What are options? An option gives you the right, but not the obligation, to buy or sell an underlying instrument (in this article, we’ll be focusing on stocks) at a specified price (the strike price) on or before a specified date (the exercise date or expiration date) in the future.

It’s worth noting that European-style options are slightly different, as you can only exercise them on their expiration date.

When you exercise an option, you’re using that right to buy or sell the underlying stock.

In simpler terms, an option allows you to pay a certain amount of money (the option price or premium) for the choice to buy or sell a stock at the price (the strike price) that you agreed upon when you bought the option.

In this article, you’ll learn more about:

- What are call options and put options?

- How exercising your options works in practice.

- The main reasons you might consider using options.

- The basics of how options are priced, including concepts like intrinsic value and time value.

- How to understand option payoff diagrams.

- Intro to options paper trading.

What are Call and Put Options?

A call option gives you the right to buy stock at a specified price, while a put option gives you the right to sell stock at a specified price.

What are Call Options?

Call options are fascinating financial contracts that grant the call buyer the right to buy an underlying asset at a specified strike price before the option expires. This means that if the market price of the asset increases above the strike price, the call option holder stands to make a profit at a certain price. For instance, a call option on Apple stock with a strike price of $165 might cost $5.50 per share. If the stock price rises to $181.50, the trader can realize a substantial profit.

On the flip side, if the price of the underlying asset falls below the strike price, the call option expires worthless, and the buyer only loses the premium paid. This inherent leverage and defined risk make call options a popular choice for traders looking to capitalize on market movements without committing large amounts of capital upfront, regardless of the underlying’s price.

Buying Calls

Buying calls is one of the most straightforward options strategies, offering significant profit potential if the underlying stock price rises. For example, purchasing a call option on Apple stock with a strike price of $165 might cost $5.50 per share. If the stock price increases by 10% to $181.50 at expiration, the trader can profit by $9,990. The maximum loss for the buyer of a long call option is limited to the premium paid for the call contract, regardless of the exercise price.

Requiring less capital than purchasing the underlying asset outright, this strategy is cost-effective for traders. However, it’s essential to understand that if the stock price doesn’t rise above the strike price, the call option will expire worthless, and the trader will lose the premium paid.

Covered Calls

The covered call strategy involves selling call options against stocks you already own, aiming to generate additional income from the premium received. For instance, if you hold shares of a stock and believe they will remain relatively stable or increase slightly, you can sell call options at a strike price higher than the current market price. If the share price rises above the strike price before expiration, you may be required to sell your shares at the strike price, but you keep the premium received from selling the call options.

This strategy provides a way to earn income from stocks that are not expected to move significantly in the short term. However, it also limits the potential profit if the stock price rises significantly, as you may have to sell your shares at the strike price, potentially missing out on further gains if the stock rises.

What are Put Options?

Put options grant the buyer the right to sell an underlying asset at a specified strike price, providing a way to profit from a decline in the asset’s price. Investors buy put options if they expect the underlying stock price to drop, allowing them to sell the stock at a higher strike price than the market price. A long put option provides the buyer the right to sell 100 shares. This right is available at the strike price if the option is in the money at expiration.

On the other hand, selling a put option obligates the seller to buy the stock if it falls below the strike price. This strategy is often used by investors who believe the stock price will not decrease significantly and are willing to take on the obligation, not the obligation, to buy the stock at a lower price.

Protective Puts

A protective put strategy involves buying a put option as a safeguard against potential losses in a stock position. Think of it as an insurance policy; if the stock price declines, the protective put will offset the losses in the stock position. For example, if you own shares of a stock and expect a decline, you can buy a put option that allows you to sell the stock at the current price, protecting against further losses.

While this strategy provides downside protection, it also comes with a cost—the premium paid for the put option. If the stock price remains above the strike price at expiration, the put option will expire worthless, and you will lose the premium paid. However, the peace of mind and protection from significant losses often justify the cost for many traders.

We go over different put options strategies in our article on Trading Credit Options.

Practical Example of Using Options

Let’s say you want to exercise 20 of your AAPL October 20th call options, which have a strike price of $100. You would inform your broker. They would then ‘use up’ your option contracts (meaning they no longer hold any value) and purchase 2,000 shares of AAPL for you at the strike price of $100 per share. (Since each option contract is for 100 shares, 20 contracts allow you to buy 20 x 100 = 2,000 shares).

This also means you must have the necessary funds – in this case, $200,000 – to purchase those 2,000 shares at $100 each. If AAPL is trading at $105 at that point, you would then earn a $10,000 profit on this trade.

Often, your broker will allow you to take the profit directly, much like what would happen if you held the options until expiry. They can do this by immediately selling the shares for you right after exercising the options.

So, in the previous example, instead of needing the $200,000 in cash to purchase the shares first, you would simply receive the $10,000 profit.

Why Use Options?

At their core, options simply track the price of an underlying asset. So, why would you choose to buy an option instead of buying the asset itself?

There are two main reasons: leverage and strategies.

1. Leverage

Options provide leverage, allowing you to significantly increase your potential profit (or loss) relative to the amount of money you invest, since each option contract typically represents 100 shares of the underlying asset.

Let’s look at a very simple example to see how you can potentially increase your profit (or loss) with options:

Imagine you buy one AAPL call option that costs $1 per share. Since it’s for 100 shares, the contract will cost you $100. Let’s say this option has a strike price of $100. With that same $100, you could instead buy 1 share of AAPL stock if it’s trading at $100 per share.

Now, let’s say the price of AAPL rises to $101, and you decide to sell your positions.

- With the option: You could sell your option (let’s assume its value increased to $2 per share, making the contract worth $200) or you could exercise it and then immediately sell the shares. In this simplified scenario, your profit would be $1 per share (the $2 sale price of the option per share minus your $1 cost per share) multiplied by 100 shares, totaling $100.

- With the stock: If you just owned the single share of stock, you would sell it for $101 and make a $1 profit.

The reverse is also true for potential losses. While in reality the differences might not always be this pronounced, options offer a straightforward way for you to leverage your positions and gain considerably more market exposure than you could by simply buying stocks.

Note: This is a very simplified example intended to explain the concept of leverage.

2. Strategies

Options open up a vast array of trading strategies that you simply can’t implement by just owning or shorting stock. These strategies allow you to select different combinations of potential pros and cons, depending on what you want to achieve.

For example, if you believe a stock’s price is unlikely to move much, you can use options to tailor a strategy that could still generate a profit for you. Imagine a scenario where you could profit if the stock price doesn’t move more than $1 in either direction over the next month – options can make such a strategy possible.

Options Pricing

Option pricing is typically calculated using complex models like Black-Scholes. The main thing for you to understand is that an option’s price generally consists of two parts:

- Intrinsic Value: This is any immediate profit you could realize if you exercised the option right now. For example, if you have a call option with a $100 strike and the stock is at $105, your option has $5 of intrinsic value per share.

- Time Value: This is the additional amount included in the option’s price, reflecting the possibility that the option could become more valuable before it expires. This value exists because there’s still time remaining until the option’s expiration date.

So, an option’s total price will reflect both any immediate profit you could make by exercising it (its intrinsic value, if any) and its time value.

For instance, even if an option is ‘out-of-the-money‘ (meaning you wouldn’t exercise it at that moment because you’d lose money on the exercise itself), it will still typically have a price above zero as long as it hasn’t expired. This is because there’s always a chance the option could become ‘in-the-money‘ before its expiration.

When an option is ‘in-the-money,’ exercising it would result in a gain on the shares themselves. However, it’s important for you to remember this doesn’t automatically mean you’re making an overall profit on the trade. You could be ‘in-the-money’ on the exercise but still have a net loss if the initial price you paid for the option was greater than the profit from exercising it.

Option Payoff Diagrams

Option Payoff Charts and tables can be very useful tools for you to visualize and understand how your potential profit or loss on an option might look at expiration. These diagrams typically show scenarios where you have already purchased an option or ‘written’ one. When you ‘write‘ an option, it means you’ve sold it to someone else who has bought it.

The stock price axis on these charts represents a ‘what if’ scenario, showing your potential outcome if the stock reaches a particular price by the time the option expires.

Example 1: Let’s say you’ve bought a call option with an $11 strike price. The option cost you $1.50.

For simplicity in this example, we’ll assume this contract is for 1 share (though normally, option contracts are for 100 shares). The stock’s current price is $10.

| Stock Price | Stock – Strike Price | Option Profit/Loss | Comment |

|---|---|---|---|

| 0 | -11 | -1.5 | In this case, the option is ‘out of the money‘ and you would not exercise it, hence the most you can lose is the price you paid. |

| 10 | -1 | -1.5 | |

| 11 | 0 | -1.5 | This point is called ‘at the money.’ |

| 11.5 | 0.5 | -1 | You are now ‘in the money‘ but still losing money. |

| 12 | 1 | -0.5 | |

| 12.5 | 1.5 | 0 | Break-Even Point. By exercising your option you will break even (0$ profit or loss). |

| 14 | 3 | 1.5 | You are now making a profit. |

| 18 | 7 | 5.5 | To calculate your profit you would do Stock Price – Strike Price – Option Price |

Example 2: Let’s say you’ve written (sold) a call option with an $11 strike price. You received an option price (premium) of $1.50 for it.

Again, for this example, we’ll assume the contract is for 1 share, and the stock’s current price is $10.

| Stock Price | Strike Price – Stock | Option Profit/Loss | Comment |

|---|---|---|---|

| 0 | 11 | 1.5 | As long as the option is “out of the money“, the owner would not exercise it, hence you make the option price. |

| 10 | 1 | 1.5 | |

| 11 | 0 | 1.5 | This point is called ‘at the money.’ |

| 11.5 | -0.5 | 1 | The owner will now start exercising it and you will be covering the price between the strike price and stock price. You still make a dollar. |

| 12 | -1 | 0.5 | |

| 12.5 | -1.5 | 0 | Break-Even Point. By exercising your option you will break even (0$ profit or loss). |

| 14 | -3 | -1.5 | |

| 18 | -7 | -5.5 | To calculate your profit you would do Strike Price – Stock Price + Option Price |

As you can see from comparing these scenarios (buying vs. writing a call), when you buy a call option, your maximum loss is limited to the price you paid for the option. However, when you write an option, your potential losses can be theoretically unlimited if the stock price rises significantly. Considering that option contracts are typically for 100 shares each, you can see how quickly you could lose very large sums by writing options if the market moves against your position.

Example 3: Imagine you’ve bought a put option with an $11 strike price, and the option cost you $1.50. We’ll continue with the 1-share contract assumption for this example, and the stock’s current price is $10.

| Stock Price | Strike Price – Stock Price | Option Profit/Loss | Comment |

|---|---|---|---|

| 0 | 11 | 9.5 | In this case you are making the most money you could. You would calculate with Strike Price – Stock Price – Option Price |

| 6 | 5 | 3.5 | |

| 9.5 | 1.5 | 0 | Break Even Point |

| 10 | 1 | -0.5 | The option is ‘in the money‘ but you still have a loss. |

| 11 | 0 | -1.5 | The option is ‘out of the money‘ and the most you can lose is the option price. |

| 16 | -5 | -1.5 |

Example 4: Now, let’s say you’ve written (sold) a put option with an $11 strike price. You received an option price (premium) of $1.50 for it. We’ll stick to the 1-share contract for this example, and the stock’s current price is $10.

| Stock Price | Stock Price – Strike Price | Option Profit/Loss | Comment |

|---|---|---|---|

| 0 | -11 | -9.5 | In this case you are losing the most money you could. You would calculate with Stock Price – Strike Price + Option Price |

| 6 | -5 | -3.5 | |

| 8.5 | -2.5 | -1.0 | The option is in the money still. |

| 9.5 | -1.5 | 0 | Break Even Point |

| 10.5 | 0 | 1 | Here the option is still ‘in the money‘ but are making a profit. |

| 13 | 2 | 1.5 | The option is ‘out of the money‘ and the most you can earn is the option price. |

| 16 | 5 | 1.5 |

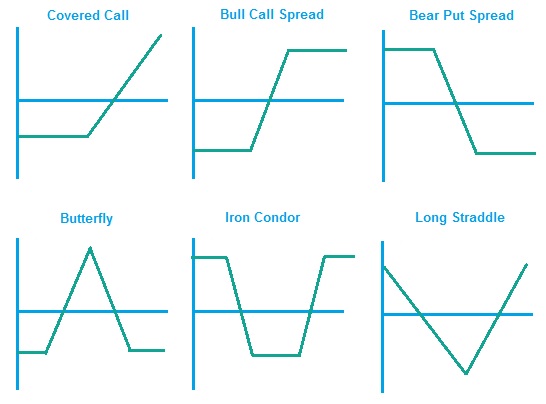

Below, you’ll see just a few common strategies that you can accomplish by using different combinations of owning or shorting (selling) options or stock, using calls or puts, and varying the strike prices. You can also create even more in-depth strategies by varying the expiration dates of your options.

Do you want to learn more about developing a trading plan that includes options? We review how to trade options, and explain different trading strategies like when to use Calls and Puts and how to identify options trading opportunities.

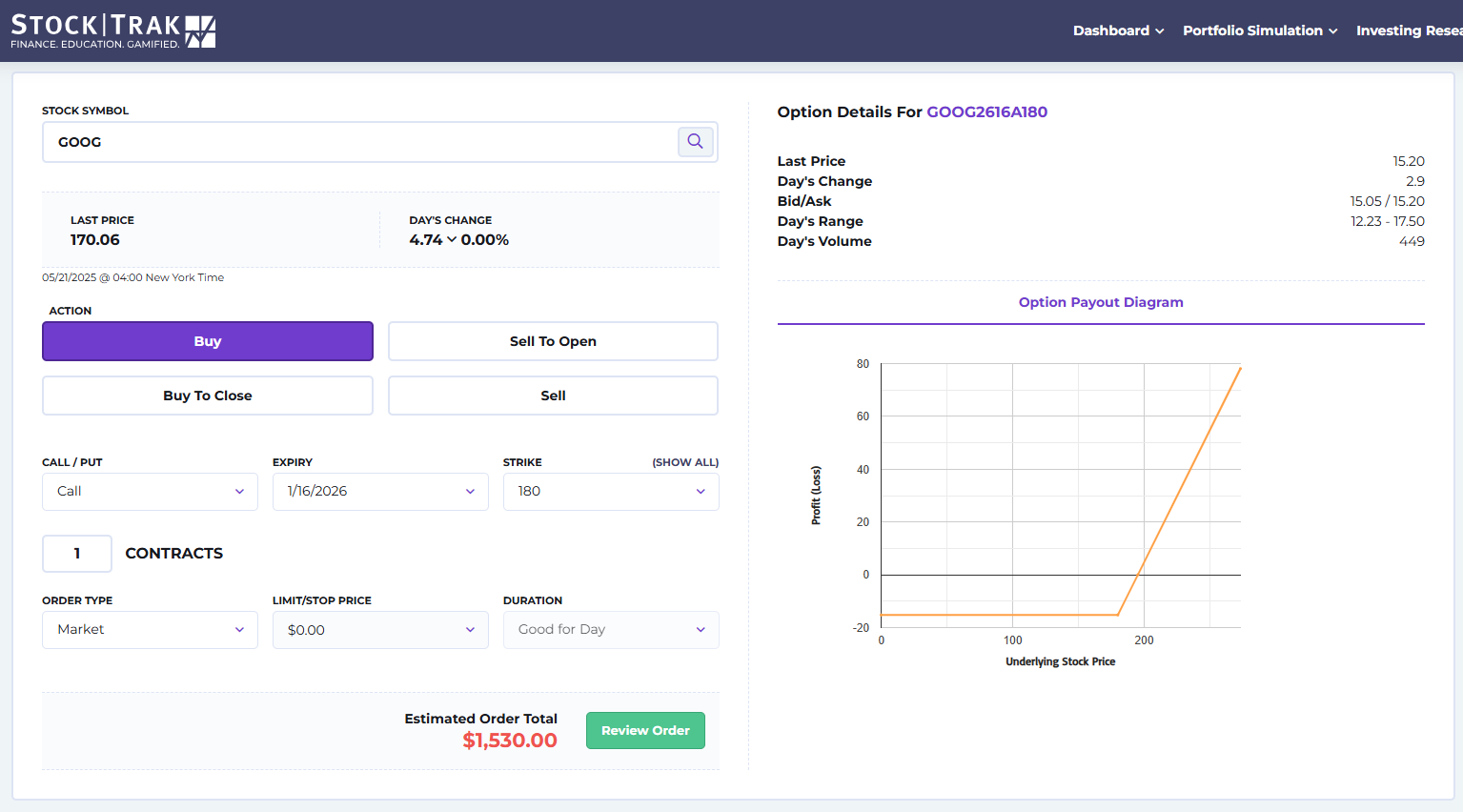

Options Paper Trading

Paper trading is a crucial practice tool for beginners, allowing you to simulate real market conditions without risking actual money. Paper trading helps identify strengths and weaknesses in your strategy before committing real funds. Utilizing a realistic trading simulator bridges the gap between theoretical knowledge and practical application.

Continued practice with paper trading can significantly enhance your confidence and readiness for real trading. This practice benefits all investors, preparing them for real-market experiences and helping ensure effective application of learned concepts.

Click here to learn more about StockTrak’s real-time options simulator that allows you to practice trading different options strategies, along with regular put and call options, stocks, ETFs, cyptos and more!