Today we will look at the Gold future trade. Gold was in a sideway movement from the end of November 2021 until now (December 14, 2021).

I have decided to take a long position on Gold. Why?

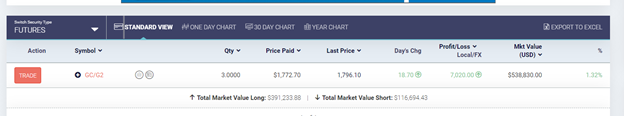

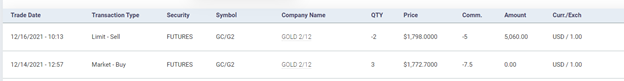

Gold has been approximately moving between $1760 to $1800. On December 14, 2021, I entered 3 long positions on the future, a Feb 2022 contract. I was looking at the 4H time frame support to take advantage of the movement up to resistance.

Dedication and patience to enter are the keys to getting this strategy to work out.

Today, Thursday December 16, 2021, I took profits on 2 contracts and moved the last one to BE+3 points (Breakeven + 3 points), but why did I do this?

- I took profits so I will not get too anxious and lose money on my trade.

- I don’t want to be greedy and wait for a bigger move, because we don’t know if it will or will not move beyond the resistance at $1800.

- Since I had 3 contracts and I took a profit on 2 contracts ($5060 – commissions), and this money is in the bank now. I will keep my last one as a runner, just in-case it breaks out on the upside, and I can earn more in profits. No matter what happens I am in a winning trade. If it retraces back and takes me out, I am still a winner on the last trade. I protected my last contract at a minimum to get +3 points of profits ($230).

To conclude, this strategy can be applied to stocks, futures, Forex or any other tradable instrument.

I could have bought the GLD ETF or bought GLD call options (cheaper than buying the ETF), but I choose to buy the Future, because the future market is open almost 24H/6 days a week. If something were to happen or any world news broke out over night, I could exit my positions fast. Unlike the ETF, where I have to wait until the market opens at 9:30 am EST to close out my position; at that time it would be too late and I would probably be in a loosing position.

Good trading!!