Stock-Trak Project

Professor Andrew Cohen teaches Wall Street 101, an introductory Undergraduate Finance class, at ODU as well as MBA-level Finance courses at Hampton University.

He actively uses Stock-Trak at both schools, where two of the mandatory assignments and two extra-credit assignments are completed using the Stock-Trak virtual investing platform.

His approach is to provide lots of opportunities to practice investing and offers many extra credit assignments to develop a familiarity with the financial markets. Cohen uses several different platforms and simulations in his class, including Bloomberg, Stock-Trak, and an investing simulation he designed himself called FutureTraders.

First Stock-Trak Assignment

His first Stock-Trak assignment is focused on beginner concepts, like what is a stock, and building a diversified portfolio. All the investing lessons included in the assignment are taken from the Stock-Trak learning library. Each lesson ends with a self-graded pop quiz. He allows students to retake the quizzes to get a better grade.

“I give my students the opportunity to redo the quizzes to ensure they learn from their mistakes and to reward the students who put in the most effort.”

– Professor Andrew Cohen

He said when describing his teaching philosophy. He sees the “retake quiz” as a great feature that Stock-Trak offers, since it allows students to improve their grades and learn from their mistakes.

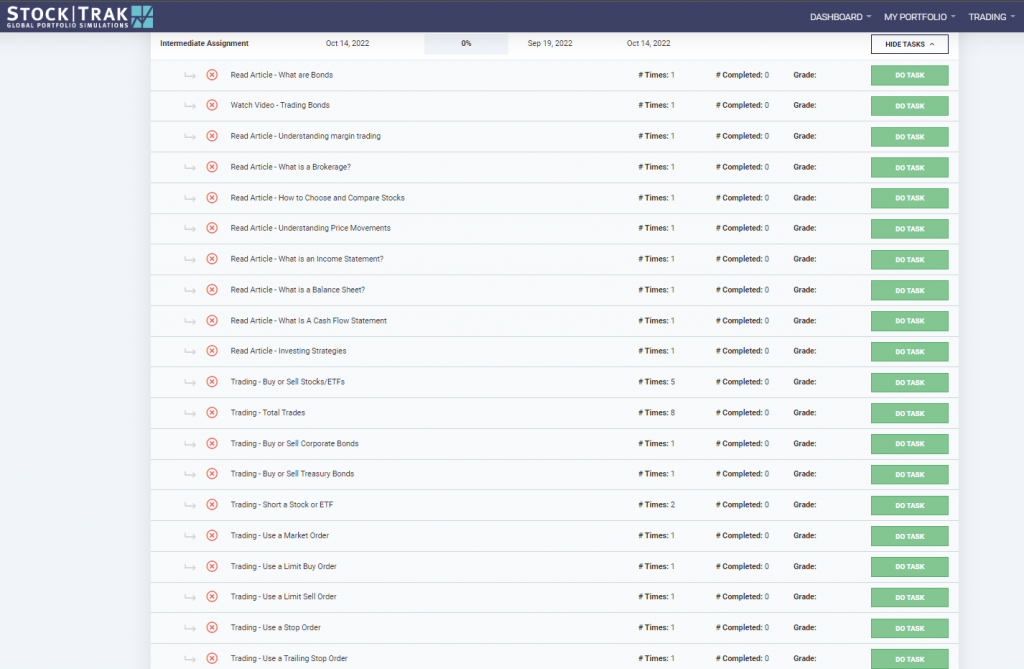

The assignment feature also allows professors like Cohen to set a specific number of trades to complete by a certain date. For example, students must place trades like, buy or sell at least 5 stocks or ETFs, short at least 2 equities, and do at least one of each order type, (market order, limit orders, and stop orders, etc.).

Students must explain their rationale for every trade they do, developing their critical thinking for short-term and long-term investing goals. This information is also used in their final class assignment.

Second Stock-Trak Assignment

His second Stock-Trak assignment goes into more intermediate topics like, bonds, margin trading, understanding price movements, how to read financial statements and other lessons that improve their financial knowledge. He assigns more advanced trades to place in their virtual portfolios as well, like placing a trailing stop order.

As he introduces more advanced security types in class, he makes them available in the simulation. For example, he’ll only turn on option trading halfway through the semester when students are assigned the extra credit assignment on options.

Professors can customize all the trading features; not just at the beginning of the semester, so they can keep students focused on what’s being covered in class so they can practice either at home or in their finance labs.

How to Start a Lemonade Stand – PowerPoint Presentation

A few years ago, the CEO of Stock-Trak, Mark T. Brookshire, shared a PowerPoint presentation on how to start a lemonade stand. This is also incorporated into Cohen’s finance class to simplify concepts, like how can students scale this fictitious lemonade company.

How can they improve their profitability?

And finally, when it comes time to raise capital, how can they do that in the capital markets?

Final Class Assignment

The final assignment of the class is a deep analysis of a stock of the student’s choice. Students must provide qualitative and quantitative reasons why they believe the stock is undervalued and should be bought or overvalued and should be shorted.

They provide their insight on what societal implications impacted the stock’s performance. They perform both absolute and relative value analysis. So, if they choose to study McDonald’s (MCD) they will need to compare it to a similar company like Chipotle (CMG).

Students use the virtual trading platform as individual investors, many of whom register to Cohen’s class from outside the business program or finance department. Nursing, art, math, and engineering students attend his class. For many, this is the only class they’ll take that exposes them to the financial markets.

Cohen has found using Stock-Trak earlier in his course helps students to feel more comfortable investing before moving onto other simulations later. He finds the platform more accessible and intuitive to newbie investors so they can learn through doing and discovering how to invest their money wisely through trial and error.

Fall 2022 Syllabus

Professor Cohen kindly shared his syllabus with us, so that you can take a look at how he structures his course. Click this link to view a PDF for his Fall 2022 class.

Class Settings

Here are the main trading settings used in Professor Cohen’s class. You can fully customize all the parameters to fit the focus of your course. You can also turn settings on or off throughout the semester.

| Trading Setting | |

| Securities | Equities, stocks, ETFs, mutual funds, bonds, and options |

| Exchanges | United States and cryptocurrencies |

| Initial Cash | $1,000,000 |

| Margin Trading | Allowed, with a 3% interest rate |

| Short Selling | Allowed, with $3.00 as the minimum shorting price |

| Day Trading | Allowed, with 10,000 total trades available |

| Position Limit | 10% for equities, 25% for bonds, options and mutual funds |

| Trade Notes | Required |

| Performance Measures | Sharp Ratio, Treynor and Jensen’s Alpha |