The buying and selling of investments (stocks, futures, stock options, commodities, currencies, etc.) within the same trading day, so that all positions are closed before the end of each day, is called day trading. Beginning investors should understand that day trading is very difficult to do successfully because you are trading against professional traders that have better access to information, faster computers, and faster trade execution platforms. Sure, you will have a winning day or two, but the majority of beginning investors end up getting crushed.

Day trading became popular during the Dot.com stock market bubble for a variety of reasons. First, the growth of the Internet made more and more data available to the individual investor (this data had previously been available only at brokerage offices). Second, the growth of software and trading strategies on various websites made learning about trading, and especially charting stocks, easier. Third, brokerage firms rushed to encourage active trading as they were forced to lower their commission structures due to competition in the online discount brokerage market (with lower commissions per trade they needed more trades to keep profits up). And finally, in a bull market, just about everyone begins to think that they are an expert stock picker because everything they buy goes up and up!

As it turns out, if those day traders had left their money in their stocks overnight for several months during the boom, most of them would have been better off because they would have paid fewer commissions, paid fewer short-term capital gains taxes, and they would have slept better!

Unlike those who are looking for long-term appreciation and growth of a portfolio, day traders are playing an active game every day the market is open. The securities are subject to short-term spikes – up or down – often based on factors over which investors have no control or even knowledge.

Should you wish to be a day trader, you should become comfortable with making and losing money – real money, not paper profits – on a daily basis. Also, be prepared to pay lots of fees to your stock broker. Even if you use an online discount broker that charges less than $10 per trade, those fees add up and begin to eat into your profits, if you can manage to make any as a day trader.

Level 2 Quotes

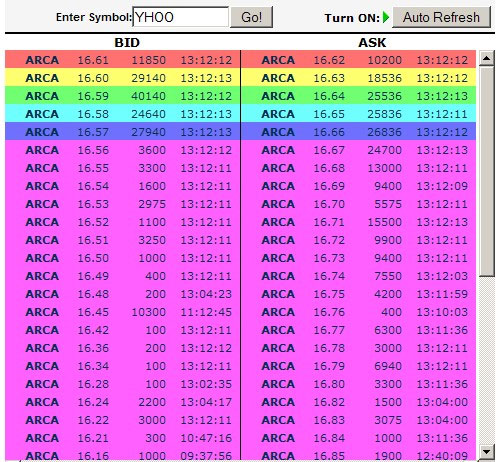

One popular strategy of day traders is to look at Level 2 quotes. Whereas Level 1 quotes show you the best bid and ask prices for a stock, Level 2 quotes allow you to see all of the bids and offers and the volumes of each order on the stock. Theoretically, if you see a lot of buy orders and only a few sell orders in the queue, then you would expect the price to hold firm or rise slightly. Or you could see a 10,000 share sell order and only a few 100 share buy orders—indicating a short-term price drop as those 10,000 shares being sold will drive the market down. Trading 500 shares of a stock and catching a 10-cent rise in a few minutes is a quick $50 profit. If you could do that 10 times a day, that’s a $500 per day profit.

A typical display of Level 2 quotes for a stock showing the queue of Bid orders on the left and Ask orders on the right.

Day trading is not for the timid or the uninformed. Market prices can change very quickly and experience wide swings as the result of heavy trading, breaking news, or market whims. Successful day traders are the subject of legend, books, and movies. However, day trading failures are more numerous than successes because of the heightened risks.Here’s a funny and true story from the Wall Street Journal shortly after the NASDAQ bubble burst in 2000. A man goes to get the oil changed in his car. After waiting more than 30 minutes for a service that normally takes less than 15, he walked into the garage to ask the auto mechanic what the problem was. As he got closer, he saw the mechanic staring at a computer screen and he thought the mechanic was using it to test his car. Instead, he saw that the mechanic was looking at charts of stocks and was actually day trading instead of changing his oil! At that point, he knew the stock bubble had gone too far and he sold all his stocks when he got back to the office.