Your home will probably be the biggest purchase you make in your lifetime. Buying a home not only saves money on rent, but is a serious asset that can appreciate over time. Since homes are so expensive, (almost) no-one buys them in cash. Instead, homes are typically purchased with a special type of loan, called a “Mortgage”.

What is a Mortgage?

A mortgage is a type of secured loan, with real estate or a house used as collateral. This means you will make an agreement with your bank, credit union, or savings & loan institution to borrow a large sum of money, with a piece of property as collateral.

This means if you default on the loan (meaning fail to pay it back), the bank can sell off the property for cash. If this happens, the bank keeps whatever outstanding balance there was on the loan, and you get the rest.

Buying a Home with a Mortgage

Mortgages can, in theory, used to buy nearly anything (so long as the collateral is property), but it is most commonly associated with buying a home. There are a few good reasons for this, including the size of the loan, the interest rate for mortgaged property, and the length of the loan.

Mortgages can, in theory, used to buy nearly anything (so long as the collateral is property), but it is most commonly associated with buying a home. There are a few good reasons for this, including the size of the loan, the interest rate for mortgaged property, and the length of the loan.

Loan Size

Homes are expensive, so buying one requires a large loan. Most people buying their first home do not have a huge amount of other assets counted towards their net worth, but a mortgage makes it very convenient to borrow the amount needed.

When you first take out a mortgage, your home’s value will be the exact amount that you need to borrow to pay for it. From the bank’s perspective, there is not a lot of risk: if you default, they simply sell the home to someone else and get their money back. This means the bank can lend you much more money to buy a home than they could for any other type of loan – the only limitation is making sure you can make the monthly payments.

Interest Rate

Interest rates for mortgages are also much lower than any other types of loans. This is for the same reason as the larger loan sizes – banks see mortgages as less-risky loans, so the cost of borrowing is lower.

Imagine having an extremely high limit on your credit card – you could theoretically buy your home just on credit, or you could take out a mortgage. Credit cards are unsecured loans, so defaulting on your credit card payments would not automatically lose your home (although this would happen if you are forced into bankruptcy). In exchange, the interest rate on your credit card will be 2-3 times higher than a mortgage, because your credit card company sees it as a much bigger risk of default, since they cannot just sell the home and get back their cash.

Loan Term

While the interest rate on your home may be lower, you will still pay a very large amount of interest over the life of the loan. This is because mortgages typically have very long lifespans – 15, 20, or 30 years being the most common. This is how banks make money on mortgages: a very long chain of small, but low-risk, interest payments.

Most other types of secured loans do not have anywhere near this term length, because most other types of loans assume depreciation (decrease in value) of the underlying asset, not appreciation. Compare this to a car loan – your car might be complete junk in 30 years and worth almost nothing, but most homes will have a big increase in value.

Requirements and Charges

Because mortgages are big and supposed to be low-risk, there are some strict requirements that any borrower needs to maintain to be eligible to borrow.

Down Payments and PMI

Mortgages typically require a 20% or greater down payment. For people buying their 2nd or 3rd home, this amount would usually come from the profit made by selling their previous home, but is sometimes harder for first-time buyers to save up.

Mortgages typically require a 20% or greater down payment. For people buying their 2nd or 3rd home, this amount would usually come from the profit made by selling their previous home, but is sometimes harder for first-time buyers to save up.

If a borrower wants to take out a mortgage with less than 20% down payment, lenders usually require insurance, called Private Mortgage Insurance (PMI). PMI is a type of insurance that protects your lender in case you default on your loan quickly. For example, if you take out a mortgage, and default within the first 12 months, your home’s value probably would not have appreciated enough to cover all the closing costs for both your initial purchase, and when the bank needs to foreclose to get their money back. PMI covers the difference for your lender, making sure they do not take a huge loss if you foreclose early.

PMI is usually paid all at once (so a smaller down payment, plus one lump-sum PMI payment), or in 12 monthly installments, added to your normal mortgage payment for the first year.

FHA Loans

The Federal Housing Administration also has programs available for certain low-income families buying their first home. The FHA provides the mortgage insurance, so the borrower can make a down payment (as low as 5%), with the government insuring the mortgage.

Homeowner’s Insurance

Homeowner’s Insurance is almost always required with any residential mortgage. Banks require it in case of fires or other damage. This means if your home is destroyed in a fire, it can be rebuilt, returning the value to your property (and securing the bank’s interest through your mortgage).

If your Homeowner’s Insurance lapses while you are still paying your mortgage, your lender will usually take out its own policy insuring themselves against loss, and charge you a penalty.

Payments and Interest

Under a traditional 30-year mortgage, the borrower makes equal payments every month for 30 years. This is becoming less common, so borrowers need to know the different types of mortgages available, and payment options.

Fixed vs Variable Interest

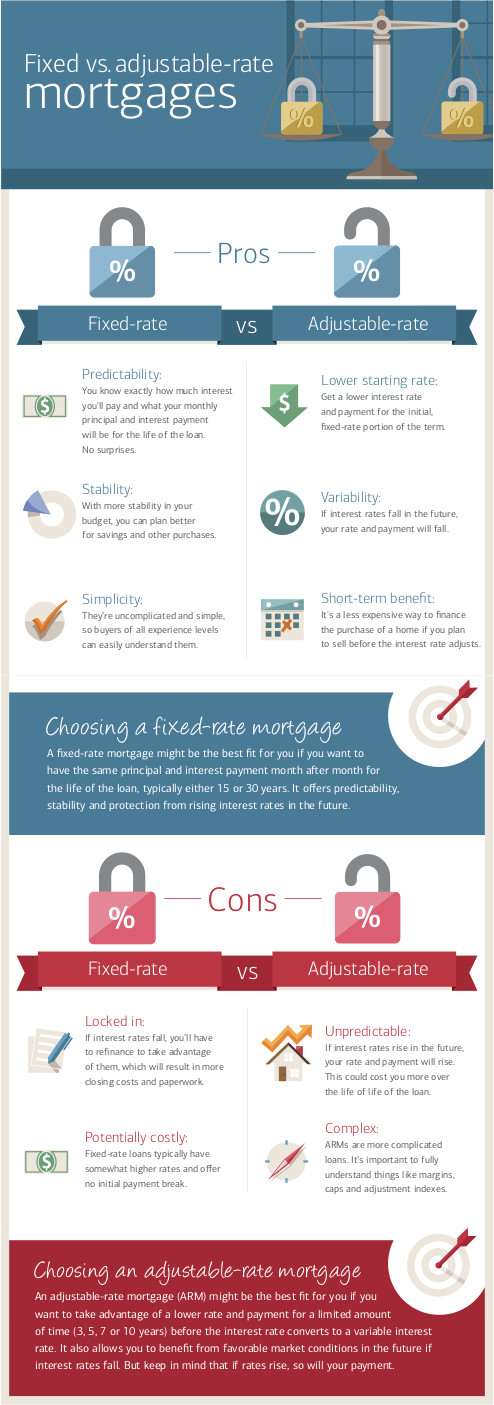

Mortgages can have a “fixed” interest rate, meaning the interest stays the same for the full term, or “variable”, where it can go up or down based on some index. From a lender’s perspective, fixed rate loans are more risky than variable, because they do not know what inflation will be like later. If you have a 3.5% interest rate mortgage, but inflation is 4%, from the lender’s point of view, they are losing 0.5%.

Mortgages can have a “fixed” interest rate, meaning the interest stays the same for the full term, or “variable”, where it can go up or down based on some index. From a lender’s perspective, fixed rate loans are more risky than variable, because they do not know what inflation will be like later. If you have a 3.5% interest rate mortgage, but inflation is 4%, from the lender’s point of view, they are losing 0.5%.

Variable interest rate mortgages were created to transfer this risk back to the buyer. With a variable interest rate mortgage, your interest rate moves up and down every month, 6 months, or year based on a market index that tracks inflation and risk of default. If inflation goes up, your interest rate will go up with it. Because banks see these as less “risky”, they usually offer lower interest rates up-front for a variable interest rate mortgage.

Today, many loans are a hybrid of both: offering a fixed interest rate for the first 5 years, then a variable interest rate afterwards. This gives the borrower more security in the short term, but still allows the interest rate to “float” with the overall markets.

Balloon Payments

Not every borrower will hold the mortgage for its full life. Instead, some make what is called a “Balloon payment”. With balloon payments, the borrower makes regular monthly interest payments for a certain amount of time, then pays off the entire remaining balance in one lump payment.

Balloon payments happen most often when the borrower sells the underlying property – the cash earned from the sale is used to pay off the remaining loan balance. Balloon payments are also frequently used in business mortgages, where the bank may require a balloon payment and a loan refinancing after a certain number of years.

Default and Foreclosure

If you fail to make your interest payments, the bank can foreclose on your home. This means legal ownership of the home is given to your lender, who evict you from the property and re-sell it to recoup their loss. If the sale of the home brings in more cash than you owed, the lender will give you back the excess.

Short Sales

Having your home foreclosed upon is generally a “worst-case scenario”. The bank wants to sell off the property as quickly as possible, so they usually sell it well below the normal market price just to get the transaction finished quickly. This means there usually is little to no cash left over for you. If you are struggling to make mortgage payments, you will always be better off selling the property yourself and making a balloon payment than letting the bank foreclose.

Loan Restructuring

Most lenders can theoretically foreclose on your home as soon as you miss one payment. In reality, foreclosing is a long and expensive process for the bank, and they would rather you continue making payments.

Most lenders can theoretically foreclose on your home as soon as you miss one payment. In reality, foreclosing is a long and expensive process for the bank, and they would rather you continue making payments.

Part of this is called “Loan Restructuring”, where you work with your lender to build a new payment plan, usually with temporarily lowered interest rates to help in times of hardship. Almost every lender has a loan restructuring program for mortgages, so if you are struggling to meet payments, this is the first call you should make.

Mortgage Variations

Besides a basic mortgage to buy a home, there are also two other common mortgages you may have heard of: Second Mortgages, and Reverse Mortgages.

Second Mortgages

When a borrower takes out a mortgage on their home, the “equity” of the home (or its total value) is divided between the borrower and lender. For example, with a 20% down payment, the borrower starts with 20% equity and the lender has 80%.

As the mortgage is paid off, the borrower builds up more equity, shifting the balance. This equity has a dollar value – the market price of the home, times the percentage of equity.

Equity is an asset, and so the equity built up in your home can be used to take out a second mortgage. With a second mortgage, you take out a new mortgage on the equity you’ve built up. This effectively brings you back to square one – you have some cash from the proceeds of the loan, and your equity is brought back down to 20%.

Second mortgages are often used to finance home renovations or expansions, since these can increase the value of the home more than the cost of the loan. Second mortgages are also often used to pay off other unsecured debt to avoid bankruptcy, or transferring high-interest credit card debt to low-interest mortgage debt.

Reverse Mortgages

Reversed mortgages are special types of mortgages only available to retirees. With a reverse mortgage, the borrower gets a one-time lump sum payment from the lender, which is determined by the equity in their home and age. The borrower does not make any monthly payments at all – the principle just accumulates interest each month. When the borrower sells their home or dies, the entire loan plus interest is paid back in one single payment.

Reverse mortgages are risky, since the loan balance can grow bigger than the value of the home. At the same time, reverse mortgages can serve as a way for retirees to pay off any outstanding debt and smooth out their retirement spending.

Pop Quiz

[mlw_quizmaster quiz=63]

Economics – Equity Markets and Institutions

Economics – Equity Markets and Institutions Banks, Credit Unions, and Savings & Loan Institutions

Banks, Credit Unions, and Savings & Loan Institutions