Once you have understood a company’s profitability, take a look at the Statement of Cash Flows because this is the second most important element of Fundamental Analysis and it frequently needs more than a cursory examination. Many experts strongly contend that good cash flow is more important than earnings to ensure company viability for the long-term. Surprised? Don’t be.

Before we discuss how to analyze a company on a cash flow basis, let’s be clear that we understand the difference between net income and cash flow.

Sorry, but it’s time for an accounting lesson! When we set up a lemonade stand as a child, we would go to the store and buy $20 worth of lemons, cups, and ice. We would then stand on the street and try to sell 50 cups for a $1 each. That $50 in revenue and $20 worth of expenses provided us a net income of $30 and a cash flow of $30.

But the reality was that we borrowed mom and dad’s table to make our lemonade stand and we didn’t pay them anything for borrowing that table. If we wanted to expand our lemonade business by opening another stand at another street corner, we would have to buy a new table—which might cost us $75. So, on the second day of our 2-lemonade stand business, we would spend $40 on lemons and $75 on a table and sell $100 worth of lemonade. That’s now $100 in revenue, $40 in lemons, and $75 for a table. So that means we end the day with $15 cash less than we started with.

On the third day, we don’t need to buy another table. So on the third day we have another $100 in revenue and $40 in costs and a positive cash flow of $60.

| Day 1 | Day 2 | Day 3 | |

|---|---|---|---|

| Revenue | $50 | $100 | $100 |

| Expenses | $20 | $115 | $40 |

| Cash Flow | $30 | $-15 | $60 |

The cash flow is easy to see each day, but what was our net income each day? The answer is that it depends on how many days we will use our table. If we think the $75 table will last for 75 days, then didn’t that table really cost us $1 a day to use? Accountants at publicly traded companies must do this type of math and allocate the costs of these “fixed assets” over the expected life of the asset. This process of expensing the table at $1 a day is called amortization (or depreciation). The purchase of fixed assets and their depreciation is one of the differences between net income and cash flow.

Now suppose in day 2 of our lemonade business, a customer took lemonade from us and then realized he didn’t have the $1 to pay for it, but promised to come back the next day to pay. On day 2 we would have only received $99 in cash from our $100 in sales, but on day three we would have received $101 in cash on $100 in sales. The sale really occurred on day 2, it’s just that we didn’t get paid until day 3.

Similarly, on day 2 in our trip to the grocery store in the morning we might have forgotten to take our wallet, but the grocery store manager gave us credit as long as we promised to pay the next day. Suddenly you can see how net income and our cash flow can really get out of alignment with the purchasing and payment for our inventory, the collection of cash from our sales, and the purchases of fixed assets that have expected useful lives of 3, 5 or even 30 years.

Now consider this: A company with excellent profitability may experience serious problems if its sales are concentrated in a very small customer base, if all products are sold on company credit resulting in massive accounts receivable, or if the company is slow to develop new or improved products in a fast moving industry. Much needed cash flow – to fund operating expenses, R&D, debt service, and marketing – may be missing and the company’s long-term ability to operate profitably – or simply operate at all – may be in danger.

Another company, working on small profit margins, however, may have excellent cash flow and inventory turnover. They enjoy sufficient cash to meet all operating, marketing, and debt service obligations and have funds leftover for future projects. As an example, consider successful supermarket chains that often work with profit margins as low as 5%. However, their consistent profit, combined with excellent cash flow (and few accounts receivable), typically keeps supermarkets viable and a very stable investment.

The Cash Flow Statement that you will find in a company’s financial statement should help you narrow down the true cash flow generated from operations. Don’t be afraid to look at these statements! You will find out how the company manages its business, how it manages its cash flow, and might reveal unexpected changes that can give you clues about future performance.

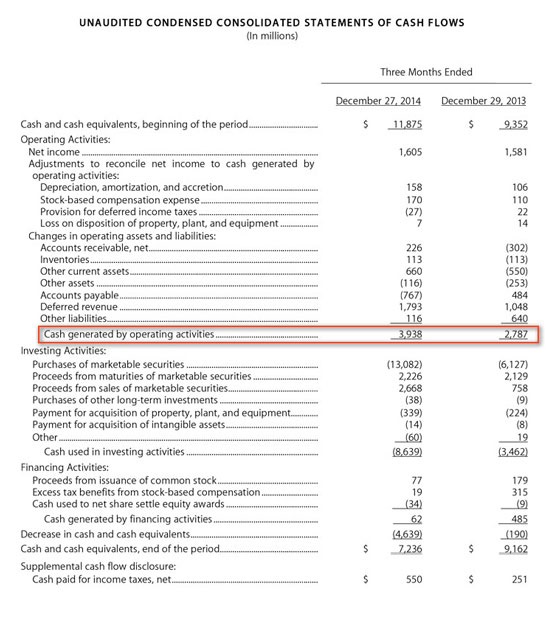

Now take a look at Apple’s Cash Flow Statement. Notice how they started the 3 months with $11,875 million, generated $3,938 from operating activities, invested $8,639 million, received $62 million from other investing activities, and that resulted in them having $7,236 million at the end of the quarter. That is quite a company!

Fortunately, the financial statements have tried to simplify some of these accounting issues with the use of a few key terms that everyone reviewing a company should be interested in.

The following section is an explanation of some of the primary sources of earnings and cash flow information with which you should become familiar. They help you analyze potential investments that may fit your strategy and eliminate others that might not match your preferences.