Your Guide to Trading Bull Puts, Bear Calls, Iron Condors & Iron Butterfly Credit Spreads

Looking to understand credit spread options? These strategies involve selling and buying options with different strike prices but the same expiration, generating upfront credit while limiting risk. In this guide, we’ll break down how they work and how you can use them effectively.

Key Takeaways

- Credit spreads involve selling one option and buying another from the same class and expiration date but with different strike prices, providing a defined risk and reward structure.

- Popular credit spread strategies include the Bull Put spread for bullish market views and the Bear Call spread for bearish outlooks, both aimed at maximizing profits while limiting risk.

- Advanced strategies such as the Iron Condor and Iron Butterfly add complexity, enabling traders to capitalize on market conditions while maintaining defined risk profiles.

What is a Credit Spread and How Does It Work?

A credit spread involves selling one option while simultaneously buying another option from the same class and expiration date, but with different strike prices. This strategy results in an upfront net credit, as the premium received from the sold option is higher than the premium paid for the purchased option. Credit spreads are vertical spreads, meaning the options share the same expiration date but differ in strike prices, providing a defined risk and reward structure.

A credit spread aims to profit if the options sold expire worthless or decrease in value, with the purchased option limiting potential loss. This defined risk aspect allows traders to know their maximum potential loss at the time of trade entry, making credit spreads a popular choice for those looking to manage risk effectively.

Credit spreads generally require less capital and have lower margin requirements compared to selling uncovered options, making them accessible to more traders.

Essential Terminology for Credit Spreads

Familiarity with key terminology is crucial when trading credit spreads. The strike price is the predetermined price at which the underlying asset can be bought (call) or sold (put) if the option is exercised. The expiration date is the specific date on which an option contract expires and ceases to exist. The premium is the price of an option contract, paid by the buyer to the seller.

The net credit is the total amount of premium received by the trader when establishing a credit spread, calculated as the premium from the sold option minus the premium paid for the bought option. Maximum profit for a credit spread is typically limited to the initial premium net credit received, while maximum loss is the difference between the strike prices of the long and short options, minus the net credit received, multiplied by 100 (per contract).

The breakeven point is the price at which the underlying asset must be at expiration for the trade to result in neither a profit nor a loss (excluding commissions). Additionally, it’s essential to understand terms like in-the-money (ITM), at-the-money (ATM), and out-of-the-money (OTM) to identify options with intrinsic value.

How to Define and Limit Your Risk

This is often the most compelling reason for investors to use spreads. By setting up a trade that involves both buying and selling an option simultaneously, you can often cap your maximum potential loss.

You will know, right from the beginning, the worst-case scenario for your trade, no matter how dramatically the market moves against you.

This ability to define your risk is fundamental to building safer, more predictable strategies. It allows you to explore opportunities with confidence, knowing your downside is contained.

How to Get Time Decay to Work for You

Many popular options spread strategies are designed to generate passive income. These strategies typically involve selling an option with a higher premium and buying another option with a lower premium as part of the same trade, resulting in a net credit received upfront.

These “credit spreads” (like Bull Put Spreads or Bear Call Spreads) profit if the underlying asset’s price stays within a certain range or moves favorably. You could benefit from the passage of time (Theta decay) if the options you sold lose value faster than the ones you bought.

Essentially, it’s a way to potentially earn passive income by strategically leveraging time.

How to Benefit from Subtle Market Movements

With single options, you’re mostly making a simple bullish (buy call) or bearish (buy put) trade. Options spreads allow you to express much more nuanced market views.

- Do you think the stock will stay within a specific range? An Iron Condor might be the right strategy.

- Do you expect a moderate move up, but want to limit risk? A Bull Call Spread could be the answer.

Spreads allow you to tailor strategies precisely to your outlook on price direction, the magnitude of the price movement, and even expected volatility, offering incredible versatility beyond simple directional bets.

How to Reduce Your Trading Costs

Beyond managing risk, generating income, and having precise strategies, options spreads offer another exciting benefit: they can often be a less expensive way to make your move in the market compared to buying a single, pricey option contract.

Here’s how it works:

When you set up an option spread, you’re usually buying one option and selling another at the same time. The money (premium) you receive from selling the second option helps pay for the option you buy.

Think of it like getting a discount. This “discount” from the sale reduces your total upfront cost – the amount of money you have to put down right away. Sometimes, the premium you receive from selling is even more than the cost of the option you buy, meaning you actually receive a net credit, getting paid upfront to put the strategy on!

This capability is huge. It can make certain strategies more accessible if buying a single option felt too expensive. And because your initial investment (your cost) might be lower, your potential return on the money you do put down can potentially be higher compared to simply buying a single, more expensive option contract.

Ultimately, adding options spreads to your toolkit means gaining the power to manage risk with precision, potentially generate income, align strategies to your exact market view, and optimize your capital – fundamentally enhancing your ability to manage your money.

Bull Put Spread: A Conservative Bullish Strategy

The bull put spread is a conservative bullish strategy that profits if the underlying asset stays above a certain price, moves sideways, or rises. Ideal for neutral to bullish market expectations, this strategy works when you anticipate the stock will rise moderately, stay flat, or not fall significantly, placing you in a bullish or bearish position with put spreads.

This strategy involves selling a put option while buying another put option with a lower strike price and the same expiration date.

How to Set Up a Bull Put Spread

Set up a bull put spread by selecting a stock or ETF and choosing an expiration date, typically between four to six weeks. Next, choose two out-of-the-money strike prices: sell a put option at a higher strike price (typically at-the-money or slightly out-of-the-money) and buy a put option with a lower strike price (further out-of-the-money) with the same expiration date. This setup allows you to collect a net premium upfront while limiting your risk to the difference between the strike prices minus the net premium received, which is a strategy often discussed alongside selling naked options.

For example, if Stock XYZ is trading at $52, you might sell a $50 put for $1.50 and buy a $45 put for $0.50, resulting in a net credit of $1.00 per share (or $100 per contract) and defining your risk and reward parameters.

The key is to select strike prices that align with your market outlook and risk tolerance.

Profit, Loss, and Breakeven Scenarios

The maximum profit for a bull put spread is the net premium received if the stock price remains above the higher (sold) put strike price at expiration. The maximum loss occurs if the stock price falls below the lower (bought) put strike price at expiration, calculated as the difference between the strike prices minus the net premium received, multiplied by 100 (per contract). Calculate the breakeven point by subtracting the net premium received from the strike price of the sold put.

For instance, using the previous example: if Stock XYZ is at $52, selling a $50 put for $1.50 and buying a $45 put for $0.50 results in a net credit of $1.00.

The maximum profit is $100, and the maximum loss is ($5 – $1) x 100 = $400, with a breakeven point at $50 – $1 = $49.

This approach helps traders understand their potential outcomes and manage their investment strategy effectively.

Bear Call Spread: Profiting from a Bearish Outlook

The bear call spread generates income or profit if the underlying asset stays below a certain price, moves sideways, or falls. Ideal for neutral to bearish market expectations, this strategy works when you anticipate the stock will fall moderately, stay flat, or not rise significantly.

This strategy involves selling a call option while buying and selling options with a higher strike price and the same expiration date.

How to Set Up a Bear Call Spread

Set up a bear call spread by selecting a stock or ETF and choosing an expiration date. Next, choose two out-of-the-money strike prices: sell a call option at a higher strike price (typically at-the-money or slightly out-of-the-money) and buy a call option with a higher strike price (further out-of-the-money) with the same expiration date. This setup allows you to collect a net premium upfront while limiting your risk to the difference between the strike prices minus the net premium received.

For example, if Stock XYZ is trading at $52, selling a $55 call for $1.30 and buying a $60 call for $0.30 results in a net credit of $1.00 per share (or $100 per contract) and defines your risk and reward parameters.

The key is to select strike prices that align with your market outlook and market risk tolerance.

Profit, Loss, and Breakeven Scenarios

The maximum profit for a bear call spread is the net premium received if the stock price remains below the lower (sold) call strike price at expiration. The maximum loss occurs if the stock price rises above the higher (bought) call strike price at expiration, calculated as the difference between the higher strike price minus the strike prices minus the net premium received, multiplied by 100 (per contract). Find the breakeven point by calculating the net premium received and adding it to the strike price of the sold call.

For instance, if Stock XYZ is at $52, selling a $55 call for $1.30 and buying a $60 call for $0.30 results in a net credit of $1.00. The maximum profit is $100, and the maximum loss is ($5 – $1) x 100 = $400.

The breakeven point is $55 + $1 = $56. This approach helps traders understand their potential outcomes and manage risk effectively.

Advanced Strategies: Iron Condor and Iron Butterfly

Advanced options trading strategies like the iron condor and iron butterfly take credit spreads to the next level. These multi-leg strategies combine different spreads to create defined risk and profit potential, allowing traders to capitalize on various market conditions.

Iron Condors

An iron condor profits if the underlying asset price stays within a defined range. Ideal for low volatility and predictable trading ranges, this strategy combines a bull put spread and a bear call spread on the same underlying asset with the same expiration date.

How to Set Up an Iron Condor

An iron condor involves four legs: selling an out-of-the-money (OTM) put, buying a further OTM put (lower strike), selling an OTM call, and buying a further OTM call (higher strike). Choose short put and short call strikes (the “body”) at levels you believe the asset price will not breach, and the long put and long call strikes (the “wings”) further out to limit risk.

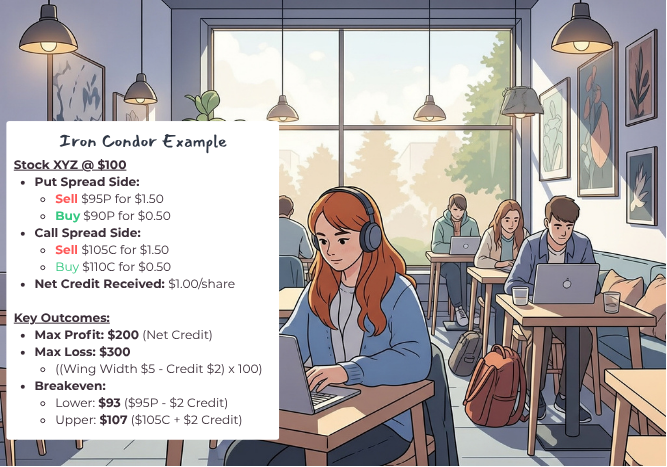

For instance, if Stock XYZ is trading at $100, selling a $95 put for $1.50 and buying a $90 put for $0.50; selling a $105 call for $1.50 and buying a $110 call for $0.50 results in a total net credit of $2.00 per share (or $200 per contract).

The width of the “body” and “wings” are key considerations as they influence the risk-reward balance.

Profit, Loss, and Breakeven Scenarios

The maximum profit for an iron condor is the total net credit received from establishing all four legs, achieved if the stock price stays between the short put and short call strikes at expiration. The maximum loss is limited and determined by the width of the wider vertical spread (either the put spread or the call spread) minus the net credit received; this occurs if the stock price moves significantly beyond one of the long option strikes.

For example, if Stock XYZ is trading at $100, selling a $95 put for $1.50, buying a $90 put for $0.50, selling a $105 call for $1.50, and buying a $110 call for $0.50 results in a total net credit of $2.00.

The maximum profit is $200, and the maximum loss is (($95-$90) – $2.00) x 100 = $300. The breakeven points are $95 – $2.00 = $93 and $105 + $2.00 = $107.

Iron Butterflies

An iron butterfly profits if the underlying asset price stays very close to a specific price point (the center/short strike) at expiration. Ideal for low volatility and a neutral market outlook, this strategy combines selling an at-the-money (ATM) call and an ATM put (short straddle) with buying an out-of-the-money (OTM) call and an OTM put as protective “wings”.

How to Set Up an Iron Butterfly

To set up an iron butterfly, sell an at-the-money (ATM) call and an ATM put, both at the same center strike price, forming a short straddle. Simultaneously, buy an out-of-the-money (OTM) call with a higher strike price and an OTM put with a lower strike price to act as protective “wings,” defining the risk.

For example, if Stock XYZ is trading at $100, selling a $100 call for $3.00 and a $100 put for $2.50, while buying a $105 call for $1.20 and a $95 put for $1.00 results in a total net credit of $3.30 per share (or $330 per contract).

Profit, Loss, and Breakeven Scenarios

The maximum profit for an iron butterfly is the net credit received if the underlying asset’s price is exactly at the center (short) strike price of the sold options at expiration. The maximum loss is limited by the protective wings and calculated as the difference between the center strike and one of the wing strikes, minus the net credit received.

For instance, using the previous example: if Stock XYZ is at $100, you sell a $100 call for $3.00, sell a $100 put for $2.50, buy a $95 put for $1.00, and buy a $105 call for $1.20. The total net credit call is $3.30.

The maximum profit is $330, and the maximum loss is (($100-$95) – $3.30) x 100 = $170. The breakeven points are $100 – $3.30 = $96.70 and $100 + $3.30 = $103.30.

Advantages and Disadvantages of Credit Spreads

Credit spreads offer a balanced approach to options trading, combining risk management with profit potential. They allow traders to define their potential maximum loss clearly and limit exposure compared to selling uncovered options, including credit put spreads.

Benefits of Using Credit Spreads

One of the primary benefits of credit spreads is the significant risk limitation compared to selling uncovered options. Traders collect a premium upfront, providing an income stream while requiring relatively lower capital and margin requirements, making them accessible to a broader range of traders.

Additionally, time decay (theta) works in the seller’s favor, eroding the value of the options sold and benefiting credit spread sellers.

Drawbacks of Credit Spreads

However, credit spreads also have drawbacks. The profit potential is limited profit potential to the net premium received, which means traders might not fully capture large, favorable market movements in a debit spread.

Credit spreads require active monitoring and management, especially as options approach expiration, to avoid unwanted assignment or increased risk. Changes in market volatility can also impact the profitability of the options strategy credit spread strategy.

Managing Risks in Credit Spread Options

Effective risk management is crucial in credit spread options. Managing risk and addressing the limits of potential losses and profits is essential for successful trading, especially when considering limited risk strategies.

Key Risk Factors to Understand

The maximum potential loss for a credit spread is inherently capped and known at the time of trade entry. Effective risk management involves implementing best practices such as defining clear exit criteria, setting stop-loss triggers or price alerts, avoiding overleveraging, and diversifying positions.

The risk of early assignment increases as options approach expiration, particularly with American-style options.

Early Assignment Risk (American-Style Options)

Early assignment risk can occur on short calls in-the-money options, particularly around ex-dividend dates for call options. Monitoring positions, especially around 21 days prior to expiration, can help mitigate gamma risk and assignment risk.

Margin Requirements

Margin requirements for credit spreads are generally lower compared to naked options due to the defined-risk nature of the strategy. The initial margin requirement is typically calculated as the difference between the strike prices of the long and short options, multiplied by 100, minus the net premium received, representing the maximum potential loss.

Margin Calls

Understanding a margin call is essential for credit spread traders. If assignment or a significant adverse move in your positions causes your account equity to fall below the broker’s maintenance margin requirement, you will receive a margin call. This is a demand from your broker to deposit more funds or securities into your account to bring it back up to the required level.

Failure to meet a margin call promptly can result in your broker forcibly liquidating a short position in your account, often at unfavorable prices, to cover the margin deficit, which may cause you to lose money.

To mitigate these risks, it’s crucial to actively manage your credit spreads, especially as they approach expiration and if they are in-the-money, to avoid unwanted assignment and the potential for sudden, large increases in margin requirements.

Enhancing Credit Spread Strategies with Technology

Technology can significantly enhance credit spread strategies by optimizing trade execution and risk management. Tools like algorithmic trading and machine learning can provide traders with a competitive edge.

Algorithmic Trading for Credit Spreads

Algorithmic trading allows traders to automate entry and exit points based on real-time market data. By leveraging market scanning, traders can identify optimal strike prices and conditions, use back-testing with historical data to refine strategies, and manage positions in real time, including rolling spreads.

Machine Learning Applications

Machine learning can identify patterns in volatility to optimize position parameters. It enhances decision-making by predicting volatility or optimal strike selections based on historical data, providing traders with a more informed approach to credit spread trading.

Practical Tips for Successful Credit Spread Trading

Successful credit spread trading relies on a clear understanding of market dynamics, including volatility and liquidity.

Practical tips can help traders navigate the complexities of this multi leg strategy.

Identifying Optimal Opportunities

Analyzing market conditions and implied volatility (IV) is crucial for identifying optimal opportunities. Scanning for high implied volatility, favorable strike prices, and sufficient liquidity in the options can enhance premiums and increase the chances of successful credit spreads.

Monitoring and Adjusting Positions

Regularly reassessing open positions, especially near expiration, is essential. Consider closing profitable spreads before expiration to lock in gains and have predefined exit strategies for both profit-taking and loss-cutting.

Be aware of significant news events that may impact the underlying asset’s price, prompting adjustments to your positions.

General Best Practices

Utilize risk-reward ratios and appropriate position sizing for effective risk management. Focus on a disciplined approach with clear entry and exit strategies, set stop-loss points, and avoid letting spreads go deep into the money or too close to expiration unmanaged.

Maintaining a trading journal and continuous education are crucial for improving credit spread trading strategies.

Conclusion: Are Credit Spreads Right for You?

Credit spreads offer a balanced approach to options trading, combining income generation, defined risk, and high probability of profit. However, they require a solid understanding of the market, continuous education, and disciplined risk management.

If you’re willing to start small, practice, and refine your strategies over time, credit spreads can be a valuable addition to your trading toolkit. Remember, the key to success in credit spread trading lies in continuous learning and adapting to market conditions.

Learn more about practicing options spreads and how you can learn by doing, make mistakes without any real financial consequences, and discover how credit spread strategies work.

Frequently Asked Questions

What is a credit spread?

A credit spread is a trading strategy that entails selling one option while purchasing another option of the same class and expiration date but with differing strike prices, generating a net credit. This approach allows traders to potentially profit from the difference in premiums.

How do you set up a bull put spread?

To establish a bull put spread, one must sell a put option at a higher strike price while simultaneously purchasing a put option at a lower strike price, ensuring both options have the same expiration date. This strategy is designed to benefit from a bullish market outlook.

What is the maximum profit potential for a bear call spread?

The maximum profit potential for a bear call spread is the net premium received, realized when the stock price stays below the sold call strike price at expiration. Therefore, the profit is capped at this premium amount.

How does an iron condor work?

An iron condor works by simultaneously selling a bull put spread and a bear call spread on the same asset, intending to profit from low volatility as the underlying price remains within a specific range until expiration. This strategy capitalizes on limited price movement while managing risk through defined spreads.

What are the key benefits of using credit spreads?

The key benefits of using credit spreads include significant risk limitation, upfront premium collection, lower capital requirements, and favorable time decay for the seller. These advantages make credit spreads an appealing strategy for risk management and potential profit in trading.