There are a lot of new enhancements that will improve how both professors and students use the platform!

Spring 2022 Key Updates

- New rankings available by Jensen’s Alpha and Treynor Ratio!

- Dozens of new graphics for event cards

- Lesson Cards have been improved with multiple-choice quizzes

- Personal Finance curriculum has new sub-units based on the Jumpstart/Council for Economic Education standards. Each sub-unit has a short introduction and short unit review quiz.

- Instructors can view the individual quiz responses from each student to see where they got questions right and or wrong, along with the time taken to complete each lesson and quiz.

- Professors will have summary reports for their class showing the average time to complete each lesson and quiz for the entire class, along with statistics on the right/wrong averages for the class on every quiz question.

Jensen’s Alpha and Treynor Ratio

In the coming semester, we will have two new ways to measure the performance of someone’s portfolio. Jensen’s Alpha is a new version of the Alpha Ratio that was previously available but has been risk-adjusted. While the Treynor Ratio considers the amount of risk that was taken. In the latter case, you could consider it the “excess return” per unit of risk.

Professors will be able to choose whether they want to have these performance indicators included in their class or not while setting up their class. They will also be able to turn them on/off at any time from the Edit Portfolio Simulation Rules page.

New Graphics

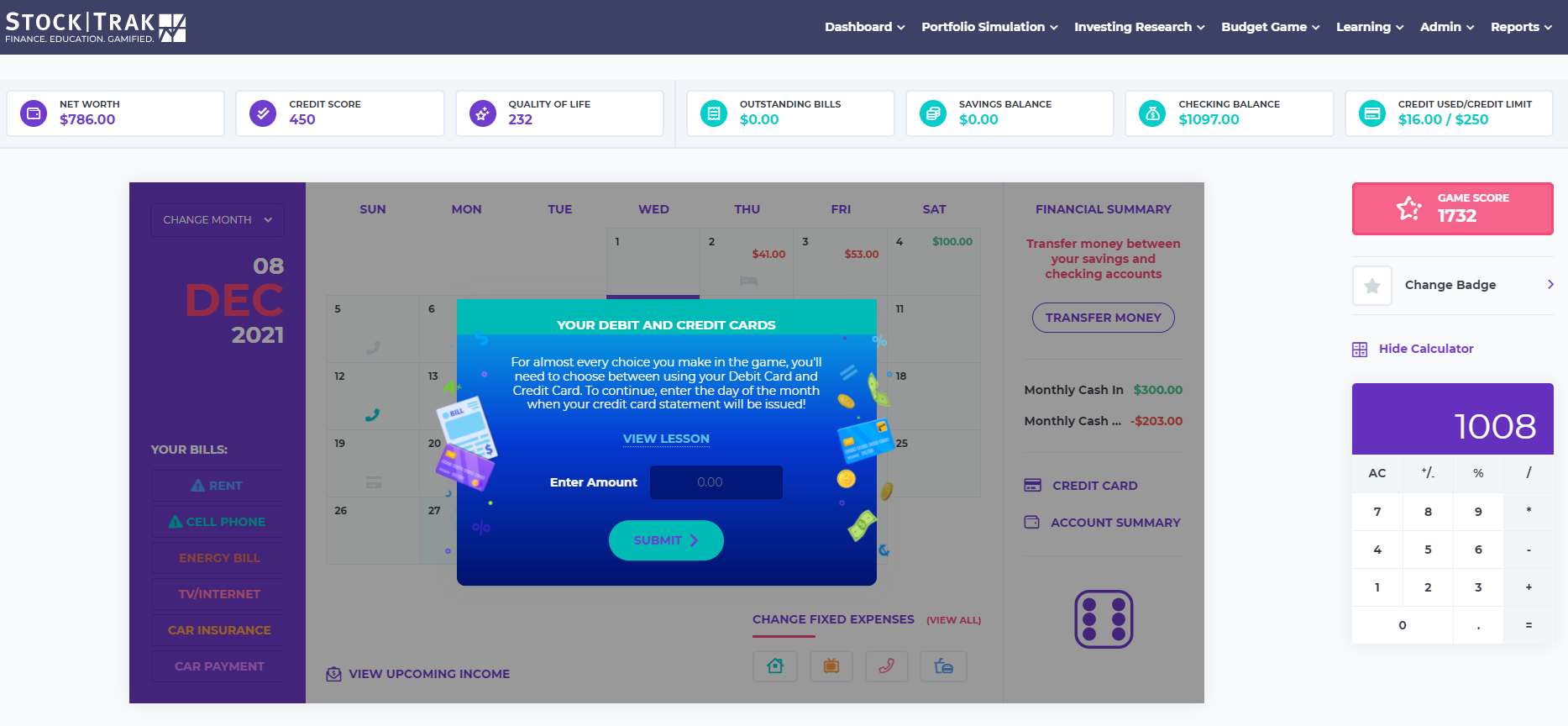

Our design team has been hard at work to bring more gamified elements to the pop-up choice and event cards in the Budget Game. As students play, they encounter some choice cards that ask them to spend money with either their debit or credit cards. Giving them the opportunity to practice using a credit card before they may have received one in real-life.

Other choice cards ask students to decide if they want to purchase or participate in an activity at all. All these choices they make have consequences. The latest enhancement will tie in similar graphics across cards to thematically represent how choosing one option over another has long-term consequences.

Pop-Up Lessons

We’ve changed how students enter their answers into the pop-up lessons in the Budget Game. Before it was an open text field, and often students were getting stuck and couldn’t move forward. Now we will have a dropdown multiple choice list so students can still test their knowledge, but can quickly and easily keep playing after completing a lesson.

Assignment Sub-Units

With over 300+ lessons, it can be difficult to know where to start; this enhancement will group our personal finance lessons according to Jump$tart standards. Not only does it make it easy to identify the lessons that reinforce knowledge statements like budgeting, credit, financial risk and decision making etc. but it allows teachers to quickly assign a whole sub-unit at a time.

By adding an introduction and exit quiz, you can be reassured that your student will be prepared for the lessons, and will be assessed on their knowledge at the end.

Student Progress & Assessments

Teacher reports just got a whole lot more useful by allowing you to see EXACTLY which questions your students are getting right or wrong. You will be able to see trends, and cover the concepts in more depth that students are struggling with. Similarly, you will know what has been firmly understood so you can safely move on to new material!

On top of what students got right or wrong, you will be able to see how much time it took to complete the quizzes. This is a great way to know which students are not being challenged enough, or who is struggling. Over time, you will see what topics your students need more time with so you can allocate class time accordingly.

Home Budget Calculator

Home Budget Calculator Portfolio Management – Investment Principles and Analysis Project

Portfolio Management – Investment Principles and Analysis Project