There are many new enhancements this Spring that will improve how both professors and students use the platform.

General Improvements

1.New Dashboard

• “Assignments” front and center – students have clear expectations

• Financial literacy classes will also include a budget game snapshot

• Generally fewer tables and less clutter

2. Onboarding

• New “Tour” launches on key pages the first time students access.

• Walkthrough making the first trade, understanding the dashboard, etc

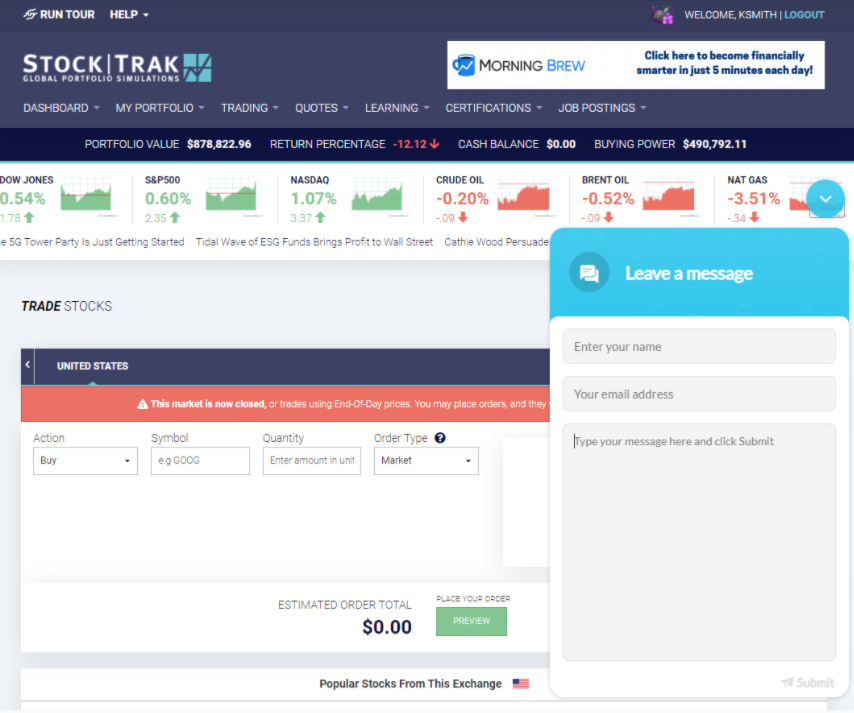

3. Live Chat

• Live Chat support now available for all professors and students (during market hours)

• Outside market hours, dropbox to our support team, with 1 business day turnaround

Trading and Research

1.Mutual Fund Research

• New mutual fund-specific research tools, including fund overviews, fund performance, and fund holdings – in addition to our previous tools (NAV, charts, historical prices, etc)

2.Custom Exchanges

• Restricted investing universe to a setlist of symbols• Common use-cases include: S&P500 only, sponsored events featuring local businesses, and student research-driven trading session

3.Commodity Spots

• Spots trading pit will soon support basic commodity spot contracts – Gold, Silver, Oil, Corn, Wheat, Soy

4.Risk-Adjusted Returns

• Sharpe Ratio – Improved Calculation, Independently set risk-free rate, Annualized for better consistency

• Jensen’s Alpha – Replaces previous Alpha/Beta rankings, Based on portfolio itself, not individual holdings

• Treynor Ratio

Administration Enhancements

1.Improved Data Exports

• Final transaction histories and open positions now available same-day class ends

• Some issues on very large classes – support can help

2.”Fun Facts” Report

• Full-Class Trading Summary – Most frequently traded/bought/sold/short/covered

• Summarize by total trades or total students trading

Financial Literacy

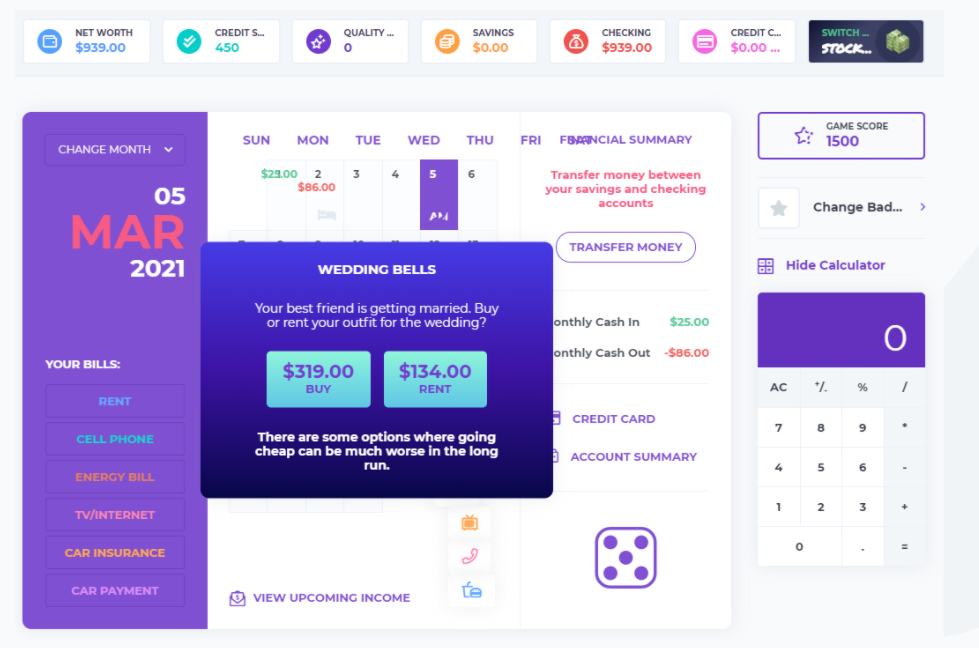

1. Budget Game

• Our new budget game is ideal for Personal Finance classes and university financial literacy initiatives

• Students manage their budget for a simulated year, focusing on setting/hitting savings goals, managing cash flow, and building credit score through the responsible use of credit cards

2. Weekly Deposits

• Alternative to “lump sum” trading sessions

• Students start with less cash but have additional deposits to invest every week

• Not compatible with risk-adjusted rankings

3. Certificates

• Certificates available for students who complete specific sets of lessons in our Learning Center, along with building their portfolio and/or completing the Budget Game

• Investing101 – “Beginner’s Investing”

• Financial Literacy – “Personal Finance”

• Ideal for “Hands-Off” sessions (department/campus challenges)