Earn a $200 Amazon Gift Card by completing our Personal Finance and Investing Curriculum!

Beyond our investing simulation, StockTrak also has a wide library of Personal Finance and Investing lessons that professors can optionally add to their classes.

This December, 2020, we are planning enhancements to help professors plan out these lessons as part of their classes. To do this, we are looking for a few students to work through our curriculum library of about 150 short lessons, and report back how long each lesson took them to complete (along with offer their recommendations to our Curriculum Team for improvements).

Curriculum Review

Students who are interested can fill out the form below. 3 students will be contacted the week of November 30 to confirm their interest, with instructions on how to report back your completion to our product team to help with the next round of updates. Each of the 3 participants will receive a $200 Amazon Gift Card for their time. Based on early estimates, it should take between 8 and 12 hours to complete all lessons and quizzes.

Budget Game Sneak Peek

Everyone who is interested will also have sneak-peek access to StockTrak’s new Personal Budgeting Game, where you will manage your cash flow as a student with a part time job transitioning to the full-time workforce. You will be challenged to maintain a healthy work/life/study balance, responsibly build your Credit Score, set and hit monthly savings goals, and experience all of the unexpected “life events” that add up to make a significant amount of real-world spending.

We are looking for general feedback on the game – what you liked, what you did not, and whether you would recommend this game for both personal finance classes or university-wide financial literacy programs open to all students. We do not have any compensation available for the Budget Game Sneak Peek (and so all students are invited to participate), but your feedback will play a major role in StockTrak’s development plans for 2021.

Learn more about the curriculum

Personal Finance

Do you know whether it’s cheaper to buy or rent? What about how much you need to save to be a millionaire?

The Personal Finance curriculum takes you through the steps of understanding your personal budget so that you can set realistic goals.

It’s not about depriving yourself, but understanding your cash flow every month, how to use debt responsibly to build credit, the pros and cons of different forms of insurance, and managing your taxes and expenses. It’s not about depriving yourself, but understanding your cash flow every month, how to use debt responsibly to build credit, the pros and cons of different forms of insurance, and managing your taxes and expenses.

The assignments include interactive calculators, videos, and pop quizzes at the end of each lesson to test your knowledge.

Investing

Whether you have a million dollars, or $100, the only way to grow your wealth is first to understand the investment choices available to you and how to use them.

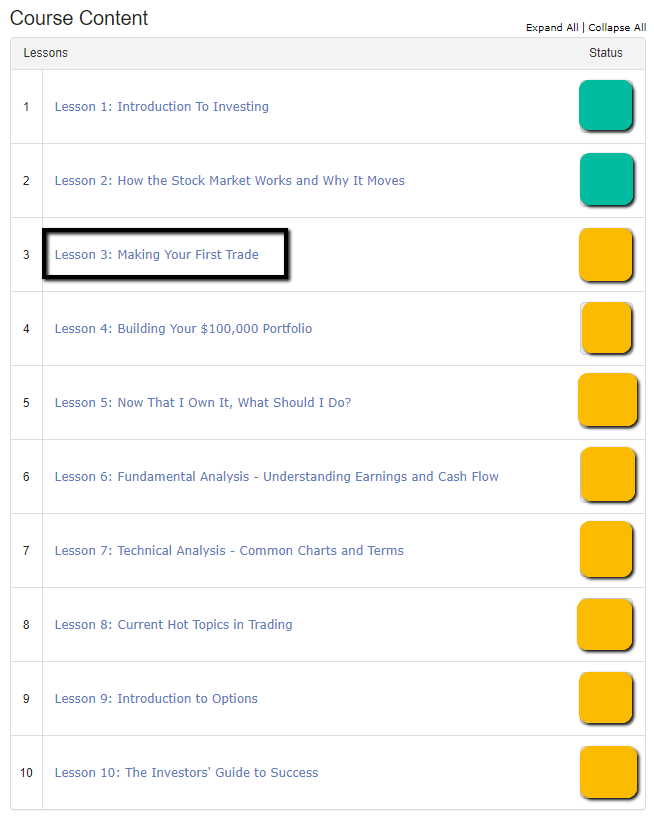

The investing curriculum takes you through how to set-up a personalized investment plan, how to build equity, and how to know when it’s time to buy, sell, or hold. You will also learn how to evaluate the worthiness of stocks through the fundamental analysis approach as well as the technician analysis approach.

By the time to take the final exam, you’ll be able to spot short term trends and understand the economic cycles that impact financial markets.