Developing a workable investing strategy – and sticking to it through its high and low points – is the major component of your overall action plan. You need to create an investing strategy that is “comfortable” for you. If it doesn’t fit you, you won’t stick to it. Here are some proven ways to select a strategy that works for you:

- Understand who you are and who you are not.

- Understand the true state of your financial fitness. Adopting a strategy popular with the world’s largest investors will do little to help you if your investment fund is less than $5,000. Be honest and create a strategy that makes sense.

- Be brutally honest when evaluating your current economic situation. While staying positive is always a benefit, evaluation of yourself must be just as objective as your analysis of companies and potential investments. At a minimum, consider the following factors

- Your current age

- Your asset position: What assets and available cash do you have?

- Your debt position: How much do you owe?

- Current income and cash flow: How much do you make from all income sources?

- Current expenses: How much do you need to spend monthly?

- Your savings plan: How much can you save regularly?

- Your retirement plans: How much do you think you’ll need to retire comfortably? Use a retirement calculator to give you some guidance

-

Age Average Net Worth Under 25 $9,660 25-29 $37,229 30-34 $136,629 35-39 $298,500 40-44 $491,100 45-49 $690,090 50-54 $702,552 55-59 $1,123,000 60-64 $1,507,000 65-69 $2,294,492 70-74 $2,546,213 75 and over $2,734,001 Evaluate your financial situation as compared to the statistics for average net worth for different age groups.

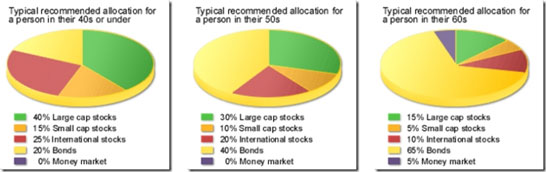

- Be aware of recommended asset allocations for portfolios of different age ranges to help guide your investment strategy.

Use this and other information you accumulate to construct an investing strategy that fits your finances, personality, and economic goals. You will make better decisions, enjoy your investment activities, and improve your chances of reaching your financial goals.