to your future investing activities. Even a flawed strategy is better than having no strategy. And trust me, your strategy will always Read More…

Summary It’s time to decide on how you’d like to construct your portfolio. Whether you decide to invest virtual money or real funds, you should now have a basis to create your own thoughtful plan and strategy. Using your virtual portfolio and trading ability, you can test your strategy and “tweak” it, if necessary, to achieve Read More…

There is an astounding volume of information available from a myriad of “experts” and a plethora of websites. Most are useful to people, but you’ll decide which sources are most useful to YOU. Here is some information on a few popular sources. MSN Money: Offering you stock quotes, financial news, rumors, strategies, and blogs, MSN Read More…

Once you get out of the shopping malls, don’t forget to make sure you are diversifying. Buying a shoe company, a hat company, a jean company, a sock company, and a dress company is NOT exactly what we mean by diversification. A way of reducing the risk and variances in your portfolio returns by buying Read More…

Peter Lynch another globally respected investment genius, also embodies a solid – not exotic – investing strategy. After graduating from Boston College (1965), Lynch was hired as an intern at the company that came to be forever linked with his name, Fidelity Investments. This was mostly because he caddied for Fidelity’s president at a local Read More…

Investing in “what” you know based on “how much” you know can provide an excellent return and a higher level of comfort. As an example, the legendary investor [ts]Warren Buffet[tm]Chairman and CEO of Berkshire Hathaway, and generally regarded as the greatest buy and hold investor of the last 30 years.[te] has amassed his fortune without Read More…

With so many stocks out there, what does the new investor buy? If you have plenty of time and wish to become an information and opinion junky, you could spend thousands of hours reading all of the newspapers, websites, financial blogs, discussion boards and newsletters out there that cover just about every single one of Read More…

To measure your success of diversifying, several calculations have been developed to provide an indication of how well your portfolio is performing in terms of its variance and its return. There is more than 1 way to get a 10% return. Graph 1 below shows a smooth portfolio increase upwards at a 10% return over Read More…

Risk, reward, and diversification are the most important concepts to understand before you start your portfolio. They are factors in all investment decisions. You must learn more than the textbook definitions of these factors–you need to understand how they, in conjunction with market timing and business cycles, affect your portfolio’s return. Even risk, when properly Read More…

Summary Ok new investor, you should be ready to begin. You can now leave the bleachers, put on a uniform, cross the white lines, and play. Stay focused, positive, and realistic. You might not make the Majors right away, but you can enter the investment world armed with solid knowledge, upon which you can expand Read More…

You should have a “game plan” for your investing life. Just as you plan your workday, vacation, college financing, golf matches, and other areas of your personal and professional life, you need a plan, objective, and goal for your investment activities. Spend some quality time with yourself, thinking about what you really want to accomplish. Read More…

Unfortunately, when it comes time to file your tax return, the IRS wants to know how much money you made or lost in your brokerage account. Your brokerage firm will even report to the IRS your total proceeds from all of your sales of stocks, but they don’t report your gains and losses. The reason Read More…

In its simplest form, short selling is selling shares that you don’t own. Just like the broker will loan you cash to buy more shares, the broker will also loan you shares that you can sell. When you [ts]sell short[tm]Borrowing shares from your broker to sell a stock that you don’t own with the hope Read More…

When you are opening a real brokerage, you will be asked if you want to open a Margin Account. Buying on margin means that you purchase securities using some of your own cash and you take a loan from your broker to complete the purchase. The collateral for the loan is the stocks or cash Read More…

As you might expect, just because you place an order, it does not necessarily get executed. Both the timing and the duration of your orders are important to successfully managing your portfolio. When you place the orders mentioned above, you will usually be allowed to specify the duration of the order. You might be placing Read More…

Once you have the ticker symbol for the company you wish to trade, you are ready to place your first order. Go to your virtual trading account and you’ll see several options for order type—market, limit and stop. You have already found the symbol to trade “LUV” and you can enter any quantity of shares to Read More…

You can easily use the quote page on your brokerage account to locate stocks you might want to buy. If you know the ticker symbol you want to buy, or know the co mpany’s name, you should be successful in locating the current price and status of any publicly traded security. Remember, some companies have Read More…

The first thing you must understand about trading stocks is that the exchanges have assigned each stock a unique “ticker symbol” for identification purposes. When researching stocks, getting quotes, and placing trades, you usually have to know the ticker symbol. Stock ticker symbols are usually 1 to 5 letters long. (Occasionally they contain a “.” Read More…

Glossary Ask Price: The price that sellers want to sell for is called the “Ask” price. Bear Market: A prolonged period of pessimism and falling stock prices that seems to feed on itself and generates even more pessimism and even lower stock prices. Bid Price: The price that buyers are willing to pay is called Read More…

As a newer investor, you should also be aware that you can save some research time by investing in mutual funds instead of individual stocks. Mutual funds contain a mix and diversity of stocks in which you will spread out one investment into many small blocks of shares. Mutual funds and ETFs (exchange traded funds) Read More…

While the wild roller coaster swings of the market make the media highlights, stocks remain an excellent choice to achieve a high – and steady – return. In finance textbooks, this is called return on investment (ROI) and is one of the most important measures of all investments choices. After all, when comparing different investment Read More…

When you are ready to make your first trade you must open a brokerage account. Brokers generally fall into two categories: full service and discount brokers. Full service brokers like to make the decisions for you and will call you frequently with their ideas, suggestions and corporate research—but they will also charge you a hefty Read More…

The mere perception that a market is becoming Bearish is not a predictor of disaster. Fortunes have been made in [ts]Bear Markets[tm]A prolonged period of pessimism and falling stock prices that seems to feed on itself and generates even more pessimism and even lower stock prices.[te]. The trick is to know when one is coming Read More…

Bull and [ts]Bear Markets[tm]A prolonged period of pessimism and falling stock prices that seems to feed on itself and generates even more pessimism and even lower stock prices.[te] play a strong role in extending or ending [ts]business cycles[tm]The typical business cycle consists of periods of economic expansion, contraction (recession) and recovery to a new peak.[te]. Read More…

Now that you know what the stock market is and what role the [ts]Stock Exchange[tm]Stock exchanges are simply organizations that allow people the ability to buy and sell stocks.[te] play, let’s take a step back and look at how stock prices and the economy move. As you might expect, timing is extremely important in investing Read More…

Now that you know what an exchange is, it’s necessary to make a very important distinction between what shares trade on exchanges and what shares don’t. Most companies are private companies and don’t trade on exchanges. The barber shop and the florist on the corner, the guy that cuts your grass, and the plumber that Read More…

In addition to the New York Stock Exchange, there is also the American Stock Exchange (AMEX) and NASDAQ. In the past, the NASDAQ was for smaller companies that were just getting started, and it was prestigious for them to move up to the NYSE or AMEX. These smaller companies included a few you might have Read More…

In the mid 1600s simple fences denoted plots and residences in the New Amsterdam settlement in what we now call lower Manhattan Island. This location on the island was critical as it allowed easy access to both the Hudson River and the East River. To protect this settlement, in 1653, the Dutch West India Company Read More…

So what exactly are “Wall Street” and the “New York [ts]Stock Exchange[tm]Stock exchanges are simply organizations that allow people the ability to buy and sell stocks.[te]”? You have probably heard these words thousands of times, but unless you are a stock owner they might have gone in one ear and out the other. Stock exchanges Read More…

Bond (Corporate, Treasury, or Municipal): A debt obligation of a company, the U.S. Treasury Department, or a city where the borrower receives funds (usually in increments of $1,000), makes semi-annual interest payments based on the coupon rate, and eventually repays the borrowed amount ($1,000) to the lender at the maturity date of the bond. Certificates Read More…

Regardless of your choice of investment types, you should learn about and understand the correlation of risk to the size and type of your investments. First, become familiar with the traditional risk levels of various types of asset groups ( [ts]stocks[tm]Stocks are “equity investments” which means that individuals that own stock shares of a company Read More…

For those just beginning, a good point of reference is the recent performance of the common investments described above. How have they done over the last five years? These charts illustrate their performance over the same time period. When looking at the charts, keep in mind what you read earlier in the lesson and what you’ve Read More…

Buying and selling real estate as an investment strategy is quite different from simply buying a home or commercial building. Just as important in determining FMV (fair market value) as comparable properties are when buying a home, the income stream generated by a property is a primary component for an investor. You typically have three Read More…

Investing in FX (foreign exchange), currency speculation, and hedging are variations of the same basic investment strategy—you are betting that one currency will strengthen or weaken against the other. Not for the faint-hearted, these investments involve more due diligence and savvy than all of the other security types we have covered so far. Trading in Read More…

Precious metals, particularly gold and silver, are attractive investments to many people. But as usual, you must learn to become a knowledgeable investor as precious metals can fluctuate in value as rapidly as common [ts]stocks[tm]Stocks are “equity investments”, which means that individuals who own stock shares of a company actually own part of that company[te]. Read More…

Stocks are “equity investments” which means that individuals who own shares of a company actually own part of that company. Bonds are a debt obligation of a company, the U.S. Treasury Department, or a city where the borrower receives funds (usually in increments of $1,000), makes semi-annual interest payments based on the coupon rate, and Read More…

ETFs are a cross between mutual funds and stocks. ETFs are simply a portfolio of stocks or [ts]bonds[tm]A debt obligation of a company, the U.S. Treasury Department, or a city where the borrower receives funds (usually in increments of $1,000), makes semi-annual interest payments based on the coupon rate, and eventually repays the borrowed amount Read More…

A mutual fund is a type of investment where a money manager takes your cash and invests it as he sees fit, usually following some rough guidelines. For example, the Fidelity Group has a fund that specializes in finding high dividend paying [ts]stocks[tm]Stocks are “equity investments”, which means that individuals that own stock shares of Read More…

Stocks are “equity investments” which means that when you own shares of a company you own part of that company. For example, if you own 1,000 shares of Apple Computer stock and Apple has 1,000,000 shares that are “issued and outstanding,” then you own 0.1% of the company. If Apple were then to be sold Read More…

A CD is an investment choice at most banks where you agree to deposit a specific amount of money for a fixed period of time (this is called the maturity). By agreeing to keep your money at the bank for a certain length of time, the bank usually pays you an interest rate higher than Read More…

So, you just got your year-end bonus of $2,000. Now what are you going to do with it? Let’s review the obvious choices… Most financial institutions, banks, credit unions, and savings and loan associations have a similar menu of investment products from which you may choose. Here are the most common and popular products: Savings Read More…

The first time Tiger Woods grabbed a golf club he couldn’t hit the ball perfectly straight 300 yards and the first time Michael Jordan touched a basketball he couldn’t dunk it, so don’t think that you will be able to earn a 100% return in the first year. Before Tiger could hit a golf ball Read More…

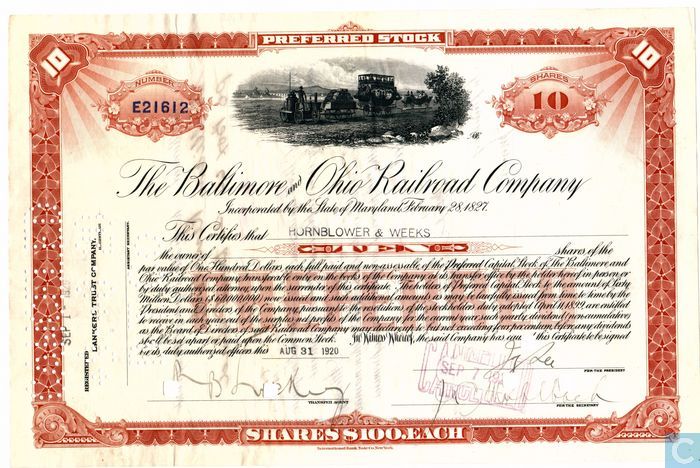

Large companies that have lots of investors often issue “stocks” or “shares” to the investors as a way of showing ownership. If you bought 100 shares of a company you might get a stock certificate like the one below indicating your ownership. If you decided you no longer wanted to own those shares you could Read More…

How Do I Build a Diversified Portfolio? Understanding what it means to build a diversified portfolio is one of the first concepts a new investor needs to understand. When talking about stocks, diversification means to make sure you don’t “put all of your eggs in one basket.” What Does It Mean To Diversify? Simply put, Read More…