Want to learn how to trade options? Options trading offers a dynamic and strategic approach to the financial markets, moving beyond the straightforward buying and selling of stocks. Whether you’re looking to hedge existing positions or speculate on market movements, understanding how to trade options can significantly expand your financial toolkit.

This article will explain what options are, how they work, and key strategies to get started. You’ll learn how to buy and sell options, manage risks, and develop a trading plan.

Key Takeaways

- Grasp Option Basics: Options trading involves buying and selling contracts that grant rights to buy or sell an underlying asset at a specified price before expiration.

- Plan & Manage Risk: Develop a clear trading strategy and strict risk rules for every trade.

- Research is Key: Use market analysis and tools to make informed trading decisions.

- Practice Before Playing: Master strategies with paper trading before risking real money.

- Unlock Strategies: Options offer ways to leverage, generate income, or tailor market views.

Understanding Options Trading Basics

Options trading is a fascinating world where traders can buy and sell contracts that grant the right to transact an asset at a specified price before a certain date. Unlike traditional stock trading, options trading opens up several strategic avenues such as leverage and income potential, which can offer significant advantages. These contracts are traded on specialized exchanges like the CBOE, BOX, and ISE, which ensures a regulated and systematic environment for investors with an options trading account and options chains. Traders can also explore how to trade options to enhance their strategies.

At its core, an options trade involves call options and put options. A call option gives the holder the right to buy the underlying asset, while a put option grants the right to sell it. These basics form the foundation for more advanced options strategies.

What Are Options?

Options are versatile financial instruments that represent contracts, giving the right to buy or sell a security at a specified price in the future. These contracts are linked to an underlying asset and have specific terms defining the rights of buyers and sellers. The two primary categories of options are calls and puts. A call option allows the holder to buy 100 shares of the stock at a predetermined price, while a put option grants the right to sell the underlying asset at a set price before the contract expires. Stock options are also a popular choice among investors looking to leverage their positions.

Options contracts are an agreement for buying or selling assets, providing a structured way to participate in the market without owning the underlying asset outright. This characteristic makes option contracts a cost-effective choice for traders, requiring less capital than directly purchasing the option contract underlying stocks.

Key Terms to Know

Understanding key terms is essential for navigating the options market effectively.

- The option premium is the price paid for an options contract, representing its value and including both intrinsic value and time value.

- The option’s strike price in options trading is the pre-set price at which the underlying asset can be bought or sold, and it determines the conditions for exercising the option.

- The expiration date is the final day on which an option can be exercised or traded; after this date, the option becomes worthless if not exercised.

- Intrinsic value represents the actual value of an option if exercised immediately, calculated as the difference between the current price of the underlying asset and the strike price for in-the-money options.

- A call option gives you the right to buy stock at a specified price, while a put option gives you the right to sell stock at a specified price.

Check out this article about What Are Options? where we explain call options and put options in more detail.

Examples of Common Options Strategies

Beyond simply buying or selling stocks, options unlock a world of strategic possibilities. For new investors, a few core strategies serve as excellent starting points to understand how options can work for different market views and goals. These foundational approaches allow you to dip your toes into options trading with a clearer understanding of potential outcomes.

Buying Call Options (The Optimist’s Play)

- The Idea: You believe a stock’s price is going to rise significantly.

- Why Use It: Instead of buying 100 shares of a stock outright (which can be expensive), you can buy one call option to control those same 100 shares for a much smaller upfront cost (the premium). If you’re right and the stock price soars above your strike price (plus the premium you paid), your potential profit can be substantial relative to your initial investment. Your maximum risk is capped at the premium you paid for the option – you can’t lose more than that if the stock price doesn’t go up as expected.

- Key Consideration: Time is working against you (due to time decay). The stock needs to move up enough, and soon enough (before the expiration date), for the trade to be profitable.

Buying Put Options (The Pessimist’s Play or Portfolio Insurance)

- The Idea: You believe a stock’s price is going to fall, OR you already own shares and want to protect them from a potential downturn.

- Why Use it:

- For a Bearish View: If you think a stock is overvalued or heading for a drop, buying a put option gives you the right to sell shares at a specific strike price. If the stock price plummets below your strike (minus the premium paid), you can profit from the decline. Again, your risk is limited to the premium paid.

- As a Protective Put: If you own 100 shares of a stock and are worried about a market correction, buying a put option acts like an insurance policy. If the stock price falls, the value of your put option will likely increase, helping to offset the losses on your shares.

- Key Consideration: Just like with calls, the premium paid is your maximum risk. For a protective put, this premium is the “cost” of your insurance. The stock needs to fall below your strike price (or significantly if it’s a protective put) for the option itself to be profitable or for the protection to fully kick in beyond its cost.

Selling Cash-Secured Puts (Willing Buyer at a Discount)

- The Idea: You believe a stock’s price will likely stay above a certain level, or you wouldn’t mind buying the stock if its price drops to that level (your chosen strike price).

- Why Use It:

- Income Generation: You sell (or “write”) a put option and collect a premium upfront. If the stock price stays above your strike price by the expiration date, the option expires worthless, and you keep the full premium as profit.

- Acquiring Stock at a Lower Price: If the stock price does fall below your strike price and the option is exercised, you’ll be obligated to buy 100 shares of the stock at that strike price. However, because you already collected the premium, your effective purchase price is actually the strike price minus the premium received, meaning you get the stock at a discount to where it was when you sold the put.

- Key Consideration: You must have enough cash set aside (hence “cash-secured”) to buy the shares if the option is exercised. Your maximum profit is limited to the premium received. Your maximum loss is substantial if the stock price drops significantly below your effective purchase price (strike price – premium), similar to owning the stock outright from that level.

Selling Covered Call Options (The Income Generator on Stocks You Own)

- The Idea: You own shares of a stock (at least 100 shares per contract you sell) and you believe the stock price will likely stay flat, rise modestly, or even dip slightly in the near term. You’re willing to sell your shares at a slightly higher price if it comes to that.

- Why Use It: This is a popular strategy to generate extra income from stocks you already hold in your portfolio. You sell (or “write”) a call option and collect the premium upfront. If the stock price stays below the strike price of the call you sold, the option expires worthless, and you keep the full premium as profit, on top of still owning your shares.

- Key Consideration: Your potential profit on the stock itself is capped if the stock price rises significantly above the strike price (as your shares will likely be “called away” or sold at that strike). You’re trading potential big upside gains for immediate income (the premium). You must own the underlying shares to make this a “covered” call, which significantly reduces risk compared to selling a “naked” call.

These four strategies are fundamental building blocks. As you gain more experience, you’ll discover how they can be combined into more complex strategies like spreads (like Vertical, Horizontal, or Diagonal Spreads, which involve simultaneously buying and selling options) to further refine your risk/reward profile for different market outlooks, such as the Bull Call Spread, Bull Put Spread, or even more intricate setups like the Iron Condor for range-bound markets. However, mastering these initial strategies is the best first step on your options trading journey.

Developing a Trading Plan

A comprehensive trading plan ensures discipline and focus on your goals, which is crucial for successful options trading. Key components of a trading plan include defining your options strategy, risk management techniques, and clear entry and exit criteria. A well-thought-out plan aids in managing risk and making informed decisions.

Your trading plan should also include predefined exit strategies for both profits and losses, ensuring you know when to close a position based on your trading objective. Such planning will help you maintain long-term success in the options market.

Defining Your Options Strategy

Developing a clear market outlook and understanding your investment objectives define your options strategy. Whether you are bullish, bearish, or expect the market to move sideways, your strategy should be tailored to your goals and risk tolerance. Beginners should keep risk small and manageable to avoid significant losses.

Approval for options trading usually requires demonstrating an understanding of various strategies, including predefined exit strategies. This ensures that you are prepared to manage your positions effectively and make informed decisions.

Risk Management

Risk management is critical in options trading to protect capital and manage potential losses. Position sizing, which determines how much capital to allocate to individual trades, is crucial for managing risk and assessing downside risk. Always consider profit-taking and loss management to protect investments and maximize returns through risk hedging.

Using strategies like covered calls can provide limited downside protection through the premium received from selling the call option. As the expiration date nears, consider adjusting or closing your options position to manage risk effectively.

Using Research Tools

Using research tools effectively can significantly enhance your options trading strategy. Evaluate a broker’s technological infrastructure to ensure quick access to trading information. Tools like the Options Analyzer help you evaluate the potential profitability of options trades by running reports on daily options volume or unusual activity.

Additionally, the Options Income Finder can screen for options income opportunities on stocks, allowing you to run back tests to see historical performance before trading. Utilizing these tools can help you generate income, make informed decisions, and identify new trading opportunities.

Identifying Trading Opportunities

Identifying trading opportunities in the options market involves analyzing various market conditions and utilizing different strategies. Options trading can be effective whether the market is moving up, down, or sideways. One key benefit of options trading during high market volatility is the potential to profit from significant price moves without owning the underlying asset.

Understanding market conditions and using the right strategies help identify trading opportunities that align with your investment objectives and risk tolerance. This approach allows you to make informed decisions and capitalize on market movements.

Fundamental Analysis

Fundamental analysis involves examining company fundamentals, such as earnings reports and financial health, to identify potential options trading opportunities. By understanding a company’s intrinsic value and underlying price, you can make informed decisions about which options to trade based on the company’s financial outlook.

Technical Analysis

Technical analysis is a powerful tool for options traders, using robust charting tools and technical indicators to analyze market trends. Embedded technical indicators and chart pattern recognition can help select appropriate strike prices and expiration dates. For example, traders might use short options to pick strike prices that they believe will stay out of the money by expiration, while long options traders select strike prices they think will go in the money.

Factors to consider when selecting strike prices include the projected target price and the target date. Incorporating technical analysis into your strategy enables more informed decisions and improves your chances of success in the options market, especially when evaluating available strike prices.

Screening for Opportunities

Screening for trading opportunities involves using tools like the Options Analyzer and Strategy Optimizer to identify potential trades. The Options Analyzer can help you analyze potential maximum profits and losses, while the Strategy Optimizer scans the market for strategy ideas based on various factors.

Additionally, the Live Action scanner allows traders to track daily options volume and identify unusual market activity. Using these tools helps effectively screen for opportunities that match your investment strategy and risk tolerance.

Monitoring Your Options Positions

Active monitoring of your options positions ensures they align with your trading strategy. If your position needs adjustment, you can either adjust it or close the position to manage risk effectively. Tracking market conditions and making necessary adjustments as the expiration date approaches can help protect your investments.

Effective tracking aids in taking necessary actions as expiration nears, keeping positions consistent with trading objectives.

Closing Out Trades

A clear exit plan is crucial for successful options trading. Factors to consider when creating an exit plan include market outlook, time horizon, profit target, and maximum acceptable loss. Options can be closed at any point before expiration, not just at the expiration date.

Actively managing your open positions through regular reviews can enhance your chances of meeting your exit plan goals. This approach helps ensure that you are prepared to close out trades effectively and maximize your potential profits.

Getting Started With Options Trading

To start trading options, you need to establish a brokerage account with a brokerage that offers options trading. However, it’s recommended to practice trading in a virtual account before committing real funds. This practice helps you understand the platform and refine your strategies without financial risk.

Using a realistic trading simulator, allows you to practice options trading before using real money.

Starting with options trading involves understanding the basics and practicing with paper trading to build confidence for real-market scenarios. By doing so, you can identify your strengths and weaknesses and make informed decisions when you start trading in your preferred brokerage account.

Practice Options Trading

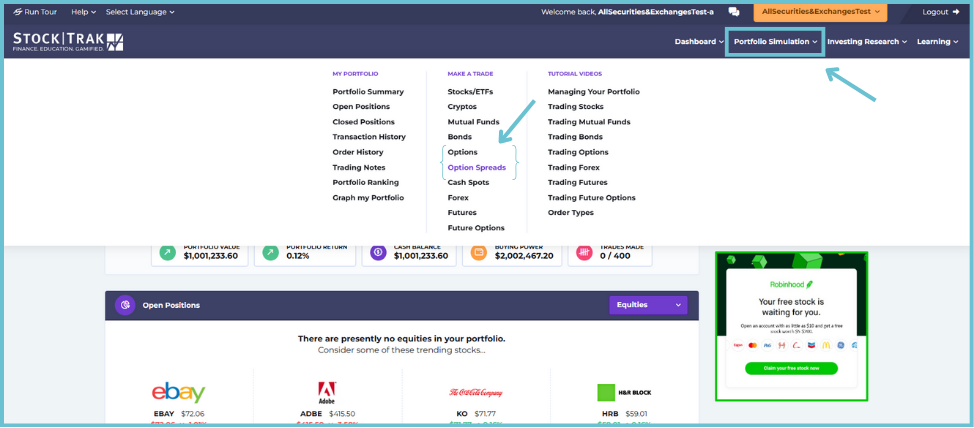

Want to start practice trading options? Learn how right here! If you have an account on StockTrak and want to practice what you’re learning, this section explains how you can begin trading options within the simulation environment.

If options trading is allowed in your session, you can use the Options trading page.

To trade options, start by going to Portfolio Simulation on the main menu. Under “Make a Trade,” select whether you want to trade Options or Options Spreads.

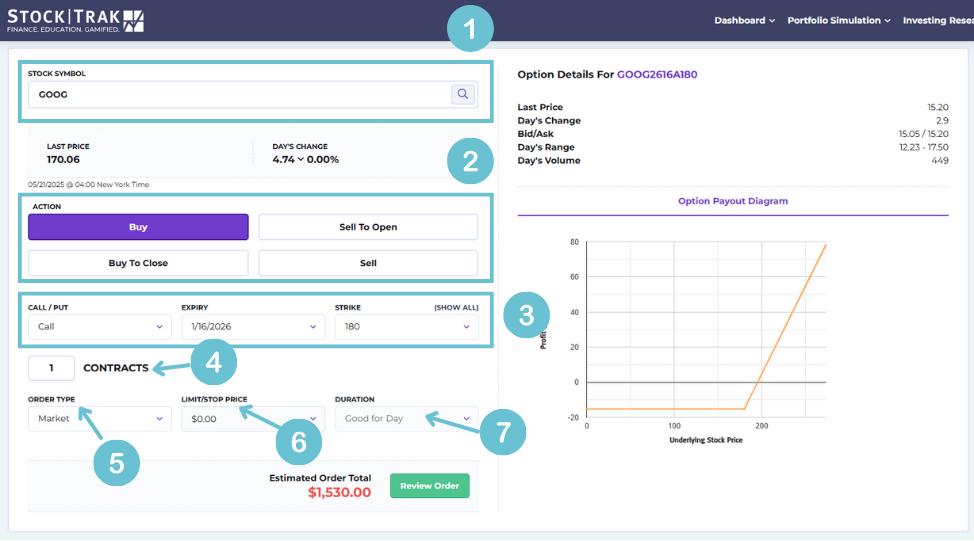

How to Place an Option Order

For those of you using StockTrak, this section provides a step-by-step guide on how to place an option order within the platform. Follow these instructions to navigate the trading interface.

1. Symbol

Enter the Ticker Symbol of the underlying stock for the option you wish to trade. Once you select your stock, you will see a recent price.

2. Action

Choose whether you want to Buy, Sell to Open, Buy to Close, or Sell to Close.

- Select Buy if you want to purchase or go long on options.

- Select Sell to Open if you would like to short or “write” options.

- Select Buy to Close if you would like to close an option position that you have previously shorted or written.

- Select Sell to Close if you want to close a long position or one that you have previously purchased.

3. Select Option

Select whether you want to trade a Call or a Put.

- A Call Option is the right to buy a stock at a certain price by a certain date.

- A Put Option is the right to sell a stock at a certain price by a certain date.

The Expiry is the expiration date of the option.

The Strike Price is the price at which the option can be exercised. The platform will show you the strike prices that are near the price of the underlying stock.

4. Quantity

Enter the number of contracts that you would like to trade. Remember, 1 contract typically equals 100 shares.

5. Order Type

Select an Order Type.

- A Market order will fill immediately at the current price.

- Set a Limit order if you only want to pay up to a certain price or sell at a certain price.

- Use a Stop order below the current price to sell if your stock starts declining in price.

- Use a Trailing Stop to have a stop order automatically adjust if the stock moves favorably.

6. Limit/Stop Price

This specifies the Limit Price or Stop Price that you are using to control when your trade is triggered. It is not available for a Market order.

7. Order Term

For your Limit or Stop orders, you must select the order term which is how long you want the order to remain open.

- Good for Day will try to execute until the end of the trading day.

- Good til Cancel will try to execute until you cancel the order.

- Good til Date will try to execute until a specific date (that you must specify).

How to Trade Options Tutorial Video

Here, you’ll find step-by-step video instructions for placing an options trade on StockTrak:

Option Nomenclature:

AAPL1504L85 is the way options are written on StockTrak and can differ from other websites or brokerages.

On StockTrak, options are written as: Symbol Year Day (Call or Put and Month) Strike Price.

Call or Put and month:

A – L are for January – December Calls respectively

M – X are for January – December Puts respectively

Hence, in the example above, AAPL1504L85: is an AAPL 2015 December Call for an $85 strike price.

Final Note: It is always a good idea for you to double-check the open interest and volume for options, as some may trade infrequently. The best and most reliable source for this information is often directly from the Chicago Board Options Exchange (CBOE).

Summary

Options trading offers numerous opportunities for traders to profit from market movements without owning the underlying assets. By understanding the basics of options trading, developing a comprehensive trading plan, and using research tools, you can make informed decisions and manage risk effectively.

As you embark on your options trading journey, remember to practice with paper trading to build confidence and refine your strategies. With the right knowledge and approach, you can navigate the options market successfully and achieve your investment objectives.

Frequently Asked Questions

What are the basic types of options?

The basic types of options are call options, which allow the holder to buy an underlying asset, and put options, which permit the holder to sell an underlying asset. Understanding these distinctions is essential for effective trading strategies.

What is a covered call strategy?

A covered call strategy entails selling call options on stocks that you already own, allowing you to generate income from the premiums received while potentially capping your upside gains. This approach is often used to enhance returns in a sideways or mildly bullish market.

How can I manage risk in options trading?

To effectively manage risk in options trading, employ techniques such as position sizing, profit-taking, and loss management, and consider strategies like covered calls for limited downside protection through received premiums. Implementing these strategies can significantly enhance your risk management approach.

Why is paper trading important for beginners?

Paper trading is important for beginners as it provides a risk-free environment to practice trading strategies, enabling them to identify their strengths and weaknesses without the threat of financial loss. This crucial step fosters confidence and knowledge before engaging in actual trading.