The most popular investment strategy preached by brokers, fund managers and even famous investors like Warren Buffet is “buy and hold.” In its most basic form, this strategy believes that you should only buy stocks of solid, well managed companies that will deliver profits for decades to come; furthermore, that you should hold onto these stocks for decades and not worry about the wild swings that we see in the stock market. If you think this description sounds like the opposite strategy employed by day traders, you’re right.

Instead of spending your days looking at charts and drawing trend lines and support and resistance lines, spend your time studying the companies that are the biggest and most profitable in the World. What is the best energy company in the U.S.? What is the best consumer products company? What is the best bank in the World? What is Warren Buffet investing in?

When you are just getting started and trying to pick stocks, it is easier to follow the experts and ride the ups and downs as they do. As you can imagine, this strategy removes much of the built-in stress that occurs with day trading or swing trading.

However, the payouts are smaller and steadier and you will have less to brag about at the cocktail parties.

The acknowledged guru of buy-and-hold strategies is world-renowned investor, Warren Buffet. For decades, Mr. Buffet never bought a stock that he didn’t want to hold for at least 5 years, and he has seldom been a seller. Remember that Buffet once said his holding period is “forever.” Many other investing experts question the “intensity” of his strategy, believing that he is too restrictive by holding almost all of his investments. There is little argument that his extreme buy-and-hold strategy has worked amazingly well for him, as he is one of the wealthiest people on our planet.

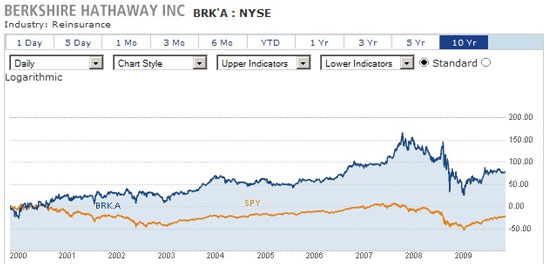

Warren Buffet’s holding company, Berkshire Hathaway (BRK.A) is the best example of a buy and hold strategy. It has clearly outperformed the S&P 500 index (green line in chart above, ticker symbol SPY) over the last 10 years. As the S&P 500 index lost about 10%, Berkshire Hathaway (BRK.A) gained about 75% over the last decade.

In spite of the conventional wisdom that buy and hold is the way to invest, many people are starting to question this strategy. Because times are changing so fast, technology is changing so fast, and consumers’ buying behavior is changing so fast, it appears that business cycles are getting shorter and that a successfully managed investment portfolio needs to react to these market conditions.