After some experience buying and selling a few stocks, you may be interested in diversifying your portfolio across different market sectors. For example, health care, information technology, consumer Discretionary, etc.

What can you do to find the best stocks in a particular sector that is outperforming the market?

First of all, my recommendation is to use Trading View for graphing and Select Sector SPDR for looking up the sectors.

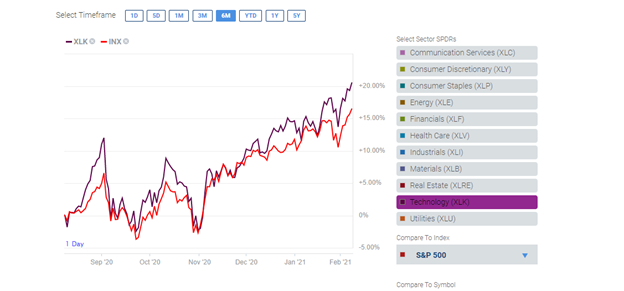

We will find the Best performing Sector against a major Index. In this case, we will use the S&P 500 index since it is an extensively used benchmark index across the world.

For example, we will look at the 6-month performance of the technology sector (XLK) and compare it against S&P 500. The graph below shows that the technology sector outperformed the S&P 500 and is up 20.22% compared to the S&P 500, which is up 16.84% during this period.

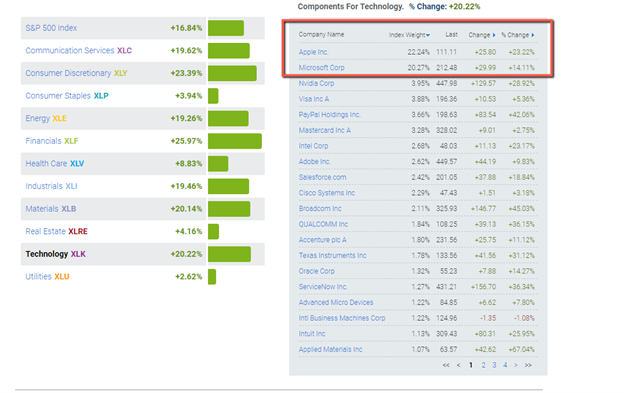

After confirming that the XLK is outperforming the S&P 500, we need to investigate more and find the best stocks in this sector. So, we will click on XLK and extract all the companies that are part of it (reference the picture below).

Now we have a list of the companies that make up the XLK sector, and we need to pick the best-performing ones to invest in. I like to look at the top 10 weighted companies since they have the largest impact and move their respective sector the most. Look for companies that have the largest stake in the sector.

Key takeaways:

- Apple Inc represents 22.24% of the XLK weight.

- Microsoft Corp represents 20.27% of the XLK weight.

In conclusion, Apple and Microsoft are the largest components of the XLK, and any movement in those two stocks will dramatically move the XLK. The other stocks can move the XLK too, but will not have any significant effect compared to the top two companies (AAPL and MSFT)

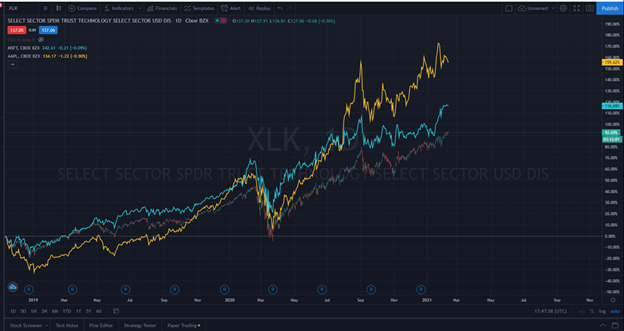

As we can see from the chart below, we have compared the XLK to MSFT and AAPL. Both stocks are moving almost the same way as XLK.

What do we learn from this?

To profit from the technology sector, we can buy AAPL or MSFT because they represent (42.5% of this sector’s weight). They are the outperformers in this sector, and any move in either of them will impact XLK positively or negatively.

Tip: Wait for a pullback to get in one of those performing stocks. Patience is a virtue!