Financial Literacy Games for College Students

For Personal Finance Classes and Campus-wide Financial Literacy Programs:

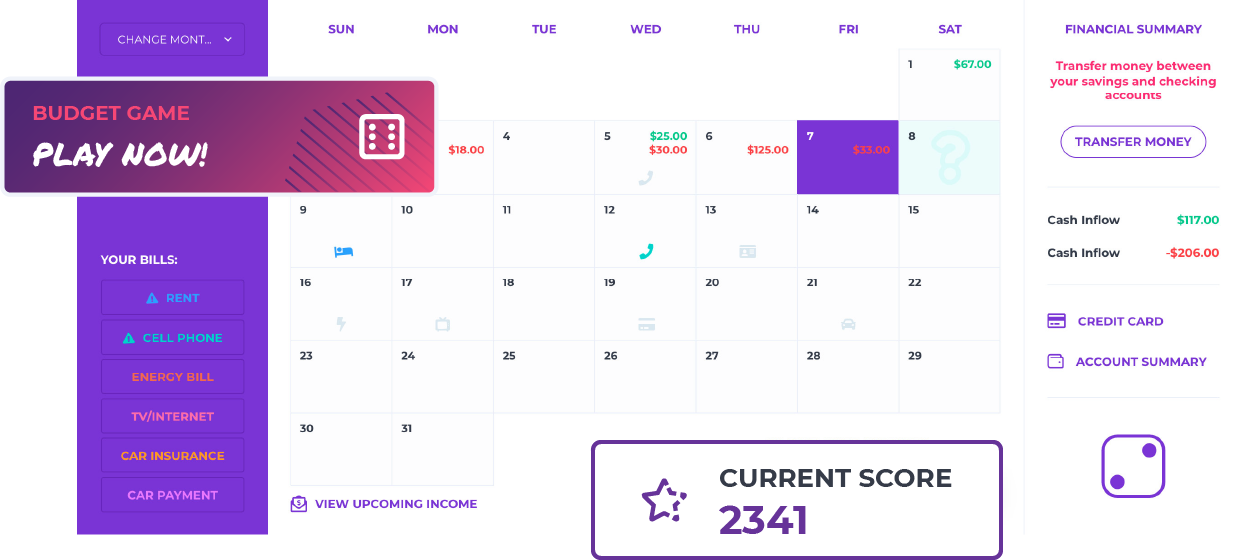

Personal Budgeting Game

College students learn about banking, budgeting, credit, debt, insurance, taxes and more as they try to manage a budget for 12 virtual months.

Investing Simulation

Students learn to invest in stocks, ETFS, bonds and

mutual funds with a virtual $100,000.

Embedded Curriculum and Certification

Built-in assignments and quizzes help students learn and

work towards earning our Financial Literacy Certificate.

Helping Colleges Teach Budgeting, Savings,

Credit, Cash Management and Investing All in One Platform

(Middle and high school teachers, please visit our financial literacy for high school students site designed specifically for your students.)

Personal Finance Classes and Life Skills

Whether you are teaching Personal Finance, Intro to Business, or providing a life skills seminar, give your students the practical experience and confidence they need to manage their personal finances, budget, credit, quality of life and investments.

Request Demo Request More Info Register Now

Campus Wide Financial Literacy Program

Financial Literacy should be taught to ALL college students, not just those students taking a Personal Finance class.

With our turnkey Campus Wide Financial Literacy Site License or Branded Site, your university can make sure EVERY student graduates with basic financial literacy skills covering everything from banking, savings, credit and debt to insurance, taxes, investing and retirement.

Request More Info Download our Financial Literacy BrochureThe Financial Life Simulation forced me to become a better manager of my money and taught me how important it is to pay ALL of my bills on time.

Helping Your Students

Become Financially Literate

Reading about savings, budgeting, credit, and paying your bills on time is one thing, but our simulation makes the students LIVE IT. From flat tires on the way to work to unexpected dentist bills, our simulation teachers students to play for the expected and the unexpected.

Request More Info Request Demo

Track Student Progress and Portfolio Performance

- Full admin section allows professors to manage and review multiple class activity with one login

- Assessments of performance by student in managing portfolios

- Class rankings and statements can easily be downloaded into Excel for further analysis

- Built-in assignments and pop quizzes to track and verify student completion

Education Through Gamification

Whether you are using our virtual stock market simulation or our personal budgeting game, each includes embedded curriculum to make sure students are learning each step of the way. Site licenses are available for larger programs, trading rooms, and campus wide financial literacy initiatives.

Virtual Stock Trading Personal Budget Game Academic ResearchMy students rated the Stock-Trak simulation as the highlight of the class. The various rankings kept ALL of my students motivated.

What Students are Saying

Spring 2025 Student Survey Data

Recommended Use Cases

Personal Finance Faculty have used our budget games and virtual trading platform in classes in a variety of ways.

With the ability to customize the content to match your curriculum and time frame, the options are unlimited.

FAQ

Who are we?

- The leading provider of financial literacy games and simulations for universities, high schools, corporates and the general public.

- Our various stock market and financial literacy simulations are used by over 20,000 professors/teachers worldwide and by over 100 corporations.

- 78% of the top 100 U.S. business schools used StockTrak in the last 2 years.

- For our Financial Literacy simulations, students learn to trade U.S. stocks, ETFs, bonds and mutual funds.

- Founded in 1990 with over 10,000,000 students served.

How it works?

Students are given a scenario where they are working full-time and living on their own. They start with a virtual checking account with $1,000, as well as a savings account, credit card account and investment account with $10,000.

Students roll virtual dice to proceed through the weeks and learn to deposit their paychecks, pay all of their bills, start an emergency fund, learn to improve their credit score, and practice investing in the stock market. Meanwhile, life’s unexpected events keep happening that challenge their budgeting and cash management skills.

Find answers to other common questions and learn everything

you need to know so you can use Stock-Trak like a pro.

Student Accounts and Site License Pricing

Find out about product pricing on the virtual stock

trading application and the new budget game.

.